Professional Documents

Culture Documents

Excise Duty

Uploaded by

pednekar30Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excise Duty

Uploaded by

pednekar30Copyright:

Available Formats

8/19/2012

CAPTIVE CONSUMPTION

8/19/2012

Intermediate products

Since excise duty is on manufacture of goods, duty is payable as soon as goods are manufactured within the factory. Such goods are called ''intermediate products''

8/19/2012

Captive Consumption

Captive Consumption : Captive Consumption means the consumption of goods manufactured by one division or unit and consumed by another division or unit of the same organization or related undertaking for manufacturing another product(s).

8/19/2012

Exemption to intermediate products used for captive

consumption

Captive consumption for dutiable final products The intermediate product manufactured within the factory is exempt from duty, if is consumed captively for manufacture of (a) Capital goods as defined in Cenvat Credit Rules

(b) Used for in or in relation to manufacture of final products eligible for Cenvat, made from inputs which are eligible for Cenvat.

The exemption is available for all intermediate products, except LDO, HSD and petrol.

8/19/2012

Final product should not be exempt from duty

This exemption is not available if final product is exempt from duty or is chargeable to nil rate of duty.

8/19/2012

Intermediate products exempt even if manufactured by third party

Intermediate products/ capital goods are exempt even if they are manufactured by third party As long as the captive consumption is within the factory.

8/19/2012

Exemption if goods cleared under rule 6 of Cenvat Rules

If final product is exempt from duty, normally duty is payable on intermediate product. However, if final product is cleared as per provisions of rule 6 of Cenvat Credit Rules [i.e. after paying 10% of price as ''amount'' or after reversing Cenvat credit], intermediate product will be exempt from duty.

8/19/2012

Exemption if final product cleared for deemed export

As per excise provisions, no duty is payable if final product is cleared * to EOU *

to a unit in Electronics Hardware Technology Park to a unit in Software technology park. In such cases, duty on intermediate product is not payable even if final product is cleared without payment of duty.

8/19/2012

Goods cleared to UN, WHO etc.

Final products cleared to ILO, WHO, UNDP, UNIDO programme etc. are exempt under Notification 108/95-CE.

In such case, intermediate product will be exempt from duty.

8/19/2012

10

Capital goods manufactured and used within factory

,capital goods (as defined in Cenvat Credit Rules) manufactured in a factory and used within the factory of production are exempt from excise duty.

Further, as per explanation 2 to rule 2(g) of Cenvat Credit Rules, inputs include goods used in manufacture of capital goods, which are further used in the factory of manufacturer. Thus, if capital goods are manufactured and used within the factory, Cenvat credit can be availed of goods, which are used to manufacture such capital goods. Moreover, no duty will be payable on such capital goods. 8/19/2012 11

Capital goods manufactured within factory of production are exempt even if manufactured by third party

exemption is available even if the capital goods are manufactured in the factory of production by third party.

Exemption even if invoice is raised on the ultimate buyer

The tools are manufactured within the factory for manufacture of goods required by ultimate buyer . In such a case invoice for buyer will be separately raised on buyer though tools may be captively consumed. 8/19/2012

12

Cenvat credit on capital goods used in manufacture of exempt intermediate product

It may happen that capital goods may be used in manufacture of an exempt intermediate product, but final product may be dutiable. In such case, Cenvat credit is available on such capital goods, if final product is chargeable to duty.

8/19/2012

13

Other exemptions to Intermediate products

Parts manufactured within the factory for repairs Goods manufactured in a workshop within the factory for use within factory for repairs or maintenance of machinery installed within the factory are exempt from duty. Thus, no duty is payable on parts manufactured within the factory for repairs or maintenance of machinery within the factory.

8/19/2012

14

Goods manufactured for defence/Government, etc.

Some goods are exempt from duty if they are supplied to defence, railways, defence stores, Indian Navy, or if manufactured in ordnance factories, mint, prison, mine, Government tool rooms, etc.

In such cases, if an intermediate product gets produced while manufacturing final product, such intermediate product is also exempt from duty - Notification No. 83/92 dated 16-9-92.

8/19/2012

15

Intermediate products used captively for exported goods

Intermediate products manufactured and used within the factory for manufacture of final products are exempt from duty,

even if CT-3 certificate is not issued and Central Excise (Removal of Goods at Concessional Rate of Duty for manufacture of Excisable Goods), Rules [earlier Chapter X] procedure is not followed,

subject to the condition that documents / records are available with manufacturer that the intermediate goods have been used for export purpose only

8/19/2012 16

Intermediate products manufactured by exempted SSI units.

A SSI units with a turnover of less then 150 lakhs is exempt from duty, if it does not avail cenvat on inputs.

exempted such SSI units may manufacture an Intermediate product which is used in manufacturing of final product. In such case no duty is payable on the Intermediate product even if final product is cleared without payment of duty.

8/19/2012

17

Transfer of Intermediate products by LTU to another unit

Intermediate goods / capital goods can be transferred from one unit to another without payment of duty, if these are to be in manufacture of excisable final products on which duty is payable

The removal should be under an invoice

It is not permissible in case if EOU/ STO units It is not permissible if the unit is enjoying exemption available in HP, UP , Sikkim , J&K Kutch or north eastern states.

8/19/2012 18

Valuation in case of captive consumption

In case of captive consumption, valuation shall be done on basis of cost of production plus 15% (Rule 8 of Valuation Rules). Captive consumption means goods are not sold but consumed within the factory.

8/19/2012 19

partly sold and partly consumed

if same goods are partly sold by assessee and partly consumed captively, goods sold have to be assessed on basis of transaction value and goods captively consumed should be assessed on basis of rule 8. The reason is, as per new section 4,

captively consumed by 'related person

In case goods are supplied to a ''related person'' but consumed by the related person and not sold, valuation will be done on the basis of cost of production plus 10%. this proviso applies when goods are transferred to a sister unit or another unit of the same factory for captive consumption in their factory.

8/19/2012 20

Valuation when no other rule is applicable

Pole were manufactured and used in transmission of electricity . These were not used in manufacturing of other goods rule 8 is not applicable Since no other rule is applicable , adopting rule 8 ie. Cost of production plus 10% is resonable.

8/19/2012 21

The simplified provision has been probably made as in most of the cases, the buyer will be able to get Cenvat credit of duty paid on inputs and there is hardly any incentive to avoid any payment of duty. Thus, the formula for determining value is simple. If the cost of production based upon general principles of costing of a commodity is Rs. 10,000 per unit, the assessable value of the goods shall be Rs. 11,000 per unit.

8/19/2012

22

Duty in certain cases on intermediate products

8/19/2012

23

intermediate product transfared to another factory of the same manufacturer

Some times intermediate product is transferred to another factory of the same manufacturer for further manufacture.

The product as such will not be sold . In such case when the goods are transfared duty will be payable.

Valuation will be on the same bases as for captive consumption.

8/19/2012

24

duty by SSI on intermediate products if final product exempt

If final product is fully exempt under any other notification (notification other then the SSI exemption notification)

Duty will be payable on intermediate product or its value will be considered for calculating limit of rs 150 /400 lakhs

8/19/2012

25

Goods cleared under special procedure for concessional rate of duty

Goods can be cleared without payment of duty under central excise .

In such case the intermediate product which may be produced while manufacturing final product is dutiable.

8/19/2012

26

Thank You

8/19/2012

27

You might also like

- LP Formulation ExDocument32 pagesLP Formulation ExcollieNo ratings yet

- LP FormulationDocument1 pageLP Formulationpednekar30No ratings yet

- Medical Supply Transportation Problem OptimizationDocument30 pagesMedical Supply Transportation Problem OptimizationDrRitu MalikNo ratings yet

- Commodities Derivativ Market ModuleDocument146 pagesCommodities Derivativ Market Modulepednekar30No ratings yet

- Commodities Derivativ Market ModuleDocument146 pagesCommodities Derivativ Market Modulepednekar30No ratings yet

- Derivative ModuleDocument153 pagesDerivative Modulepednekar30No ratings yet

- Bacics of DerivativesDocument22 pagesBacics of Derivativespednekar30No ratings yet

- Cost Management NotesDocument1 pageCost Management Notespednekar30No ratings yet

- Nse Options Strategies Explanation With ExamplesDocument60 pagesNse Options Strategies Explanation With ExamplesVatsal ShahNo ratings yet

- LP FormulationDocument1 pageLP Formulationpednekar30No ratings yet

- Life Cycle CostingDocument34 pagesLife Cycle Costingpednekar30No ratings yet

- Excise DutyDocument27 pagesExcise Dutypednekar30100% (1)

- Credit RatingDocument38 pagesCredit Ratingpednekar30No ratings yet

- LUX - An HUL BrandDocument22 pagesLUX - An HUL Brandaditig2275% (4)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Moral Logic of Survivor's GuiltDocument5 pagesThe Moral Logic of Survivor's GuiltKeyton OwensNo ratings yet

- Cambridge IGCSE: 0450/22 Business StudiesDocument12 pagesCambridge IGCSE: 0450/22 Business StudiesTshegofatso SaliNo ratings yet

- Supreme Court's Triple Talaq JudgmentDocument395 pagesSupreme Court's Triple Talaq JudgmentThe Quint100% (1)

- John D. Ozbilgen ComplaintDocument7 pagesJohn D. Ozbilgen ComplaintAsbury Park PressNo ratings yet

- History Assignment 4 Interview of Napoleon BonaparteDocument2 pagesHistory Assignment 4 Interview of Napoleon BonaparteRyan BurwellNo ratings yet

- Pre-Trial Brief of ProsecutionDocument3 pagesPre-Trial Brief of ProsecutionJoan PabloNo ratings yet

- To Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyDocument22 pagesTo Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyInstitute for Research on Public Policy (IRPP)No ratings yet

- Faith Leaders Call For Quinlan's FiringDocument7 pagesFaith Leaders Call For Quinlan's FiringThe Columbus DispatchNo ratings yet

- CH 12 Fraud and ErrorDocument28 pagesCH 12 Fraud and ErrorJoyce Anne GarduqueNo ratings yet

- Activity 1 Home and Branch Office AccountingDocument2 pagesActivity 1 Home and Branch Office AccountingMitos Cielo NavajaNo ratings yet

- 2022 062 120822 FullDocument100 pages2022 062 120822 FullDaniel T. WarrenNo ratings yet

- Torts For Digest LISTDocument12 pagesTorts For Digest LISTJim ParedesNo ratings yet

- Milton Ager - I'm Nobody's BabyDocument6 pagesMilton Ager - I'm Nobody's Babyperry202100% (1)

- February 11, 2015 Tribune Record GleanerDocument24 pagesFebruary 11, 2015 Tribune Record GleanercwmediaNo ratings yet

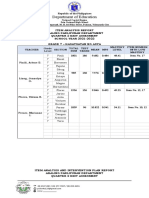

- Item Analysis Repost Sy2022Document4 pagesItem Analysis Repost Sy2022mjeduriaNo ratings yet

- 2nd PVC ONA Bill FormatDocument8 pages2nd PVC ONA Bill FormatSuresh PatilNo ratings yet

- Kerala rules on dangerous and offensive trade licensesDocument3 pagesKerala rules on dangerous and offensive trade licensesPranav Narayan GovindNo ratings yet

- CA 101 Lecture 8Document22 pagesCA 101 Lecture 8Johnpatrick DejesusNo ratings yet

- Land Management CommitteeDocument14 pagesLand Management CommitteeDisha Ahluwalia50% (4)

- Misha Regulatory AffairsDocument26 pagesMisha Regulatory AffairsGULSHAN MADHURNo ratings yet

- Case Chapter 02Document2 pagesCase Chapter 02Pandit PurnajuaraNo ratings yet

- Projector - Manual - 7075 Roockstone MiniDocument20 pagesProjector - Manual - 7075 Roockstone Mininauta007No ratings yet

- Wells Fargo Statement - Sept 2021Document6 pagesWells Fargo Statement - Sept 2021pradeep yadavNo ratings yet

- The Elite and EugenicsDocument16 pagesThe Elite and EugenicsTheDetailerNo ratings yet

- Business Practices of Cooperatives: Principles and Philosophies of CooperativismDocument32 pagesBusiness Practices of Cooperatives: Principles and Philosophies of CooperativismJaneth TugadeNo ratings yet

- WR CSM 20 NameList 24032021 EngliDocument68 pagesWR CSM 20 NameList 24032021 EnglivijaygnluNo ratings yet

- Kursus Binaan Bangunan B-010: Struktur Yuran Latihan & Kemudahan AsramaDocument4 pagesKursus Binaan Bangunan B-010: Struktur Yuran Latihan & Kemudahan AsramaAzman SyafriNo ratings yet

- Magnitude of Magnetic Field Inside Hydrogen Atom ModelDocument6 pagesMagnitude of Magnetic Field Inside Hydrogen Atom ModelChristopher ThaiNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceN.prem kumarNo ratings yet

- Swot Analysis of IB in PakistanDocument2 pagesSwot Analysis of IB in PakistanMubeen Zubair100% (2)