Professional Documents

Culture Documents

Change Bank Details Form

Uploaded by

Mustafa BapaiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Change Bank Details Form

Uploaded by

Mustafa BapaiCopyright:

Available Formats

D.

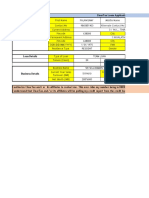

DOCUMENTS SUBMITTED HEREWITH (PLEASE READ SECTION ON PROCEDURE PROCEDURE REQUIRED FOR CHANGE IN BANK DETAILS OVERLEAF)

Unitholders will receive redemption/ dividend proceeds directly into their bank account via Direct credit / NEFT / ECS facility. I/We want to receive the redemption / dividend proceeds (if any) by way of a cheque / demand draft instead of direct credit / credit through NEFT system / credit through ECS into my / our bank account [Please tick ( )] Note : The charges, if any, levied by the unit holder's bank for receiving payments (i.e. dividend / redemption proceeds) through NEFT and crediting the unitholder's account, will be borne by the unit holder.

I/We hereby declare that particulars given above are correct and express my willingness to receive credit of Dividend / Redemption proceeds through the mode indicated above. If the transaction is delayed or not effected at all for reasons of incomplete or incorrect information, I/we would not hold HDFC Mutual Fund / HDFC Asset Management Company Limited, its registrars and other service providers responsible. I/we will also inform HDFC Mutual Fund / HDFC Asset Management Company Limited about any changes in my/our bank account. SIGNATURE(S) (To be signed by ALL UNIT HOLDERS if mode of holding is Joint)

>

PROCEDURE REQUIRED FOR CHANGE IN BANK DETAILS In case a 'Change of Bank Mandate Form' is submitted, the following procedure needs to be adhered to: 1. Unit holders will be required to submit the duly filled in Change of Bank Mandate Form along with a cancelled original cheque leaf of the new bank account as well as the bank account currently registered with the Mutual Fund (where the account number and first unit holder name is printed on the face of the cheque). Unit holders should without fail cancel the cheque and write 'Cancelled' on the face of it to prevent any possible misuse. 2. Where such name is not printed on the original cheque, the Unit holder may submit a letter from the bank on its letterhead certifying that the Unit holder maintains/ maintained an account with the bank, the bank account information like bank account number, bank branch, account type, the MICR code of the branch & IFSC Code (where available). 3. In case of non-availability of any of these documents, a self attested copy of the bank pass book or a statement of bank account with current entries not older than 3 months having the name and address of the first unit holder and account number. Note: The above documents shall be submitted in Original. If copies are furnished, the same must be submitted at the ISCs where they will be verified with the original documents to the satisfaction of the Fund. The originals documents will be returned across the counter to the Unit holder after due verification. In case the original of any document is not produced for verification, then the copies should be attested by the bank manager with his / her full signature, name, employee code, bank seal and contact number. In the event of a request for change in bank account information being invalid / incomplete / not satisfactory in respect of signature mismatch/document insufficiency/ not meeting any requirements more specifically as indicated in clauses 1-3 above, the request for such change will not be processed. Redemptions / dividend payments, if any, will be processed and the last registered bank account information will be used for such payments to Unit holders. Unit holders may note that it is desirable to submit their requests for change in bank details atleast 7 days prior to date of redemption / dividend payment, if any and ensure that the request for change in bank mandate has been processed before submitting the redemption request. If change in bank mandate has not been processed, payment will be made in the existing bank account registered in the folio. Further, in the event of a request for redemption of units being received within seven days of change in bank account details, the normal processing time as specified in the Scheme Information Document, may not necessarily apply, however it shall be within the regulatory limits. Any unregistered bank account or a new bank account mentioned by the Unit holder along with the redemption request may not be considered for payment of redemption /dividend proceeds.

You might also like

- Electronic Clearance FormDocument1 pageElectronic Clearance FormShubham KambleNo ratings yet

- LETTER OF AUTHORIZATION AND IMFPA AND CIS Doyle AnthonyDocument12 pagesLETTER OF AUTHORIZATION AND IMFPA AND CIS Doyle AnthonySATRIO BUDI LEKSONO100% (1)

- Claim Form: State of Colorado Department of The Treasury Unclaimed Property DivisionDocument3 pagesClaim Form: State of Colorado Department of The Treasury Unclaimed Property Divisionjohn mascarenasNo ratings yet

- 2016 SSS Loan Form PDFDocument4 pages2016 SSS Loan Form PDFAnonymous 1AXVu3Gh60% (5)

- Copart Wire IntructionsDocument1 pageCopart Wire IntructionsGeorge PlishkoNo ratings yet

- PDFDocument1 pagePDFharessh100% (1)

- KYC Test CasesDocument18 pagesKYC Test CasesrekhaNo ratings yet

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- Third Party FDDocument4 pagesThird Party FDWali AshrafNo ratings yet

- Policy Payout Request Form for hassle-free processingDocument4 pagesPolicy Payout Request Form for hassle-free processingAkshayNo ratings yet

- Business Loan - Application Form & Document ListDocument5 pagesBusiness Loan - Application Form & Document ListsamaadhuNo ratings yet

- Ach Origination Authorization Form: Transfer InformationDocument1 pageAch Origination Authorization Form: Transfer InformationRebekka ZmoraNo ratings yet

- Pay in SlipDocument1 pagePay in Slipdashing_aviNo ratings yet

- Colombian Student Visa Application for US StudyDocument3 pagesColombian Student Visa Application for US StudyJose Antonio Valero AtuestaNo ratings yet

- Certificate of Ownership of A Business: For Additional Owners, Please Complete The BackDocument2 pagesCertificate of Ownership of A Business: For Additional Owners, Please Complete The BackmarkanapierNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormFermarc Lestajo100% (1)

- Ein Irs NoticeDocument3 pagesEin Irs NoticepostovNo ratings yet

- Payroll Direct Deposit SetupDocument1 pagePayroll Direct Deposit SetupstefonlawlessNo ratings yet

- Gmail - Your Flight Tickets For BLR-BOMDocument1 pageGmail - Your Flight Tickets For BLR-BOMPranav100% (1)

- Rashed CVDocument3 pagesRashed CVRasedul BariNo ratings yet

- Form A PDFDocument2 pagesForm A PDFSundar SethNo ratings yet

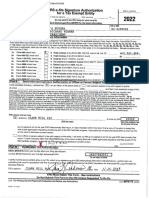

- JUUL Medical Authorization Packet - Tarek WegDocument4 pagesJUUL Medical Authorization Packet - Tarek WegTed RustNo ratings yet

- PWR - Carrier PacketDocument3 pagesPWR - Carrier Packetmeda590No ratings yet

- APPLY FOR ATM/DEBIT CARDDocument1 pageAPPLY FOR ATM/DEBIT CARDVivek DhimanNo ratings yet

- Printing H - FORMFLOW - SF3107.FRPDocument10 pagesPrinting H - FORMFLOW - SF3107.FRPKeller Brown JnrNo ratings yet

- Nairn Letter and Check From School001Document1 pageNairn Letter and Check From School001Killi Leaks100% (1)

- 2019 11 SNS BANK + SNS REAAL OfferDocument5 pages2019 11 SNS BANK + SNS REAAL OfferSouthey CapitalNo ratings yet

- Checklist Report V1Document22 pagesChecklist Report V1Anil kadamNo ratings yet

- Non-Immigrant Visa - Review Personal, Address, Phone, and Passport InformationDocument2 pagesNon-Immigrant Visa - Review Personal, Address, Phone, and Passport InformationTie PereiraNo ratings yet

- Book Agadir to Rabat flight with Air ArabiaDocument2 pagesBook Agadir to Rabat flight with Air ArabiaCubecraft GamesNo ratings yet

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's Recordsbassomassi sanogoNo ratings yet

- Signature Card InfoDocument1 pageSignature Card Infosadik lawanNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNo ratings yet

- Welcome Letter BonanzzaDocument3 pagesWelcome Letter BonanzzaNimish MethiNo ratings yet

- Bank Confirmation Audit RequestDocument6 pagesBank Confirmation Audit RequestNur Alis Majid100% (1)

- AZ Argan Ventures LTDDocument20 pagesAZ Argan Ventures LTDBarangaySanLuisNo ratings yet

- Neha Enterprises: Flooring, Dry-Cleaningat (Estb. 2001)Document2 pagesNeha Enterprises: Flooring, Dry-Cleaningat (Estb. 2001)mohitNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931MuraliMohanNo ratings yet

- Wright Express - Non Acquiring - MemphisDocument8 pagesWright Express - Non Acquiring - MemphisShashi Mae BonifacioNo ratings yet

- 1099-INT 2023 - Tax FormDocument3 pages1099-INT 2023 - Tax Form16baezmcNo ratings yet

- Credit Card - SalmanDocument9 pagesCredit Card - SalmanssalmanhaiderNo ratings yet

- ABL Modification FormDocument1 pageABL Modification FormVishal JogiNo ratings yet

- Request For A Domestic Wire Transfer: Please NoteDocument1 pageRequest For A Domestic Wire Transfer: Please NoteCharmin N. RickardsNo ratings yet

- MSDS for Li-ion Battery Material Safety Data SheetDocument8 pagesMSDS for Li-ion Battery Material Safety Data SheetLee PeterNo ratings yet

- Application Details and Consumer AuthorizationDocument10 pagesApplication Details and Consumer AuthorizationAnna GassettNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- A Mba Lo SurrenderDocument6 pagesA Mba Lo SurrenderGabe AmbaloNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- Vba-26-1880-Are VA Certificate of Eligability ApplicationDocument2 pagesVba-26-1880-Are VA Certificate of Eligability ApplicationJohnnie L. MockNo ratings yet

- 3232 Void Corrected: Form W-2GDocument8 pages3232 Void Corrected: Form W-2GMichael HenryNo ratings yet

- Dell RG2 01 LatitudeDocument5 pagesDell RG2 01 LatitudeMichelle McknightNo ratings yet

- SL ParticularsDocument18 pagesSL ParticularsRRajath ShettyNo ratings yet

- Request for Taxpayer ID FormDocument4 pagesRequest for Taxpayer ID FormMichael RamirezNo ratings yet

- Annu Acc StatementDocument1 pageAnnu Acc StatementAHMAD ANTOINE DELAINENo ratings yet

- Procurement Fee Agreement BreakdownDocument9 pagesProcurement Fee Agreement BreakdownPedro Ant. Núñez UlloaNo ratings yet

- Jaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Document8 pagesJaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Julius MasiganNo ratings yet

- Owner Ledger ReportDocument1 pageOwner Ledger ReportRachelNo ratings yet

- Martin Nussbaum Credit Report SummaryDocument1 pageMartin Nussbaum Credit Report SummaryChris PearsonNo ratings yet

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino RivasNo ratings yet

- COB DeclarationDocument2 pagesCOB DeclarationParul KumarNo ratings yet

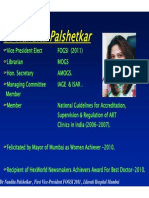

- GP - Clinics 2020 07Document44 pagesGP - Clinics 2020 07Mustafa BapaiNo ratings yet

- HDFC Account Closure FormDocument4 pagesHDFC Account Closure FormMustafa BapaiNo ratings yet

- ListDocument1 pageListMustafa BapaiNo ratings yet

- Ca 125Document1 pageCa 125Mustafa BapaiNo ratings yet

- Mutual Funds ResearchDocument2 pagesMutual Funds ResearchMustafa BapaiNo ratings yet

- Male InfertilityDocument37 pagesMale InfertilityMustafa BapaiNo ratings yet

- Mutual Funds ResearchDocument2 pagesMutual Funds ResearchMustafa BapaiNo ratings yet

- Hakimi Clinic Telephone Bill Payment 2013 10 16Document1 pageHakimi Clinic Telephone Bill Payment 2013 10 16Mustafa BapaiNo ratings yet

- Residence Telephone Bill Payment 2013 10 16Document1 pageResidence Telephone Bill Payment 2013 10 16Mustafa BapaiNo ratings yet

- 25 - The Borderline CaseDocument56 pages25 - The Borderline CaseMustafa BapaiNo ratings yet

- 200 Hospital BenchmarksDocument16 pages200 Hospital BenchmarksMustafa BapaiNo ratings yet

- Abbas - Thyroid Report !Document1 pageAbbas - Thyroid Report !Mustafa BapaiNo ratings yet

- PS 1Document4 pagesPS 1BlackRoseNo ratings yet

- Prospectus of UPGDCLDocument159 pagesProspectus of UPGDCLuuuuufffffNo ratings yet

- Dental MGT SysDocument63 pagesDental MGT Systsfahmad360100% (1)

- Retainer Agreement for New Pilot Caregiver Legal ServicesDocument7 pagesRetainer Agreement for New Pilot Caregiver Legal Servicesvimar teroNo ratings yet

- Supercard Most Important Terms and ConditionsDocument26 pagesSupercard Most Important Terms and Conditionstauseef21scribdNo ratings yet

- 2.3 Metrobank Vs Junnel's MarketingDocument29 pages2.3 Metrobank Vs Junnel's MarketingMarion Yves MosonesNo ratings yet

- Authorize bank to insert date on undated chequeDocument1 pageAuthorize bank to insert date on undated chequeovifinNo ratings yet

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument12 pagesTally Tips - Accounting Heads of Incomes - ExpensescooNo ratings yet

- Internship Report of Askari BankDocument109 pagesInternship Report of Askari BankharisNo ratings yet

- United States v. Mumma, 509 F.3d 1239, 10th Cir. (2007)Document14 pagesUnited States v. Mumma, 509 F.3d 1239, 10th Cir. (2007)Scribd Government DocsNo ratings yet

- Uk Frtol PDFDocument6 pagesUk Frtol PDFKumaraswamy RSNo ratings yet

- Yusay Barcelona Complaint AffidavitDocument8 pagesYusay Barcelona Complaint AffidavitBelenReyesNo ratings yet

- G.R. No. 134699Document5 pagesG.R. No. 134699Juhainah TanogNo ratings yet

- Special ContractDocument28 pagesSpecial Contractsnbhatia3No ratings yet

- HDFC Customer Preference & Attributes Towards Saving-AccountDocument50 pagesHDFC Customer Preference & Attributes Towards Saving-Accountpmcmbharat264No ratings yet

- Peacehaven Reg Form PDFDocument5 pagesPeacehaven Reg Form PDFJacob PaulNo ratings yet

- Tenant Three Day To Pay Rent NoticeDocument3 pagesTenant Three Day To Pay Rent NoticeOHFinancialNo ratings yet

- Bid Documents RCF-Kapurthala RevisedDocument26 pagesBid Documents RCF-Kapurthala RevisedSadashiva sahooNo ratings yet

- Missouri Direct Deposit FormDocument2 pagesMissouri Direct Deposit FormitargetingNo ratings yet

- Power Finance Corporation LTDDocument4 pagesPower Finance Corporation LTDAritra BhattacharjeeNo ratings yet

- Godfrey David KamandeDocument19 pagesGodfrey David KamandeDismus Ng'enoNo ratings yet

- Quickbooks in The Classroom - Lesson Exercises With Answers: WWW - Intuiteducation.CaDocument50 pagesQuickbooks in The Classroom - Lesson Exercises With Answers: WWW - Intuiteducation.CaMarjocristNo ratings yet

- City Bank StatementDocument1 pageCity Bank StatementAbu Shadot100% (1)

- Online Banking System DFDs and UML DiagramsDocument45 pagesOnline Banking System DFDs and UML DiagramsPankaj SoniNo ratings yet

- Export FinanceDocument27 pagesExport FinanceShekhar SagarNo ratings yet

- Credit DepartmentDocument49 pagesCredit DepartmentSalman RaviansNo ratings yet

- Accounting Revenue CycleDocument59 pagesAccounting Revenue CycleNikkiNo ratings yet

- T & C Page: Item Artist Description Catalogue & Condition Format Bid or PriceDocument96 pagesT & C Page: Item Artist Description Catalogue & Condition Format Bid or PriceWerner D. SchröderNo ratings yet

- Birla Sun Life Tax Relief 96 Fund Application FormDocument3 pagesBirla Sun Life Tax Relief 96 Fund Application FormDrashti Investments100% (2)

- ADL 12 Business Laws V4Document26 pagesADL 12 Business Laws V4Aditya BhatNo ratings yet