Professional Documents

Culture Documents

Family Business Succession Planning

Uploaded by

api-246909910Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Family Business Succession Planning

Uploaded by

api-246909910Copyright:

Available Formats

Law Office Of Keith R Miles, LLC

Keith Miles Attorney-at-Law 2250 Oak Road PO Box 430 Snellville, GA 30078 678-666-0618 mileslawoffice@gmail.com www.TimeToEstatePlan.com

Family Business Succession Planning

January 30, 2014 Page 1 of 9, see disclaimer on final page

Transferring Your Family Business

As a business owner, you're going to have to decide when will be the right time to step out of the family business and how you'll do it. There are many estate planning tools you can use to transfer your business. Selecting the right one will depend on whether you plan to retire from the business or keep it until you die. Perhaps you have children or other family members who wish to continue the business after your death. Obviously, you'll want to transfer your business to your successors at its full value. However, with potential income, gift, and estate taxes, it takes careful planning to prevent some (or all) of the business assets from being sold to pay them, perhaps leaving little for your beneficiaries. Therefore, business succession planning must include ways not only to ensure the continuity of your business, but also to do so with the smallest possible tax consequences. Some of the more common strategies for minimizing taxes are explained briefly in the following sections. Remember, none are without drawbacks. You'll want to consult a tax professional as well as your estate planning attorney to explore all strategies. paid in annual installments over a period of up to 10 years (installment payments include both principal and interest). This allows your beneficiaries more time to raise sufficient funds or obtain more favorable interest rates. The business must exceed 35 percent of your gross estate and must meet other requirements to qualify.

There are many estate planning tools you can use to transfer your business. Selecting the right one will depend on whether you plan to retire from the business or keep it until you die.

Selling your business interest outright

When you sell your business interest to a family member or someone else, you receive cash (or assets that you can convert to cash) which can be used to maintain your lifestyle or pay transfer taxes. You choose when to sell--now, at your retirement, at your death, or anytime in between. As long as the sale is for the full fair market value (FMV) of the business, it is not subject to transfer taxes. But if the sale occurs before your death, it may be subject to capital gains tax.

Transferring your business interest with a buy-sell agreement

A buy-sell agreement is a legal contract that prearranges the sale of your business interest between you and a willing buyer. A buy-sell agreement lets you keep control of your interest until the occurrence of an event that the agreement specifies, such as your retirement, disability, or death. Other events like divorce can also be included as triggering events under a buy-sell agreement. When the triggering event occurs, the buyer is obligated to buy your interest from you or your estate at the FMV. The buyer can be a person, a group (such as co-owners), or the business itself. Price and sale terms are prearranged, which eliminates the need for a fire sale if you become ill or when you die. Remember, you are bound under a buy-sell agreement: You can't sell or give your business to anyone except the buyer named in the agreement without the buyer's consent. This could restrict your ability to reduce the size of your estate through lifetime gifts of your business interest, unless you carefully coordinate your estate planning goals with the terms of your buy-sell agreement.

You may get some relief under the Internal Revenue Code

If you are prepared to begin transferring some of your business interest to your beneficiaries, a systematic gifting program can help accomplish this while minimizing federal gift and estate tax liability (and state transfer tax liability, if applicable) that might otherwise be incurred. This is done by utilizing your ability to gift up to $14,000 (in 2013, $13,000 in 2012) per year per recipient without incurring transfer tax. By transferring portions of your business in this manner, over time you may manage to transfer a significant portion of your business free from transfer tax. Clearly, the disadvantage of relying solely on this method of transferring your business is the amount of time necessary to complete the transfer of your entire estate. In addition, Section 6166 of the Internal Revenue Code allows any federal gift and estate tax incurred because of the inclusion of a closely held business in your estate to be deferred for 5 years (with interest-only payments for the first four years), and then

Page 2 of 9, see disclaimer on final page

Grantor retained annuity trusts or grantor retained unitrusts

A more sophisticated business succession tool is a grantor retained annuity trust (GRAT) or a grantor retained unitrust (GRUT). GRAT/GRUTs are irrevocable trusts to which you transfer appreciating assets while retaining an annuity or unitrust payment for a set period of time. In general, an annuity means you receive fixed periodic payments, while a unitrust means you receive payments of a fixed percentage of trust assets (revalued annually). At either the end of the payment period or your death, the assets in the trust pass to the other trust beneficiaries (the remainder beneficiaries). The value of the retained annuity or unitrust interest is subtracted from the value of the property transferred to the trust (i.e., a share of the business), so if you live beyond the specified payment period, the business may be ultimately transferred to the next generation at a reduced value for transfer tax purposes.

Until very recently, exchanging property for an unsecured private annuity allowed you to spread out any gain realized, deferring capital gains tax. Proposed regulations have effectively eliminated this benefit for most exchanges, however. If you're considering a private annuity, be sure to talk to a tax professional.

Self-canceling installment notes

A self-canceling installment note (SCIN) allows you to transfer the business to the buyer in exchange for a promissory note. The buyer must make a series of payments to you under that note. A provision in the note states that at your death, the remaining payments will be canceled. SCINs provide for a lifetime income stream and avoidance of transfer taxes similar to private annuities. Unlike private annuities, SCINs give you a security interest in the transferred business.

A more sophisticated business succession tool is a grantor retained annuity trust (GRAT) or grantor retained unitrust (GRUT).

Family limited partnerships

A family limited partnership can also assist in transferring your business interest to family members. First, you establish a partnership with both general and limited partnership interests. Then, you transfer the business to this partnership. You retain the general partnership interest for yourself, allowing you to maintain control over the day-to-day operation of the business. Over time, you gift the limited partnership interest to family members. The value of the gifts may be eligible for valuation discounts as a minority interest and for lack of marketability. If so, you may successfully transfer much of your business to your heirs at significant transfer tax savings.

Private annuities

A private annuity is the sale of property in exchange for a promise to make payments to you for the rest of your life. Here, you transfer complete ownership of the business to family members or another party (the buyer). The buyer in turn makes a promise to make periodic payments to you for the rest of your life (a single life annuity) or for your life and the life of a second person (a joint and survivor annuity). A joint and survivor annuity provides payments until the death of the last survivor; that is, payments continue as long as either the husband or wife is still alive. Again, because a private annuity is a sale and not a gift, it allows you to remove assets from your estate without incurring transfer taxes.

Grantor Retained Annuity Trust (GRAT)

Definition

A grantor retained annuity trust (GRAT) is an irrevocable trust into which a grantor makes a one-time transfer of property, and in which the grantor retains the right to receive a fixed amount (an annuity) at least annually for a specified term of years. At the end of the retained annuity period, the property remaining in the trust passes to the remainder beneficiaries or remains in trust for their benefit. A transfer of property to an irrevocable trust is a taxable gift. The value of the gift on which federal gift and estate tax is imposed is generally its fair market value. However, because the grantor retains an interest in a GRAT, the value of the transfer is discounted; transfer tax is imposed only on the remainder interest. Note: Any transfer tax due may be sheltered by the grantor's lifetime gift and estate tax applicable exclusion amount ($5,250,000 in 2013). This taxable value is calculated using an interest rate provided by the IRS (known as the discount rate or Section 7520 rate), which

Page 3 of 9, see disclaimer on final page

A grantor retained annuity trust (GRAT) allows the value of the property transferred to the trust to be discounted, while removing the trust property from the grantor's gross estate.

is based on current interest rates and changes monthly. This interest rate assumes the GRAT property will earn a certain rate of return during the annuity period. Any actual return that exceeds the assumed return passes to the remainder beneficiaries transfer tax free. Investment performance, therefore, is central to this strategy.

Key tradeoffs

If the GRAT property underperforms the Section 7520 rate, no tax savings is achieved (and if the GRAT is depleted, no property is transferred to the remainder beneficiaries) If the GRAT property underperforms the Section 7520 rate, gift taxes paid and/or any applicable exclusion amount used will be wasted (though the amounts would be minimal) If the grantor does not outlive the term of years, any property remaining in the GRAT is includable in the grantor's gross estate for federal gift and estate tax purposes If the GRAT is unsuccessful, any costs incurred to create and maintain the GRAT will have been wasted

For a GRAT to be successful:

The grantor must outlive the term of years The GRAT property must outperform the Section 7520 rate The GRAT document must be properly drafted

Potential tax advantages of a GRAT include:

Because of the retained interest, the value of the transfer for federal gift and estate tax purposes may be discounted Principal remaining in the GRAT at the end of the term of years is removed from the grantor's gross estate for federal gift and estate tax purposes Interest (i.e., appreciation and/or earnings) remaining in the GRAT at the end of the term of years passes to the remainder beneficiaries federal gift and estate tax free

How is it implemented?

Hire an experienced attorney to draft the GRAT document Have property that is transferred to GRAT professionally appraised Transfer property to GRAT (i.e., retitle assets) File gift tax return(s)

Grantor Retained Unitrust (GRUT)

Definition

A grantor retained unitrust (GRUT) is an irrevocable trust into which a grantor makes a one-time transfer of property, and in which the grantor retains the right to receive a variable amount (based on a fixed percentage of trust assets valued annually) at least annually for a specified term of years. At the end of the retained unitrust period, the property remaining in the trust passes to the remainder beneficiaries or remains in trust for their benefit. A transfer of property to an irrevocable trust is a taxable gift. The value of the gift on which federal gift and estate tax is imposed is generally its fair market value. However, because the grantor retains an interest in a GRUT, the value of the transfer is discounted; transfer tax is imposed only on the remainder interest. Note: Any transfer tax due may be sheltered by the grantor's lifetime gift and estate tax applicable exclusion amount ($5,250,000 in 2013). This taxable value is calculated based on the value of the property transferred to the GRUT, the unitrust payout rate, the term of the trust, and using an interest rate provided by the IRS (known as the discount rate or Section 7520 rate), which is based on current interest rates and changes monthly. However, unlike with a GRAT, the Section 7520 rate has little or no effect on the value of the remainder interest in a GRUT. A GRUT is the same type of trust as a grantor retained annuity trust (GRAT), except that with a GRAT, the grantor receives a fixed annuity amount rather than a variable unitrust payment. Because of this, payments to the grantor of a GRUT may increase or decrease each year depending on the value of the trust assets. And, because the unitrust payment must be recalculated each year, the cost to administer a GRUT may be greater than with a GRAT. Another important difference between these two trusts is that unlike a

A grantor retained unitrust allows a discount for the value of the property transferred to the trust, while removing the property from the grantor's gross estate.

Page 4 of 9, see disclaimer on final page

GRAT, a GRUT can't be zeroed out, and therefore a taxable gift always results.

For a GRUT to be successful:

The grantor must outlive the term of years The GRUT document must be properly drafted

Potential tax advantages of a GRUT include:

Because of the retained interest, the value of the transfer for federal gift and estate tax purposes may be discounted Principal remaining in the GRUT at the end of the term of years is removed from the grantor's gross estate for federal gift and estate tax purposes While not a tax advantage, if the value of the trust property increases, payments to the grantor increase, possibly providing protection against inflation

and gift taxes paid and/or any applicable exclusion amount used may be wasted If the grantor does not outlive the term of years, any property remaining in the GRUT is includable in the grantor's gross estate for federal gift and estate tax purposes If the GRUT is unsuccessful, any costs incurred to create and maintain the GRUT will be wasted If the value of the trust property decreases, payments to the grantor decrease, and may not provide enough income If payments to the grantor increase because the value of the trust property increases, the additional payments will be included in the grantor's gross estate for federal estate tax purposes unless consumed or given away

How is it implemented?

Hire an experienced attorney to draft the GRUT document Have property that is transferred to the GRUT professionally appraised Transfer property to GRUT (i.e., retitle assets) File gift tax return(s)

Key tradeoffs

If the GRUT property performs poorly or is depleted, there may be less than anticipated transferred to the remainder beneficiaries and little or no tax savings

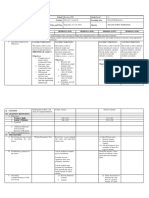

Planning for Succession of a Business Interest Flowchart

Page 5 of 9, see disclaimer on final page

Business Succession Planning Alternatives

Lifetime gifts Bequest If you want to: Sell your business interest Not appropriate Not appropriate Lifetime sale You may be able to sell your business outright-but there is no guarantee Estate sale Your estate may be able to sell your business outright-but there is no guarantee Not appropriate Buy-sell agreement Buy-sell agreement can be used to guarantee the sale of your business Not appropriate

If you want to: Give business to your children

You can control the timing and size of the gifts

You control Not the size of the appropriate gift through your will Not appropriate You can control timing of sale-but sale is not guaranteed You can control timing of sale-but sale is not guaranteed

If you want Can be used to: in conjunction Sell business with sale to your children If you want to: Minimize value of your estate Can be used to reduce the value of your estate and maximize gift tax exclusion

Your child could buy from your estate-but sale is not guaranteed Value of business must be included in your estate

Buy-sell can be used to guarantee your child's option to buy your interest Value of business must be included in your estate, but the buy-sell can help establish that value

Will not minimize value of your estate

Page 6 of 9, see disclaimer on final page

Business Succession Planning: Comparison of Alternatives

FLP Minimize Federal Gift Tax Minimize Federal Estate Tax Minimize Federal Income Tax Yes1 Private Annuity Yes2 SCIN Yes GRAT Yes2 Lifetime Gifts No

Yes3

Yes4

Yes4

Yes4

Yes3

Yes5

No

No

No

Yes5

Minimize Yes6 Federal Capital Gains Tax Income for Transferor Control by Donor Creditor Protection Risk 1. 2. 3. 4. 5. 6. 7. 8. Yes Yes Yes7 No

No

Yes

Yes6

Yes6

Yes No No Yes8

Yes No No Yes8

Yes Yes No No

No No Yes No

Value of gifted interest may be discounted, otherwise eligible for annual and lifetime gift tax exemptions To the extent fair market value of business does not exceed present value of annuity Shifts future appreciation to children But not to the extent payments are received and increase the transferor's estate value Shifts income to children But note that donees do not receive a "step up" in basis on transferred assets Limited partners generally have no personal liability for partnership debts Transferor may not live long enough to receive full payment

Page 7 of 9, see disclaimer on final page

Overview of Buy-Sell Agreement Forms

Agreement form Wait and see Buyer Business entity, co-owner, or both Co-owner Transaction overseen by trustee Works well with Business with two or more owners Business with two or more owners Simplifies plan when large number of owners Business with two or more owners Business with two or more owners Business with two or more owners, especially family business Business with two or more owners, especially family business Business with two or more owners Unsuitable for Sole proprietor and single-shareholder corporation Sole proprietor and single-shareholder corporation

Trusteed cross purchase

Entity purchase (stock redemption) Section 302 stock redemption Section 303 stock redemption

Business entity Business entity

Most expensive type Sole proprietor and single-shareholder corporation Sole proprietor and single-shareholder corporation Sole proprietor and single- shareholder corporation Sole proprietor and single-shareholder corporation Large number of owners (gets complicated with four or more) Any scenario where guaranteed sale is needed

Business entity

Reverse Section 303 stock redemption

Business entity

Cross purchase (crisscross) agreement

Co-owner

Option plan

Business entity, co-owner, or any eligible third party Sale not guaranteed

Business with any number of owners, including sole proprietorship and single-shareholder corporation Business with any number of owners, including sole proprietorship and single-shareholder corporation

One-way buy-sell

Business entity, co-owner, or any eligible third party

Sole proprietor with no willing buyer

Page 8 of 9, see disclaimer on final page

Disclosure Information -- Important -- Please Review

IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliablewe cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Law Office Of Keith R Miles, LLC Keith Miles Attorney-at-Law 2250 Oak Road PO Box 430 Snellville, GA 30078 mileslawoffice@gmail.com 678-666-0618

Page 9 of 9 January 30, 2014 Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2014

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Private Family FoundationsDocument5 pagesPrivate Family Foundationsapi-246909910100% (4)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 403b PlansDocument2 pages403b Plansapi-246909910No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Charitable Remainder TrustDocument4 pagesCharitable Remainder Trustapi-246909910100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Charitable Lead TrustDocument4 pagesCharitable Lead Trustapi-246909910No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 401k PlansDocument2 pages401k Plansapi-246909910No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Business Succession Planning CaseDocument5 pagesBusiness Succession Planning Caseapi-246909910No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grantor Retained Annuity Trust GratDocument2 pagesGrantor Retained Annuity Trust Gratapi-246909910No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Dynasty TrustDocument4 pagesDynasty Trustapi-246909910No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Qualified Terminable Interest Property Qtip TrustDocument5 pagesQualified Terminable Interest Property Qtip Trustapi-246909910No ratings yet

- Business Succession PlanningDocument2 pagesBusiness Succession Planningapi-246909910No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Asset ProtectionDocument10 pagesAsset Protectionapi-246909910No ratings yet

- Portability of Applicable Exclusion Amount Between SpousesDocument2 pagesPortability of Applicable Exclusion Amount Between Spousesapi-246909910No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Credit Shelter TrustDocument5 pagesCredit Shelter Trustapi-246909910No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- FLP or FLLCDocument2 pagesFLP or FLLCapi-246909910No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Roth 403bDocument2 pagesThe Roth 403bapi-246909910No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Roth 401kDocument2 pagesThe Roth 401kapi-246909910No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- All About IrasDocument2 pagesAll About Irasapi-246909910No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Long-Term Care AnnuitiesDocument2 pagesLong-Term Care Annuitiesapi-246909910No ratings yet

- Stretch IrasDocument2 pagesStretch Irasapi-246909910No ratings yet

- Roth Ira ConversionsDocument2 pagesRoth Ira Conversionsapi-246909910No ratings yet

- Changing Jobs Take Your 401k and Roll ItDocument2 pagesChanging Jobs Take Your 401k and Roll Itapi-246909910No ratings yet

- Retirement Planning With AnnuitiesDocument11 pagesRetirement Planning With Annuitiesapi-246909910No ratings yet

- Retirement Planning Key NumbersDocument2 pagesRetirement Planning Key Numbersapi-246909910No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Basic Retirement PlanningDocument12 pagesBasic Retirement Planningapi-246909910No ratings yet

- Gift TaxDocument6 pagesGift Taxapi-246909910No ratings yet

- New Estate Tax Rules and Your Estate PlanDocument2 pagesNew Estate Tax Rules and Your Estate Planapi-246909910No ratings yet

- Estate Tax BasicsDocument7 pagesEstate Tax Basicsapi-246909910No ratings yet

- Social Security Retirement Benefit BasicsDocument2 pagesSocial Security Retirement Benefit Basicsapi-246909910No ratings yet

- Social Security Claiming Strategies For Married CouplesDocument2 pagesSocial Security Claiming Strategies For Married Couplesapi-246909910No ratings yet

- De La Salle University Business Analysis 1 SyllabusDocument4 pagesDe La Salle University Business Analysis 1 SyllabusJanusz Paolo LarinNo ratings yet

- Lesson 1: Fair Market Value of An AnnuityDocument7 pagesLesson 1: Fair Market Value of An AnnuityAlex Albarando SaraososNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Learning Resource 8 Lesson 1Document7 pagesLearning Resource 8 Lesson 1Vianca Marella SamonteNo ratings yet

- Principles of Money-Time Relationship (Part 2) : After Completing This Module, You Are Expected ToDocument10 pagesPrinciples of Money-Time Relationship (Part 2) : After Completing This Module, You Are Expected ToCyrelle EscritorNo ratings yet

- Quarter 2 - Module 4 GENERAL MATHEMATICSDocument6 pagesQuarter 2 - Module 4 GENERAL MATHEMATICSKristine AlcordoNo ratings yet

- Financial MathsDocument206 pagesFinancial MathsEVANS50% (2)

- Time Value of MoneyDocument37 pagesTime Value of MoneyNicole PunzalanNo ratings yet

- Cfa L1 R1 OutlineDocument9 pagesCfa L1 R1 OutlineKazi HasanNo ratings yet

- Tugas04_AKM 1-D_23013010276_Bagas Arya Satya DinataDocument13 pagesTugas04_AKM 1-D_23013010276_Bagas Arya Satya DinataBagas Arya Satya DinataNo ratings yet

- Homework QuestionsDocument6 pagesHomework Questionsgaurav shetty100% (1)

- ENGINEERING ECONOMY: KEY CONCEPTSDocument13 pagesENGINEERING ECONOMY: KEY CONCEPTSbabadapbadapNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2nd Periodical Test 2023Document3 pages2nd Periodical Test 2023Gideon CayogNo ratings yet

- DLL - Genmath - General and Deferred - AnnuityDocument6 pagesDLL - Genmath - General and Deferred - AnnuityGerson Tampolino Acosta100% (2)

- Time Value of MoneyDocument5 pagesTime Value of MoneyXytusNo ratings yet

- Tutorial 1 Problem Set Answers - FinalDocument38 pagesTutorial 1 Problem Set Answers - FinalHelloNo ratings yet

- Formule Corporate FinanceDocument6 pagesFormule Corporate FinanceБота Омарова100% (1)

- AnnuitiesDocument74 pagesAnnuitiesbingNo ratings yet

- Workflow Expression Parser: From Docuware Version 7.1 OnDocument26 pagesWorkflow Expression Parser: From Docuware Version 7.1 OnMoises AstorgaNo ratings yet

- Finance Chapter 9 Questions and SolutionsDocument28 pagesFinance Chapter 9 Questions and SolutionsAliAltaf67% (3)

- ReSA B44 FAR First PB Exam Questions Answers SolutionsDocument17 pagesReSA B44 FAR First PB Exam Questions Answers SolutionsWesNo ratings yet

- ACTSC 221 - Review For Final ExamDocument2 pagesACTSC 221 - Review For Final ExamDavidKnightNo ratings yet

- Accounting for LeasesDocument4 pagesAccounting for LeasesDaryl Dizon Cabanza100% (1)

- Time Value of Money QuestionsDocument8 pagesTime Value of Money QuestionswanNo ratings yet

- M1 10-Eng'gEconomyDocument4 pagesM1 10-Eng'gEconomyApril Bacaser DancilNo ratings yet

- Financial Mathematics Exam—June 2018 ReviewDocument6 pagesFinancial Mathematics Exam—June 2018 ReviewshuNo ratings yet

- Present Value Calculations for Retirement PlanningDocument38 pagesPresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- Lesson 6Document10 pagesLesson 6Jean LeysonNo ratings yet

- Amortization and Sinking FundDocument2 pagesAmortization and Sinking FundClariz Angelika EscocioNo ratings yet

- L3 Ch4Document60 pagesL3 Ch4Gulzhan KassymovaNo ratings yet

- Lesson 5 (Semis)Document10 pagesLesson 5 (Semis)Joesil Dianne SempronNo ratings yet

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Crushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooFrom EverandCrushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooRating: 5 out of 5 stars5/5 (887)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Creative Personal Branding: The Strategy To Answer What's Next?From EverandCreative Personal Branding: The Strategy To Answer What's Next?Rating: 4.5 out of 5 stars4.5/5 (3)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)