Professional Documents

Culture Documents

Powers of Reserve Bank of India

Uploaded by

PayalRajputOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Powers of Reserve Bank of India

Uploaded by

PayalRajputCopyright:

Available Formats

POWERS OF RESERVE BANK OF INDIA

-Piyush Rajput

1

The Reserve Bank of India is armed with many more powers to control the Indian money market. Every

bank has to get a licence from the Reserve Bank of India to do banking business within India, the licence

can be cancelled by the Reserve Bank of certain stipulated conditions are not fulfilled. Every bank will

have to get the permission of the Reserve Bank before it can open a new branch. Each scheduled bank

must send a weekly return to the Reserve Bank showing, in detail, its assets and liabilities. This power of

the Bank to call for information is also intended to give it effective control of the credit system. The

Reserve Bank has also the power to inspect the accounts of any commercial bank.

As supreme banking authority in the country, the Reserve Bank of India, therefore, has the following

powers:

(a) It holds the cash reserves of all the scheduled banks.

(b) It controls the credit operations of banks through quantitative and qualitative controls.

(c) It controls the banking system through the system of licensing, inspection and calling for information.

(d) It acts as the lender of the last resort by providing rediscount facilities to scheduled banks.

In addition to its traditional central banking functions, the Reserve bank has certain nonmonetary

functions of the nature of supervision of banks and promotion of sound banking in India. The Reserve

Bank Act, 1934, and the Banking Regulation Act, 1949 have given the RBI wide powers of supervision

and control over commercial and co-operative banks, relating to licensing and establishments, branch

expansion, liquidity of their assets, management and methods of working, amalgamation, reconstruction,

and liquidation. The RBI is authorised to carry out periodical inspections of the banks and to call for

returns and necessary information from them. The nationalisation of 14 major Indian scheduled banks in

July 1969 has imposed new responsibilities on the RBI for directing the growth of banking and credit

policies towards more rapid development of the economy and realisation of certain desired social

objectives. The supervisory functions of the RBI have helped a great deal in improving the standard of

banking in India to develop on sound lines and to improve the methods of their operation.

The powers relating to RBI shall be dealt separately under Banking Regulation Act and Reserve Bank of

India act.

1

LL.M 1 year, Business law ID No. 578

UNDER THE BANKING REGULATION ACT

LICENSING OF BANKS AND BRANCHES

2

Banking business in India shall be conducted only by banking company it holds a licence issued in That

behalf by the Reserve Bank and any such licence may be issued subject of such conditions as the Reserve

Bank may think fit to impose.

Before granting any licence under this section, the Reserve Banking may require to be satisfied

by an inspection of the books of the company or otherwise the following conditions are fulfilled, namely :

That the company is or will be in a position to pay its present or future depositors in full as their

claims accrue

That the affairs of the company are not being, or are not likely to be, conducted in a manner

detrimental to the interests of its present or future depositors

That the general character of the proposed management of the company will not be prejudicial to

the public interest or the interest of its depositor

That the company has adequate capital structure and earning prospects

That the public interest will be served by the grant of a licence to the company to carry on banking

business in India

That having regard to the banking facilities available in the proposed principal area of operations

of the company, the potential scope for expansion of banks already in existence in the area and

other relevant factors the grant of the licence would not be prejudicial to the operation and

consolidation of the banking system consistent with monetary stability and economic growth.

INSPECTION

3

The Reserve Bank at any time may, and on being directed so to do by the Central Government shall,

cause an inspection to be made by one or more of its officers of any banking company and its books and

accounts; and the Reserve Bank shall supply to the banking company a copy of its report on such

inspection.

2

Section 22 Banking Regulation Act. 1949.

3

Section 35 Banking Regulation Act. 1949

The Reserve Bank, at any time, may also cause a scrutiny to be made by any one or more of its officers,

of the affairs of any banking company and its books and accounts; and a copy of the report of the scrutiny

shall be furnished to the banking company if the banking company makes a request for the same or if any

adverse action is contemplated against the banking company on the basis of the scrutiny.

It shall be the duty of every director or other officer of the banking company to produce to any officer

making an inspection all such books, accounts and other documents in his custody or power and to

furnish him with any statements and information relating to the affairs of the banking company as the said

officer may require of him within such time as the said officer may specify.

The Reserve Bank shall, if it has been directed by the Central Government to cause an inspection to be

made, and may, in any other case, report to the Central Government on any inspection made under this

section, and the Central Government, if it is of opinion after considering the report that the affairs of the

banking company are being conducted to the detriment of the interests of its depositors, may, after giving

such opportunity to the banking company to make a representation in connection with the report as, in the

opinion of the Central Government, seems reasonable, by order in writing-

(a) Prohibit the banking company from receiving fresh deposits;

(b) Direct the Reserve Bank to apply under section 38 for the winding up of the banking company.

POWER OF THE RESERVE BANK TO GIVE DIRECTIONS

4

.

Where the Reserve Bank is satisfied that in public interest or in the interest of banking policy or to

prevent the affairs of any banking company being conducted in a manner detrimental to the interests of

the depositors or in a manner prejudicial to the interests of the banking company or to secure the proper

management of any banking company generally, it is necessary to issue directions to banking companies

generally or to any banking company in particular, it may, from time to time, issue such directions as it

deems fit, and the banking companies or the banking company, as the case may be, shall be bound to

comply with such directions.

The Reserve Bank may, on representation made to it or on its own motion, modify or cancel any direction

issued and in so modifying or cancelling any direction may impose such conditions as it thinks fit, subject

to which the modification or cancellation shall have effect.

4

Section 35 Banking Regulation Act. 1949

FURTHER POWERS AND FUNCTIONS OF RESERVE BANKS

5

The Reserve Bank may

(a) Caution or prohibit banking companies or any banking company in particular against entering into any

particular transaction or class of transactions, and generally give advice to any banking company

(b) On a request by the companies concerned and subject to the provision of section 149[44A], assist, as

intermediary or otherwise, in proposals for the amalgamation of such banking companies

(c) Give assistance to any banking company by means of the grant of a loan or advance to It.

The Reserve Bank may appoint such staff at such places as it considers necessary for the

Scrutiny of the returns, statements and information furnished by banking companies under this Act, and

generally to ensure the efficient performance of its functions under this Act.

POWER OF RESERVE BANK TO REMOVE MANAGERIAL AND OTHER PERSONS FROM

OFFICE.

The Reserve Bank is satisfied that in the public interest or for preventing the affairs of a banking

company being conducted in a manner detrimental to the interests of the depositors or for securing the

proper management of any banking company it is necessary so to do, the Reserve Bank may, for reasons

to be recorded in writing, by order, remove from office, with effect from such date as may be specified in

the order, any chairman, director, chief executive officer (by whatever name called) or other officer or

employee of the banking company.

Provided that if, in the opinion of the Reserve Bank, any delay would be detrimental to the interests of the

banking company or its depositors, the Reserve Bank may, at the time of giving the opportunity aforesaid

or at any time thereafter, by order direct that, pending the consideration of the representation aforesaid, if

any,[the chairman or, as the case may be, director or chief executive officer or other officer or employee,

shall not, with effect from the date of such order.

WINDING UP BY HIGH COURT

The High Court shall order the winding up of a banking company

5

Section 36 Banking Regulation act. 1949

(a) If the banking company is unable to pay its debts; or

(b) If an application for its winding up has been made by the Reserve Bank under section 37.

The Reserve Bank shall make an application under this section for the winding up of a banking company.

If in the opinion of the Reserve Bank

(i) a compromise or arrangement sanctioned by a court in respect of the banking company cannot be

worked satisfactorily with or without modifications.

(ii) The returns, statements or information furnished to it under or in pursuance of the provisions of this

Act disclose that the banking company is unable to pay its debts.

(iii) The continuance of the banking company is prejudicial to the interests of its depositors.

SUSPENSION OF BUSINESS

6

The RBI may suspend the business when the bank is temporarily unable to meet its obligations,. The

reserve bank shall follow the under mentioned steps-

The bank to apply to HC u/s 37

The report of the RBI be enclosed

If not the court can take action, by calling the report

If satisfied the court can (with conditions) for all proceedings to stay for fixed term not

exceeding six months

On passing of the moratorium order, the court may appoint a special officer to take

custody and control of the assets, books etc.of the bank.

6

Section 37 Banking Regulation act. 1949

UNDER THE RBI ACT

POWER OF DIRECT DISCOUNT

7

When, in the opinion of the Bank, a special occasion has arisen making it necessary or expedient that

action should be taken for the purpose of regulating credit in the interests of Indian trade, commerce,

industry and agriculture, the Bank may, notwithstanding any limitation contained in

Section 17

purchase, sell or discount any bill of exchange or promissory note though such bill or promissory

note is not eligible for purchase or discount by the Bank under that section

make loans or advances to

(a) A State co-operative bank,

(b) On the recommendation of a State co-operative bank, to a co-operative society registered within the

area in which the State co-operative bank operates,

(c) any other person,

repayable on demand or on the expiry of fixed periods, not exceeding ninety days, on such terms and

conditions as the Bank may consider to be sufficient.

POWER OF BANK TO COLLECT CREDIT INFORMATION

8

The Bank may

(a) Collect, in such manner as it may think fit, credit information from banking

Companies and

(b) Furnish such information to any banking company in accordance with the provisions of section 45D

For the purpose of enabling the Bank to discharge its functions under this Chapter, it may at any time

direct any banking company to submit to it such statements relating to such credit information and in such

form and within such time as may be specified by the Bank from time to time.

7

Section 18 of the Reserve Bank of India act, 1934

8

Section of 45B the Reserve Bank of India act, 1934

POWER OF BANK TO DETERMINE POLICY AND ISSUE DIRECTIONS

9

If the Bank is satisfied that, in the public interest or to regulate the financial system of the country to its

advantage or to prevent the affairs of any non-banking financial company being conducted in a manner

detrimental to the interest of the depositors or in a manner prejudicial to the interest of the non-banking

financial company, it is necessary or expedient so to do, it may determine the policy and give directions

to all or any of the non-banking financial companies relating to income recognition, accounting standards,

making of proper provision for bad and doubtful debts, capital adequacy based on risk weights for assets

and credit conversion factors for off-balance-sheet items and also relating to deployment of funds by a

non-banking financial company or a class of non-banking financial companies or non-banking financial

companies generally, as the case may be, and such non-banking financial companies shall be bound to

follow the policy so determined and the directions so issued.

POWER OF BANK TO CALL FOR INFORMATION FROM FINANCIAL INSTITUTIONS AND

TO GIVE DIRECTIONS

10

If the Bank is satisfied that for the purpose of enabling it to regulate the credit system of the country to its

advantage it is necessary so to do; it may

(a) Require financial institutions either generally or any group of financial institutions or financial

institution in particular, to furnish to the Bank in such form, at such intervals and within such time, such

statements, information or particulars relating to the business of such financial institutions or institution,

as may be specified by the Bank by general or special order.

(b) Give to such institutions either generally or to any such institution in particular, directions relating to

the conduct of business by them or by it as financial institutions or institution.

Information or particulars to be furnished by a financial institution may relate to all or any of the

following matters, namely, the paid-up capital, reserves or other liabilities, the investments whether in

Government securities or otherwise, the persons to whom, and the purposes and periods for which,

finance is provided and the terms and conditions, including the rates of interest, on which it is provided.

9

Section 45JA of the Reserve Bank of India act, 1934

10

Section 145L of the Reserve Bank of India act, 1934

POWER OF BANK TO PROHIBIT ACCEPTANCE OF DEPOSIT AND ALIENATION OF

ASSETS.

11

If any non-banking financial company violates the provisions of any section or fails to comply with any

direction or order given by the Bank under any of the provisions of this Chapter, the Bank may prohibit

the non-banking financial company from accepting any deposit.

POWER OF BANK TO FILE WINDING UP PETITION

12

The Bank, on being satisfied that a non-banking financial company,

(a) is unable to pay its debt; or

(b) Has by virtue of the provisions of section 45-IA become disqualified to carry on the business of a non-

banking financial institution;

(c) Has been prohibited by the Bank from receiving deposit by an order and such order has been in force

for a period of not less than three months; or

(d) The continuance of the non-banking financial company is detrimental to the public interest or to the

interest of the depositors of the company, may file an application for winding up of such non-banking

financial company under the Companies Act, 1956.

A non-banking financial company shall be deemed to be unable to pay its debt if it has refused or has

failed to meet within five working days any lawful demand made at any of its offices or branches and the

Bank certifies in writing that such company is unable to pay its debt

INSPECTION

13

The Bank may, at any time, cause an inspection to be made by one or more of its officers or employees or

other persons of any non-banking institution, including a financial institution, for the purpose of verifying

the correctness or completeness of any statement, information or particulars furnished to the Bank or for

the purpose of obtaining any information or particulars which the non-banking institution has failed to

11

Section 45MB of the Reserve Bank of India act, 1934

12

Section 45 MC of the Reserve Bank of India act, 1934

13

Section 45N of the Reserve Bank of India act, 1934

furnish on being called upon to do so; or of any non-banking institution being a financial institution, if the

Bank considers it necessary or expedient to inspect that institution

POWER OF BANK TO EXEMPT

14

The Bank, on being satisfied that it is necessary so to do, may declare by notification in the Official

Gazette that any or all of the provisions of this Chapter shall not apply to a non-banking institution or a

class of non-banking institutions or a non-banking financial company or to any class or non-banking

financial companies either generally or for such period as may be specified, subject to such conditions,

limitations or restrictions as it may think fit to impose

14

Section 45NC of the Reserve Bank of India act, 1934

You might also like

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- Banking Regulations SummaryDocument20 pagesBanking Regulations SummaryGraceson Binu Sebastian100% (1)

- Residential Status and Tax Incidence: Dr. Niti SaxenaDocument11 pagesResidential Status and Tax Incidence: Dr. Niti SaxenaYusufNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- Project On Banker and CustomersDocument85 pagesProject On Banker and Customersrakesh9006No ratings yet

- RBI Role as India's Central BankDocument6 pagesRBI Role as India's Central Bankabhiarora07No ratings yet

- Financial Market Regulation FDDocument15 pagesFinancial Market Regulation FDShubham RawatNo ratings yet

- Buy Back of Shares Under The Companies Act, 1956 - An InsightDocument4 pagesBuy Back of Shares Under The Companies Act, 1956 - An InsightHrdk DveNo ratings yet

- Banking Regulation ActDocument18 pagesBanking Regulation ActHomiga BalasubramanianNo ratings yet

- Capital Market Vs Money Market: Key DifferencesDocument23 pagesCapital Market Vs Money Market: Key Differencessaurabh kumarNo ratings yet

- Final Project of RBIDocument19 pagesFinal Project of RBISonia Singh100% (1)

- Kinds of ProspectusDocument5 pagesKinds of ProspectusPriya KumariNo ratings yet

- Narasimham Committee Report I & IIDocument5 pagesNarasimham Committee Report I & IITejas Makwana0% (3)

- Functions of RBIDocument3 pagesFunctions of RBITarun BhatejaNo ratings yet

- Rights and Obligations of Banker and CustomerDocument12 pagesRights and Obligations of Banker and Customerbeena antu100% (1)

- SARFAESI Act and Case Study Presentation SummaryDocument22 pagesSARFAESI Act and Case Study Presentation Summarylakshmi govindaprasadNo ratings yet

- Export FinanceDocument6 pagesExport FinanceMallikarjun RaoNo ratings yet

- Role of Sebi in Capital Market IssuesDocument6 pagesRole of Sebi in Capital Market Issuescoolfaiz2No ratings yet

- Difference Between Shares and DebenturesDocument4 pagesDifference Between Shares and DebenturesVinodKumarMNo ratings yet

- MRTP ACT - Monopolies and Restrictive Trade Practices ACT-1969Document9 pagesMRTP ACT - Monopolies and Restrictive Trade Practices ACT-1969Gopalakrishnan SivaramNo ratings yet

- Pre-Pack (UK and US)Document37 pagesPre-Pack (UK and US)Neeral JainNo ratings yet

- Insolvency and Bankruptcy Code 2016Document14 pagesInsolvency and Bankruptcy Code 2016Parth SharmaNo ratings yet

- Role of NCLT and NCLAT in Indian Company LawDocument15 pagesRole of NCLT and NCLAT in Indian Company LawAdarsh HimatsinghkaNo ratings yet

- DepositoryDocument29 pagesDepositoryChirag VaghelaNo ratings yet

- Banking Law NotesDocument17 pagesBanking Law NotesgoluNo ratings yet

- Economic Project On RBI PDFDocument20 pagesEconomic Project On RBI PDFDEVENDRA SHARMANo ratings yet

- Banking Law Project 8th SemDocument23 pagesBanking Law Project 8th SemSneha Singh100% (2)

- Pledge Study NotesDocument3 pagesPledge Study NotesJason MarquezNo ratings yet

- Role of Bank in Money Market & CapitalDocument16 pagesRole of Bank in Money Market & CapitalHarsh BazajNo ratings yet

- 1 Chapter 5 Internal Reconstruction PDFDocument22 pages1 Chapter 5 Internal Reconstruction PDFAbhiramNo ratings yet

- Customer For A Bank:: The Rights and Responsibilities of A Banker Towards Their CustomersDocument17 pagesCustomer For A Bank:: The Rights and Responsibilities of A Banker Towards Their Customerssyeda_yaseenNo ratings yet

- Recovery of Debts Act: Key Provisions and ProceduresDocument42 pagesRecovery of Debts Act: Key Provisions and ProceduresAdhi ChakravarthyNo ratings yet

- Dispute Settlement in WtoDocument4 pagesDispute Settlement in WtoRaghavendra RaoNo ratings yet

- Alteration of MemorandumDocument10 pagesAlteration of Memorandumjain7738No ratings yet

- Depository Services ExplainedDocument7 pagesDepository Services ExplainedakhilNo ratings yet

- Doctrine of Constructive Notice ExplainedDocument12 pagesDoctrine of Constructive Notice ExplainedIshaan JoshiNo ratings yet

- Role of RBI Under Banking Regulation Act, 1949Document11 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Company Law (Prospectus) : PPT-05, Unit - IVDocument29 pagesCompany Law (Prospectus) : PPT-05, Unit - IVkritika0% (1)

- Essentials of a Writ PetitionDocument20 pagesEssentials of a Writ PetitionPrakhar Keshar HNLU Batch 2016No ratings yet

- Role of Sebi in Indian Capital MarketDocument9 pagesRole of Sebi in Indian Capital MarketSomalKantNo ratings yet

- Borrowing Powers of A Company - PDFDocument23 pagesBorrowing Powers of A Company - PDFDrRupali GuptaNo ratings yet

- History of IDBIDocument43 pagesHistory of IDBIanuragchandrajhaNo ratings yet

- Assam Shops Establishments Acts 1971Document14 pagesAssam Shops Establishments Acts 1971Farhin KhanNo ratings yet

- Banking OmbudsmanDocument46 pagesBanking Ombudsmanp00rnimasinghNo ratings yet

- Role and Functions of IRDADocument2 pagesRole and Functions of IRDAEknath BirariNo ratings yet

- Modes of winding up a company under Companies Act 2013Document9 pagesModes of winding up a company under Companies Act 2013kunjapNo ratings yet

- Credit Control in India - WikipediaDocument20 pagesCredit Control in India - WikipediapranjaliNo ratings yet

- Serfasi ActDocument22 pagesSerfasi ActprakashNo ratings yet

- Riddhi Corporate FinanceDocument21 pagesRiddhi Corporate FinanceManas BhawsarNo ratings yet

- Competition Commission of India (CCI)Document27 pagesCompetition Commission of India (CCI)Supriya Pawar100% (1)

- Reserve Bank of IndiaDocument17 pagesReserve Bank of IndiaShivamPandeyNo ratings yet

- Characteristics of Bank Regulations Act 1949Document8 pagesCharacteristics of Bank Regulations Act 1949ankita16_wlsn100% (1)

- Credit Control Policy of RbiDocument7 pagesCredit Control Policy of RbiSeba MohantyNo ratings yet

- SEBI's Role as India's Market RegulatorDocument18 pagesSEBI's Role as India's Market RegulatorUtkarsh KumarNo ratings yet

- Sarfaesi ActDocument3 pagesSarfaesi ActJatin PanchiNo ratings yet

- Need For Takeover CodeDocument15 pagesNeed For Takeover CodePriyanka TaktawalaNo ratings yet

- Roles and Function of RbiDocument15 pagesRoles and Function of RbiCharu LataNo ratings yet

- Capital Gains Taxation in IndiaDocument3 pagesCapital Gains Taxation in IndiavikramkukrejaNo ratings yet

- Module 12 - Regulatory Bodies For Banks and Non - Bank Financial InstitutionsDocument5 pagesModule 12 - Regulatory Bodies For Banks and Non - Bank Financial InstitutionsMarjon DimafilisNo ratings yet

- Re Trib Tion Rest or Tati VeDocument49 pagesRe Trib Tion Rest or Tati VePayalRajputNo ratings yet

- DLF CaseDocument8 pagesDLF CasePayalRajputNo ratings yet

- Project On ITLDocument24 pagesProject On ITLPayalRajputNo ratings yet

- DLF CaseDocument8 pagesDLF CasePayalRajputNo ratings yet

- Example Pooling and Servicing Agreement PDFDocument2 pagesExample Pooling and Servicing Agreement PDFTrentonNo ratings yet

- MBA 7427 Sample Questions CH 6: Multiple ChoiceDocument5 pagesMBA 7427 Sample Questions CH 6: Multiple ChoiceAlaye OgbeniNo ratings yet

- Internet Banking ModulesDocument13 pagesInternet Banking ModulesRahul GavandeNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Fintech in Asia Pacific: Digital Payment Platforms: October 2019Document42 pagesFintech in Asia Pacific: Digital Payment Platforms: October 2019VaishnaviRaviNo ratings yet

- STMTDocument2 pagesSTMTJorge LopezNo ratings yet

- AC Power Booster - SBI PO CLERK BOB PO 2018 PDFDocument112 pagesAC Power Booster - SBI PO CLERK BOB PO 2018 PDFPrathyusha KunaparajuNo ratings yet

- Competitive Exams Accountancy: Terminology: Definition of Accounting TerminologyDocument2 pagesCompetitive Exams Accountancy: Terminology: Definition of Accounting TerminologyVikas ChoudharyNo ratings yet

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document50 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- Three Essays On Macroeconomic Management 2008Document214 pagesThree Essays On Macroeconomic Management 2008Chan RithNo ratings yet

- From The Comfort of Your HomeDocument7 pagesFrom The Comfort of Your Homemoveee2No ratings yet

- Trade Online Introduction To Trade OnlineDocument7 pagesTrade Online Introduction To Trade Onlinesales MPNo ratings yet

- Loan Settlement Audit ProgramDocument3 pagesLoan Settlement Audit ProgramJohn MfumyaNo ratings yet

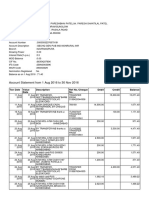

- Aug To NovDocument4 pagesAug To NovRuchir OzaNo ratings yet

- Banking Products and ServicesDocument5 pagesBanking Products and ServicesAikya GandhiNo ratings yet

- Money and Credit-Ncert SolutionsDocument4 pagesMoney and Credit-Ncert SolutionsSafwa KhasimNo ratings yet

- Chapter 1 Audit of Cash and Cash EquivalentsDocument129 pagesChapter 1 Audit of Cash and Cash EquivalentsMelodyn RotoneNo ratings yet

- Instabiz: Mobile Banking App For Self Employed Segment CustomersDocument146 pagesInstabiz: Mobile Banking App For Self Employed Segment Customerssiva krishna60% (5)

- FLS020 HDMF Calamity Loan Application Form Aug 09 - 092809Document2 pagesFLS020 HDMF Calamity Loan Application Form Aug 09 - 092809appantaleon_gcdriveNo ratings yet

- Role of Mortgage Finance Institutions in NigeriaDocument68 pagesRole of Mortgage Finance Institutions in NigeriaCrystalNo ratings yet

- GD - Assignment 2 LatestDocument29 pagesGD - Assignment 2 LatestNurFazalina AkbarNo ratings yet

- New Central BankDocument3 pagesNew Central BankMARIANo ratings yet

- Kunal Uniforms CNB TxnsDocument2 pagesKunal Uniforms CNB TxnsJanu JanuNo ratings yet

- Research Report FinalDocument71 pagesResearch Report FinalParveen KumarNo ratings yet

- Internship ReportDocument49 pagesInternship ReportRafid HossainNo ratings yet

- Walk in CustomersDocument50 pagesWalk in CustomersIan DañgananNo ratings yet

- New Product DevelopmentDocument20 pagesNew Product DevelopmentAbhinav SachdevaNo ratings yet

- About CimbDocument7 pagesAbout CimbShahmin HalimiNo ratings yet

- Ethiopia's Banking Sector Performance and OutlookDocument72 pagesEthiopia's Banking Sector Performance and OutlookSolomon Erifo100% (1)

- PVB: Philippine Bank for Veterans and Their FamiliesDocument34 pagesPVB: Philippine Bank for Veterans and Their FamiliesAhnJelloNo ratings yet