Professional Documents

Culture Documents

QS13 - Class Exercises Solution

Uploaded by

lyk0texCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QS13 - Class Exercises Solution

Uploaded by

lyk0texCopyright:

Available Formats

Accounting 225 Quiz Section #13

Chapter 6-2 & 11 Class Exercises Solution

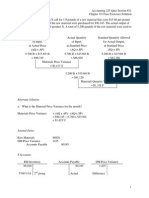

1. Kulp Corporation has two major business segments-East and West. In July, the East business

segment had sales revenues of $900,000, variable expenses of $441,000, and traceable fixed

expenses of $171,000. During the same month, the West business segment had sales revenues of

$450,000, variable expenses of $234,000, and traceable fixed expenses of $45,000. The common

fixed expenses totaled $321,000 and were allocated as follows: $180,000 to the East business

segment and $141,000 to the West business segment.

*Given

Solve in the following steps:

$450,000 - $234,000 = $216,000

$900,000 - $441,000 = $459,000; $450,000 - $234,000 = $216,000

$459,000 - $171,000 = $288,000; $216,000 - $45,000 = $171,000

$288,000 + $171,000 = $459,000

$459,000 - $321,000 = $138,000

a) The contribution margin of the West business segment is: $216,000

b) A properly constructed segmented income statement in a contribution format would show that

the segment margin of the East business segment is: $288,000

c) A properly constructed segmented income statement in a contribution format would show that

the net operating income of the company as a whole is: $138,000

2. A company's average operating assets are $220,000 and its net operating income is $44,000.

The company invested in a new project, increasing average assets to $250,000 and increasing its

net operating income to $49,550. What is the project's residual income if the required rate of

return is 20%?

Project average operating assets = $250,000 - $220,000 = $30,000

Project net operating income = $49,550 - $44,000 = $5,550

Residual income = Net operating income - Minimum required rate of return x Average operating

assets = $5,550 - (20% x $30,000) = ($450)

Accounting 225 Quiz Section #13

Chapter 6-2 & 11 Class Exercises Solution

3. Financial data for Beaker Company for last year appear below:

The company paid dividends of $2,100 last year. The "Investment in Cedar Company" on the

statement of financial position represents an investment in the stock of another company.

a. Compute the company's margin, turnover, and return on investment for last year.

Average operating assets = ($220,000 + $240,000)

2 = $230,000

Margin = Net operating income / Sales = $62,100

$414,000 = 15%

Turnover = Sales / Average operating assets = $414,000

$230,000 = 1.8

ROI = Net Operating Income / Average Operating Assets = 62100/ 230000 = 27%

b. The Board of Directors of Beaker Company has set a minimum required return of 20%. What

was the company's residual income last year?

You might also like

- 1Document10 pages1Tariq AbdulazizNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- UntitledDocument20 pagesUntitledapriljoyguiawanNo ratings yet

- Morales, Jonalyn M.Document7 pagesMorales, Jonalyn M.Jonalyn MoralesNo ratings yet

- 2 - Special IssuesDocument18 pages2 - Special IssuesMoe AdelNo ratings yet

- CF Quiz AprilDocument5 pagesCF Quiz Aprilsumeet9surana9744100% (1)

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezNo ratings yet

- Study Guide For Mgr. Exam 2Document10 pagesStudy Guide For Mgr. Exam 2Skirmante ZalysNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- Problems For Cash and Cash EquivalentsDocument1 pageProblems For Cash and Cash EquivalentsTine Vasiana DuermeNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Chapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementDocument33 pagesChapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementYukiNo ratings yet

- AGS CUP 6 Auditing Elimination RoundDocument17 pagesAGS CUP 6 Auditing Elimination RoundKenneth RobledoNo ratings yet

- D5Document12 pagesD5Mark Lord Morales BumagatNo ratings yet

- Set ADocument9 pagesSet AGladys Mae CorpuzNo ratings yet

- Financial Accounting FundamentalsDocument11 pagesFinancial Accounting FundamentalsCarl Angelo100% (1)

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- AE120 - Final Activity 1Document1 pageAE120 - Final Activity 1Krystal shaneNo ratings yet

- Accounting For Foreign Currency TransactionDocument3 pagesAccounting For Foreign Currency TransactionWilmar AbriolNo ratings yet

- CH 3 Vol 1 AnswersDocument17 pagesCH 3 Vol 1 Answersjayjay112275% (4)

- Day 1 financial statement reviewDocument12 pagesDay 1 financial statement reviewneo14No ratings yet

- Consulting Quiz Results & AnswersDocument25 pagesConsulting Quiz Results & AnswersQuendrick SurbanNo ratings yet

- CPA Firm MAS Purpose & Collection Cost Savings for Accounts ReceivableDocument30 pagesCPA Firm MAS Purpose & Collection Cost Savings for Accounts ReceivableMarc Allen Anthony GanNo ratings yet

- ToA Quizzer 1 - Intro To PFRS (3TAY1617)Document6 pagesToA Quizzer 1 - Intro To PFRS (3TAY1617)Kyle ParisNo ratings yet

- Chapter 09 - Answer PDFDocument9 pagesChapter 09 - Answer PDFjhienellNo ratings yet

- PAMANTASAN NG LUNGSOD NG VALENZUELA REVIEW PRACTICAL ACCOUNTING II INTEGRATED QUIZ ON BUSINESS COMBINATION AND CONSOLIDATED FINANCIAL STATEMENT DATE OF ACQUISITIONDocument6 pagesPAMANTASAN NG LUNGSOD NG VALENZUELA REVIEW PRACTICAL ACCOUNTING II INTEGRATED QUIZ ON BUSINESS COMBINATION AND CONSOLIDATED FINANCIAL STATEMENT DATE OF ACQUISITIONRichel Lidron100% (1)

- Karma Company Sells Televisions at An Average Price of P7Document1 pageKarma Company Sells Televisions at An Average Price of P7Nicole AguinaldoNo ratings yet

- Chapter 14 Financial StatemDocument198 pagesChapter 14 Financial StatemDan Andrei BongoNo ratings yet

- Dr. Lee's patient service revenue calculation under accrual basisDocument6 pagesDr. Lee's patient service revenue calculation under accrual basisAndrea Lyn Salonga CacayNo ratings yet

- Items 1Document7 pagesItems 1RYANNo ratings yet

- Accounting 2 FinalDocument21 pagesAccounting 2 Finalapi-3731801No ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- C36 Planning-W RevisionsDocument23 pagesC36 Planning-W RevisionsNicole Johnson100% (1)

- Variance AnalysisDocument21 pagesVariance Analysismark anthony espiritu0% (1)

- Activity # 1: Management Advisory Services Part 1Document2 pagesActivity # 1: Management Advisory Services Part 1Vince BesarioNo ratings yet

- Non-Profit OrganizationsDocument44 pagesNon-Profit OrganizationsJayvee BernalNo ratings yet

- ABC Company Current Assets and LiabilitiesDocument9 pagesABC Company Current Assets and LiabilitiesChristine Joy LanabanNo ratings yet

- Quiz ConstructionDocument1 pageQuiz ConstructionErjohn PapaNo ratings yet

- 1Document10 pages1Viannice AcostaNo ratings yet

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNo ratings yet

- The Following Information Will Be Used For Question Nos. 8 and 9Document5 pagesThe Following Information Will Be Used For Question Nos. 8 and 9jenieNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Multiple Choice ProblemsDocument3 pagesMultiple Choice ProblemsZvioule Ma FuentesNo ratings yet

- سناء انتر5 PDFDocument40 pagesسناء انتر5 PDFMohammed Isa HomidatNo ratings yet

- AGS CUP 6 Auditing Final RoundDocument19 pagesAGS CUP 6 Auditing Final RoundKenneth RobledoNo ratings yet

- Acctba3 - Comprehensive ReviewerDocument10 pagesAcctba3 - Comprehensive ReviewerDarwyn MendozaNo ratings yet

- 2007-05-25 050934 QuizDocument15 pages2007-05-25 050934 QuizRohith Kumar VennaNo ratings yet

- AFAR FinalMockBoard BDocument11 pagesAFAR FinalMockBoard BCattleyaNo ratings yet

- Abdullah Khalifa Ghanem Al Mutaiwei H00152904Document8 pagesAbdullah Khalifa Ghanem Al Mutaiwei H00152904Abdullah Al MutaiweiNo ratings yet

- Corporate Finance Final ExamDocument30 pagesCorporate Finance Final ExamJobarteh FofanaNo ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Tugas Studi Kasus AKM1 Kelompok 4Document4 pagesTugas Studi Kasus AKM1 Kelompok 4Marchelino GirothNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Chapter 1Document13 pagesChapter 1JacobMauckNo ratings yet

- Wild Chap 1Document7 pagesWild Chap 1Rahul GargNo ratings yet

- QS16 - Class ExercisesDocument5 pagesQS16 - Class Exerciseslyk0texNo ratings yet

- QS17 - Class Exercises SolutionDocument4 pagesQS17 - Class Exercises Solutionlyk0texNo ratings yet

- QS17 - Class ExercisesDocument4 pagesQS17 - Class Exerciseslyk0texNo ratings yet

- QS14 - Class Exercises SolutionDocument4 pagesQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS15 - Class Exercises SolutionDocument5 pagesQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS15 - Class ExercisesDocument4 pagesQS15 - Class Exerciseslyk0texNo ratings yet

- QS16 - Class Exercises SolutionDocument5 pagesQS16 - Class Exercises Solutionlyk0texNo ratings yet

- QS14 - Class ExercisesDocument4 pagesQS14 - Class Exerciseslyk0texNo ratings yet

- QS12 - Class Exercises SolutionDocument2 pagesQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS11 - Class ExercisesDocument5 pagesQS11 - Class Exerciseslyk0texNo ratings yet

- QS12 - Midterm 2 Review SolutionDocument7 pagesQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS12 - Class ExercisesDocument2 pagesQS12 - Class Exerciseslyk0texNo ratings yet

- QS10 - Class ExercisesDocument1 pageQS10 - Class Exerciseslyk0texNo ratings yet

- QS13 - Class ExercisesDocument2 pagesQS13 - Class Exerciseslyk0texNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS06 - Class ExercisesDocument3 pagesQS06 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class ExercisesDocument2 pagesQS05 - Class Exerciseslyk0texNo ratings yet

- QS10 - Class Exercises SolutionDocument2 pagesQS10 - Class Exercises Solutionlyk0texNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS04 - Class Exercises SolutionDocument3 pagesQS04 - Class Exercises Solutionlyk0texNo ratings yet

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- QS07 - Class ExercisesDocument8 pagesQS07 - Class Exerciseslyk0texNo ratings yet

- QS09 - Class ExercisesDocument4 pagesQS09 - Class Exerciseslyk0texNo ratings yet

- QS08 - Class ExercisesDocument4 pagesQS08 - Class Exerciseslyk0texNo ratings yet

- QS07 - Class Exercises SolutionDocument8 pagesQS07 - Class Exercises Solutionlyk0texNo ratings yet

- QS04 - Class ExercisesDocument3 pagesQS04 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- QS06 - Class Exercises SolutionDocument2 pagesQS06 - Class Exercises Solutionlyk0texNo ratings yet