Professional Documents

Culture Documents

El Pollo Loco - Aug 18 2014

Uploaded by

SuhailCapitalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

El Pollo Loco - Aug 18 2014

Uploaded by

SuhailCapitalCopyright:

Available Formats

August 18, 2014

www.suhailcapital.com

El Pollo Loco: PE Bust-out, 20+ years of failed

domestic expansion and pre-IPO window dressing

make this blind leap of faith stock an ideal short

There should be ZERO bid for this stock anywhere north

of $20.

Price Target: $6.10/share

Timeframe: next 12 months

-More like a Pollos Hermanos

than the Chipotle media

comparison it is currently getting

-20+ Years of failed Domestic

Expansion Track record

-Two year comp momentum is

largely average check growth

driven, and thus should be heavily

discounted

-Existing equity holders will be very

motivated sellers at lockup expiry

August 18, 2014

www.suhailcapital.com

Contents

I. Background & Introduction ...................................................................... 3

II. The Next Chipotle? Not even Close! ....................................................... 5

III. A Long History of Failed Domestic Expansion ........................................ 7

IV. Dissecting El Pollo Locos Pre-IPO Comparable Same-Store Sales ......... 9

V. El Pollo Locos Ownership History......................................................... 17

VI. Valuation: Whats it worth?................................................................. 24

Summary ................................................................................................... 30

August 18, 2014

www.suhailcapital.com

I. Background & Introduction

Juan Francisco Ochoa started the restaurant in Guasave, Sinaloa, Mexico, in

1975. After expanding in Mexico the first US location opened in 1980 in Los

Angeles, California. Which is when the journey of the publicly listed El Pollo

Loco we see trading as LOCO today began. After achieving notable

success in the LA market, in 1983 the US restaurants in the chain were

acquired by Denny's. Juan Francisco Ochoa and family would continue to

operate the restaurants in Mexico (he went on to setup a taco chain in

Texas called Taco Palenque and the Palenque Grill both serving Mexican

cuisine with recipes similar to El Pollo Loco). American Securities Capital

Partners (ASCP) acquired El Pollo Loco in 1999 and sold it to current

majority owner Trimaran Capital Partners in 2005.

August 18, 2014

www.suhailcapital.com

Which brings us to the fanfare surrounding the July 25

th

2014 first trading

day for El Pollo Loco. On the first trading day the stock opened at $19

(from an IPO price of $15) and closed near the days high at $24. Which

prompted articles touting El Pollo Loco as the latest quick service/fast

casual chain to emulate Chipotles rapid growth Which as you will see later

couldnt be further from the truth. The next 5 days of trading in El Pollo

Loco were truly epic in what appeared to be a high frequency trading game

of hot potato, combined with mini short-squeezes combined with day

traders gone mad. We think the below charts and tables sufficiently convey

the Loco-ness of it all:

August 18, 2014

www.suhailcapital.com

II. The Next Chipotle? Not even Close!

When El Pollo Loco filed to go public, we took a look at the chain knowing

full well that any Mexican themed restaurant chain going public would

draw surface comparisons to Chipotle. We figured that with Chipotles

recent operating and share price momentum that this IPO might actually

attract the momentum fast money crowd that eventually creates a good

short regardless of the underlying business involved (much like Veeva

during the SAAS euphoria in Q4 2013). What we concluded after just one

days worth of research and analysis was that a deeper dive on the name

was not justified as there was NO WAY the market would buy this story,

and this is coming from individuals who are rarely surprised by just how

stupid the market can be at times. This is because even the most cursory

look at El Pollo Loco leads one to conclude this company has no business

being compared to any restaurant chain growth story, let alone Chipotle.

Yet here it is a few weeks after going public trading at a higher multiple

than Chipotle, and garnering the type of market media attention bestowed

on growth story darlings. So, lets take a closer look.

Date Open High Low CloseVolume Float Turnover

8/13/2014 34.51 34.6 33 33.3 1,700,700 24%

8/12/2014 34.76 34.9 29 34.1 3,261,600 46%

8/11/2014 38.4 38.5 35.8 35.8 2,458,700 35%

8/8/2014 38 38.2 36.1 37 3,057,200 43%

8/7/2014 39.43 40.3 38.3 38.9 6,133,900 86%

8/6/2014 34.44 37.8 34 37 6,222,500 88%

8/5/2014 36.27 36.9 33.6 34.3 7,881,500 111%

8/4/2014 41.35 41.5 37.6 38.4 9,067,000 128%

8/1/2014 39.05 41.7 38.4 41.2 14,425,400 203%

7/31/2014 35.83 39.9 35.2 38.8 18,345,300 258%

7/30/2014 31.78 38.3 31.6 34.6 15,520,100 219%

7/29/2014 31.84 32.5 29.1 29.9 12,108,400 171%

7/28/2014 26.88 34.7 26.3 34.5 26,901,000 379%

7/25/2014 19 24.4 18.5 24 23,673,600 333%

Total 150,756,900 2123%

Float 7,100,000

Shares Short 900,173 *as of July 31 NASDAQ short report

August 18, 2014

www.suhailcapital.com

El Pollo Loco vs. Chipotle:

Chipotle Store Count End of 1999: 37 Stores All in Colorado

El Pollo Loco Store Count End of 1999: 278 Stores in 4 States(CA, NV,

TX, AZ) with 85%+ Los Angeles.

Chipotle Store Count End of 2013: 1,572 Across 43 States and D.C.

as well as 16 International

Stores in Canada, England,

France, and Germany.

El Pollo Loco Store Count End of 2013: 401 Stores in 5 States with 88%

of Stores in California

Here is a detailed snapshot of key metrics at these two companies over the

last decade:

As you can see from a historical analysis standpoint, these two companies

couldnt be more different. The only thing they have in common is that they

both offer Mexican themed cuisine.

Metric El Pollo Loco Chipotle Mexican Grill

2003 Revenue($ Mil) $206 $315

2013 Revenue($ Mil) $314 $3,214

10-Yr Revenue CAGR 4.31% 26.10%

2003 ADJ EBITDA $33 $7

2013 ADJ EBITDA $55 $644

10-Yr ADJ EBITDA CAGR 5.20% 56.80%

2003 Store Count 315 298

2013 Store Count 401 1595

Past 5-Yr Same-Store Sales Avg 1% 7.10%

Past 10-Yr Same-Store Sales Avg 2.10% 10.90%

August 18, 2014

www.suhailcapital.com

Ahh, but this is the story of the past, this stock is trading on what the future

will bring. Surely this IPO opens the door to significant domestic and

subsequently international expansion.

We seriously doubt that.

III. A Long History of Failed Domestic Expansion

El Pollo Loco is not some new hot restaurant franchise on the verge of

massive domestic expansion. They have a long history of trying and failing

to meaningfully grow their brand outside of the Southwest United States or

for that matter, the core Los Angeles market.

Here are some of the most recent failed attempts to expand geographically

across the United States

Chicago: 4 stores starting in 2005, all closed by 2012

Colorado: 1 stores starting in 2006, closed by 2011

Connecticut: 1 store opened in 2006, closed in 2012

Georgia: 9 stores starting in 2007, all closed by 2011

Massachusetts: 2 stores starting in 2007, all closed by 2010

New Jersey: 1 store 2009, closed in 2010

Oregon: 2 stores starting in 2008, all closed by 2011

St. Louis: 1 store opened in 2009, closed by 2011

Virginia: 3 stores starting in 2008, all closed by 2011

Vancouver,WA: 1 store opened in 2008, closed in 2009

Thats ten states entered and exited between 2005 and 2012!

Here is what management has had to say about this:

August 18, 2014

www.suhailcapital.com

As of March 30, 2011, we had 14 system-wide restaurants open in markets east of the Rockies.

Additionally, three stores (two franchise locations and one company location) were closed in

2010 and four stores located east of the Rockies (all franchise locations) were closed in 2011 in

these areas due to low sales. Our restaurants open east of the Rockies are experiencing a wide

range of sales volumes, and a majority of them have sales volumes that are significantly less

than the chain average due to the lack of brand awareness in the new markets.

Now here is an excerpt from one of their east coast franchisees on his

experience:

"That style of Mexican grilled chicken is very, very regional," said Ed

Doherty, president and chief executive of Doherty Enterprises. It originally

secured the rights to open as many as 30 El Pollo Locos in New Jersey and

New York, but the company decided not to go further with the concept after

sales in North Bergen were less than what they had hoped. To expand the

concept, Doherty said, his company wanted to see sales of $40,000 to

$45,000 a week at the North Bergen El Pollo Loco. Instead, it was doing

about $25,000 a week. After a fire at the store two years ago, the company

sold the location to a Wendy's, which is doing more than double the sales

volume.

"It wasn't the location," Doherty said. "Wendy's is doing great."

And keep in mind this is not the first time El Pollo Loco has had a tough go

of it geographically expanding. In the late 80s and early 90s there were

failed forays into Florida, North Carolina, Hawaii, and even Japan.

Suffice to say, El Pollo Locos repeated struggles to expand geographically

are very difficult to ignore. While discounting some of the failure to

multiple instances of poor economic timing, it is still hard to fathom the

uniform nature of the failure. This is not a case of one or two markets

failing to absorb 20 to 30 units, but rather about every single market failing

to accept the brand at all. We have no doubt that if In-N-Out Burger (a

chain which literally has the same exact Southwest regional presence as El

Pollo Loco) opened in these same markets that there would be lines out the

August 18, 2014

www.suhailcapital.com

door, and that those first couple of stores in each new geography would

literally mint money.

Clearly, El Pollo Loco, despite its near ubiquitous presence in the second

largest American city, has not developed the commiserate brand identity.

Banking on that drastically changing after two decades worth of irrefutable

empirical evidence requires nothing short of a tremendous Blind Leap of

Faith.

Well, then what about those solid pre-IPO comps?

IV. Dissecting El Pollo Locos Pre-IPO Comparable Same-Store

Sales

Anyone who has ever invested in restaurant franchise stocks knows how

hyper-sensitive the names can be to short-term comp sales numbers. One

need only look at the recent collapses of Bloomin Brands and Potbelly for

fresh examples of what happens when you slightly disappoint in this area.

Mature brands trading at close to 2x EV/Sales can quickly turn into 1x or

less EV/Sales stocks, and for hyped younger growth stories the 20x+

EV/EBITDA is quickly replaced by something a lot closer to a 10x multiple.

Thus, with El Pollo Loco trading at north of 30x EV/EBITDA and 5x EV/Sales,

one has to be quite cognizant of their recent comps and whats driving

them.

This goes without saying for any restaurant stock trading at such levels, but

is even more relevant for one that just went public. This is because there is

a tendency to window dress a company before an IPO by pulling short-term

levers that are typically not sustainable and/or not in the long-term

interests of the business model. This window dressing is most common in

August 18, 2014

www.suhailcapital.com

businesses that have been around for a while, and especially common in

ones that have been passed around by PE firms. That being said, once you

get to our review of the ownership/financial history of this brand, you will

understand why we pulled out the microscope to look at their pre-IPO

numbers.

We imagine that when the JOBS Act was passed that the sponsors did not

envision it being used to limit disclosures by companies that have been in

business for over 30 years. Thats what you get with El Pollo Loco. A

company that has nearly two decades worth of accessible financial

information, only ends up needing to disclose the results from the last

three years. Luckily for us, a company that has incurred this level of

indebtedness often has registered securities that require regular filings with

the SEC, and that is precisely the case with the El Pollo Loco. Combine these

filings with a failed 2006 IPO prospectus and a recent note exchange offer

that you can go through, and you end up with all the data you need to paint

a complete picture. With that in mind, any discerning investor looking at

the last two years of pre-IPO comps within the context of the chains

broader comp trends over the last 15 years is going to raise a red flag and

ask some questions.

El Pollo Locos company owned same-store sales have averaged 7% growth

over the last two years. This is a huge deviation from the 1.4% average over

the preceding 11 years, and jumps off the page when you see that traffic

attribution in the comps has been trending closer to 2%.

Why does it jump off the page?

1) El Pollo Loco reported some of the worst comps in their peer group

in the recession. In 2009, they ranked 47 out 50 QSR chains for year-

over-year same-store sales. Their combined 2009/2010 performance

puts them at virtually the bottom of the entire QSR 50 list. When

August 18, 2014

www.suhailcapital.com

you are looking for comp sustainability, you are trained to be wary of

what might be unusually easy comparable periods or sudden swings

that look like one-off/macro rebound driven numbers.

2) El Pollo Locos store base shrunk throughout the reported pre-IPO

comp period (412 stores end of 2010 to 401 at the end of 2013);

store closures remove underperforming restaurants from the store

comp base. This is good news for short-term comps, but again not a

sustainable positive trend one expects to be leveraged going

forward. Furthermore, it is an explicitly bad sign for a chain whose

stock is being valued at the highest end of the future growth

expectation range.

3) Large average check count increases for a non-growing regionally

concentrated chain tend to imply price increases. This is notable as

price hikes are by definition not a sustainable comp driver and also

come with their own potential down the road trade-off as customers

may gradually look elsewhere for value. Furthermore, in El Pollo

Locos case, this phenomena is accentuated by the fact that 80% of

their revenue is derived from one state, and even within California

its largely weighted towards the city of Los Angles (we estimate in

the 65-70% range). If your core demographic is Hispanic-Americans in

Los Angeles, investors are even more likely to discount comp growth

that implies significant price driven average check growth.

Now, #1 and #2 above speak for themselves, it is #3 were investors in

El Pollo Loco have not surprisingly been left in the dark.

The below excerpt is from Chipotles recent Q2 Conference Call:

Overall sales for the quarter increased 28.6% to $1.05 billion, driven by the comp and

from new restaurant openings. Year to date sales were $1.95 billion, an increase of

26.6%, including a comp for the year so far of 15.5%. The quarter comp was primarily

August 18, 2014

www.suhailcapital.com

driven by an increase in customer traffic, along with an increase in our average check,

which includes a 2.5% benefit from our menu price increase rolled out during the

quarter. Average check in the quarter was up about 5% from last year with half of this

increase coming from the menu price increase and the rest of the check increase coming

from catering, an increase in the group size per transaction along with additional sides

such as Chips & Guac.

As you can see, Chipotle clearly deconstructs their comp numbers.

The 17.2% comp for the quarter only includes at 2.5% benefit from

price (note to Cramer, Chipotles 17.2% and El Pollo Locos disclosed

prelim 4.9%-5% Q2 comp are not similar comps as one chain is

experiencing 14% yr/yr traffic growth while the other is doing 1.4%!).

This is not something Chipotle just started doing because the market

has been focusing on their recent nationwide menu price hike; this is

something they have always disclosed to investors even when price

increases have been more targeted.

El Pollo Loco does not offer this level of transparency in their

prospectus even though EPL Intermediate has offered it in past 10-

ks.

Here is how they define Comparable Restaurant Sales:

Comparable restaurant sales growth can be generated by an increase in the number of meals

sold and/or by increases in the average check amount resulting from a shift in menu mix and/or

higher prices resulting from new products or price increases.

The problem here is that when it comes to disclosing average check,

they do not break out the impact of menu price increases. For

example, in their banner 2012 comp year, 6% of their 8.6% increase

in company owned same-store sales came from average check

August 18, 2014

www.suhailcapital.com

growth. A number like that for a non-organically growing chain

screams significant menu price increases. Now, if this was a chain

with a large national presence, deconstructing these menu price

increases would be a challenge, but you dont have that problem

here.

Here are two photos we took a few days ago of an El Pollo Loco

drive-thru menu in LA

August 18, 2014

www.suhailcapital.com

What you see above is El Pollo Locos new menu, which is largely a

reflection of where management has decided to take the brand over the

past couple of years. What should jump out at you, (if you are familiar with

the brand) is the fact that the value QSR element has gradually been

replaced by what looks more like a fast casual menu. Over the past few

years the Dollar Menu morphed into the Value Menu, which is now

being replaced by the more value indifferent Snack Menu.

Now we could show you plenty of photos illustrating this genesis, but

deciphering the price changes from multiple images from countless

locations spread across several years is not ideal. So we will try and keep it

simple for you by sharing what our extensive research dug up.

This link is from an El Pollo Loco menu circa summer of 2009. As you can

see, when compared to the prices from the drive-thru screen shots above,

things have changed quite a bit. Popular value items like the BRC Burrito

and Chicken Taco al Carbon have seen price increases of 65% and 69%

August 18, 2014

www.suhailcapital.com

respectively. The introductory 8-pc family meal has increased in price by

14%, and the 10 piece by 17%. A 3 piece chicken leg and thigh combo has

increased by 27%, and the price of a small side has gone up by 44%. Now to

be clear the above photographed menu is new and is not reflective of the

entire store base, and 2009 is a little too far back for what we were looking

for in terms of pre-IPO comp insight.

A more relevant visual comparison would be this bloggers Jan 2012 visit

and review (with menu price photos) of an El Pollo Loco. At this specific

restaurant, we verified that popular value items, the BRC Burrito and the

Chicken Taco al Carbon, increased in price by 29% and 39% over the past

two years. Meanwhile, the intro 8 piece leg and thigh family meal increased

by 13%.

Now setting aside these select comparisons, our more comprehensive

research indicates that the key takeaways here are that the low end (i.e.

the value items) of the menu has come up rather significantly over the past

2.5 years, and that the family meals, starting in mid-2011 have seen 9-15%

increases. Basically the intro 8 piece range has gone from $15.99-$16.49 to

$17.49-$18.99 with comparable hikes as you go up in family meal size. The

ability to track the changes on the family meals is actually quite helpful as

management does disclose that these meals accounted for a little less than

a third of company operated store sales. Thus, you can estimate that there

is a 2.5-5.0% price hike impact embedded in the last two years average

check growth just from the pricing taken on this part of the menu. As for

other items, we can say that bowls and burritos have been relatively stable

over the past 2 years with a trend of new higher intro price point menu

items entering the total mix.

Overall, we came away from this exercise with the simple conclusion that

pricing has been a very relevant and likely dominant part of an already

average check dominated comp stack. We also have concluded that

August 18, 2014

www.suhailcapital.com

managements decision to move towards a more upmarket brand identity,

as they seek to try and grow the brand again, risks alienating the brands

core demographic and putting them head-to-head with much established

healthy fast casual chains. Basically, becoming more like Chipotle 15 years

ago would have been a good idea, but at this juncture it actually opens the

door to that powerhouse making inroads against you in your bread and

butter market. When your bread and butter market is literally one city, that

is a pretty risky maneuver. Chipotle has never really faired too well in LA

because of all the Mexican options and the existence of the likes of El Pollo

Loco dominating the value/family element amongst the Hispanic

community, if that were to drastically change sometime in the near future,

El Pollo Loco would quickly become a candidate for liquidation or

restructuring.

August 18, 2014

www.suhailcapital.com

V. El Pollo Locos Ownership History

Think Los Pollos Hermanos or the Bamboo Lounge from

Goodfellas and not Chipotle!

Anyone who has seen Breaking Bad is quite familiar with the Los Pollos

Hermanos story. Gus sells tasty chicken out the front door while Walter

and Jesse cook Meth in the basement.

August 18, 2014

www.suhailcapital.com

Well, if there is ever a private equity version of the hit series Breaking Bad,

El Pollo Locos story should be at the top of the list.

Sell Tasty Chicken out the front door while financial engineers behind the

scenes cash-in by piling on debt to pay outrageous dividends, management

fees and transaction fees.

The Bamboo Lounge bust-out in Goodfellas is also a good analogy. Find a

solid cash flowing business, run up its credit to take supplies in the front

door that are sold at 100% profit out the back door, and then light a match

to the place. When PE goes awry in the restaurant business its very hard

not to think of the Goodfellas bust-out, as piles of cash in the form of debt

literally come in the front door and go out the back, with barely a cent

seemingly ever making its way into the operating business.

The History of the LBO Family Chicken Meal:

The 12 restaurant Los Angeles based El Pollo Loco that was acquired by

Dennys in 1983 had the makings of what might have one day be todays

Chipotle. The chain expanded rapidly over the following seven years

(almost exclusively in southern California) to 200 units, and developed very

strong brand equity. But thanks to the late 1980s Junk bond driven LBO

boom (Coniston Partners purchase of their parent TW Services for $1.7

billion with $1.5 billion in high yield debt was the last great junk bond deal

of the 1980s), it spent most of the early 1990s as a neglected asset within

the portfolio of a large and financially burdened holding company.

Consequently, over the first half of the decade, El Pollo Locos parent only

managed to add 16 new restaurants. There were also multiple non-focused

failed expansions during this time that saw the chain open and close in

Florida, Hawaii, and even as far away as Japan. Not exactly how you grow a

restaurant franchise, but when you are that leveraged you take what you

August 18, 2014

www.suhailcapital.com

can get. Yet, a remodeling program and a new strategy to target the lunch

crowd in the mid 1990s seemed to position El Pollo Loco for an era of

renewed expansion. In 1996, their parent company announced ambitious

plans to expand the chain to 600 units by the end of the decade. Of course

the parents bankruptcy filing the following year threw a wrench into those

plans. The huge expansion never materialized, and by the end of the

decade a decision was made to put El Pollo Loco up for sale.

Enter alleged savoir/value creator PE Firm American Securities Capital

Partners.

The El Pollo Loco that was acquired by ASCP for $128 million in cash at the

end of 1999 ($44 million in equity from ASCP and the rest in debt financing

in the form of a senior loan) had generated $21 million in EBITDA the

previous year.

Here is what they saw themselves bringing to the table in a joint

presentation by Steve Carley- El Pollo Loco CEO and Glenn Kaufman-

Managing Director of ASCP

August 18, 2014

www.suhailcapital.com

Admittedly over the next three years they did seem to be making some

progress putting the chain back on the right track. They remodeled stores,

upgraded IT systems and improved overall operating efficiency while

selectively expanding in the core market. And yes, they reduced some of

the leverage used to finance their acquisition.

Then at the end of 2003 it would appear they got bored or determined that

El Pollo Locos future was limited to being a solid LA Mexican Chicken chain

whose cash flows were better served being milked than reinvested in

domestic expansion; $70 million in additional debt was incurred. $50

million of that was paid out in the form of a dividend and $20 million was

used to buyback preferred stock. El Pollo Loco ended the year with $133

million in debt. In 2004, we got more of the same. ASCP borrowed to pay

themselves a $37 million dividend. Then in 2005 ASCP decided to sell El

Pollo Loco, but not before another $11 million distribution was tacked on in

the form of transaction fees. All in all, in just over 5 years, ASCP took a

August 18, 2014

www.suhailcapital.com

company with $15 million in capital lease debt and $21 EBITDA and turned

it into one with nearly $185 million in long-term debt and $33 million in

EBITDA. If you run the numbers on the deal financing for the acquisition,

fees, and leveraged dividends cashed out; nearly every last cent of the

indebtedness incurred by El Pollo Loco effectively never made it into the

business.

Now here is an excerpt from the PR ASCP put out after they agreed to sell El

Pollo Loco in 2005:

Through continued and long-term focus on operational investment and strategic growth

during its time with American Securities, El Pollo Loco has substantially improved restaurant

level operating performance while more than doubling the

more

companys profitability. The heritage of our firm is in building great enterprises. We are

completely committed to working as partners with managers to build businesses that are far

better operationally, financially and competitively when we exit than when we initially

invested, added Mr. Kaufman. Our El Pollo Loco experience is a perfect example of our

business philosophy.

Seriously? Now doesnt that post sale case study slide about reducing this

acquired Orphans leverage seem a bit ridiculous to you. If El Pollo Loco

was an Orphan when ASCP bought it from TW Services, it was an orphan

with a new pair of shoes and no legs by the time they sold them to

Trimaran Capital Partners. A better analogy here would be that ASCP

acquired an orphaned chain, dabbled with nursing them back to health,

only to turn around and thoroughly bust them out before they sold them

off to somebody else.

During these five years of financial ingenuity, while El Pollo Loco was being

used as a PE ATM machine, Chipotle opened nearly 500 restaurants across

the nation. One cant help but wonder what El Pollo Loco would like today

August 18, 2014

www.suhailcapital.com

if all that debt had been used to fund a gradual and laser focused expansion

of the brand.

So, El Pollo Loco, whose biggest problem had been that it was stuck in the

portfolio of a restaurant holding company mired in junk bond mania debt,

was now also buried in debt.

The Solution: Why of course, another LBO to tack on even more debt, and

hopefully a quick flip IPO to save the day.

Enter Trimaran Capital, the current majority shareholder, which clearly had

no intention of holding onto El Pollo Loco for very long. Going back through

SEC filings we found the 2006 S-1 for El Pollo Loco in which they were

looking to raise up to $135mln for a company with $260mln in debt and

$36mln in EBITDA (according to 2005 numbers in the S-1.) Note, this S-1

was initially filed just a few months after the closing of the acquisition by

Trimaran. So for them having this quick-flip turn into a 9 year investment

was definitely not part of their original game plan. Their timing was to put it

mildly not very good. Over their ownership period El Pollo Loco reported an

aggregate net loss of $191 million. Their last profitable year was 2006, and

for the last year the company earned more than $1 million you have to go

all the way back to 2003. And as if being the last PE buyer in the door

before the music stopped and a major recession appeared wasnt bad

enough, they got hit losing a trademark lawsuit to the original Mexican

founder of El Pollo Loco (they ended up settling for just under $11 million in

2008). Not exactly a pleasant journey. In fact, it is a sheer miracle that they

averted bankruptcy here. Just a look back at their filings and you can see

that as recently as August, 2011 they were marking El Pollo Loco at 30c on

the dollar ($30 million equity value for the whole company). Yet now they

are sitting on a majority stake in a company that the market is valuing at

$1.4 billion, and income tax receivable agreement that is worth some $40

August 18, 2014

www.suhailcapital.com

million in distributions (to both PE firms) going forward. This is a pretty

remarkable turn of events to say the least.

So, what was the point of this trip down memory lane?

Well, to be clear, we wanted to set the record straight as far as current

popular perception of this name being some sort of hot story stock. El

Pollo Locos last twenty years of operating history are an absolute tragedy.

This was a business with a lot of potential that always seemed to find the

wrong owners, and now after decades of missed opportunity it is being

dumped on the unsuspecting retail investor. Now, there is no doubt that

management has done an excellent job stabilizing the ship, especially

considering they have been operating with the financial equivalent of a

noose around their neck. But that does not obscure the fact that this is just

about the furthest thing from an exciting growth story, and that owning the

shares at these levels is the equivalent of simply burning the cash in your

wallet.

August 18, 2014

www.suhailcapital.com

VI. Valuation: Whats it worth?

El Pollo Loco shares currently trade in excess of 30x EV/ 2013 ADJ EBITDA

(Chipotle is at 29x trailing and 24x consensus estimate for 2014)

Consider that multiple within the context of how long the brand has been

around, the missed opportunities to expand while PE played LBO hot

potato with it, subsequent and very recent failed domestic expansion, the

concurrent domestic metamorphosis of Chipotle into a Mexican chain

national powerhouse, and overall intense competition in their very

crowded niche. How many Pollo [fill in the blank] are there in the USA? We

counted at least 10 other regional chains including El Pollo Rico, Gordo, de

Oro, Regio, Inka, Primo, Campero, Feliz, Norteno and just plain El Pollo. The

multiple is just plain LOCO! When you further factor in El Pollo Locos

concentrated exposure to one city, a menu that is pushing the outer limits

of value for a brand with core demographic that is highly value conscious,

and still somewhat limited balance sheet flexibility; a multiple north of 10x

EV/ ADJ EBITDA becomes completely indefensible.

At 10x EV/ADJ EBITDA the stock would be trading at $9.80 which implies

over 70% downside from current levels. This would put it on par with

where recent food and beverage IPO Potbelly is now trading. We think fair

value for this business is still lower, with a price close to $6/share in the

coming 12-18 months not being out of the question.

$6 that must be some crazy sensationalist short biased target, right?

To be clear that target is not even predicated on some sort of gloom and

doom scenario.

Mature niche restaurant chains are very sensitive to short-term comps, and

there is no shortage of them trading at trailing EV/Sales multiples of 1x or

August 18, 2014

www.suhailcapital.com

less (Potbelly, Bloomin Brands, and Red Robin Gourmet all trade at EV/Sales

multiples of less than one). Considering El Pollo Loco generated $315

million in revenue last year, a 1x EV/Sales multiple works out to

$3.50/share. Now Potbelly is interesting comp because its a more recent

expansion story, IPOd less than a year ago, operates 280+ company owned

shops across 18 states, had 20% shop level margins vs El Pollo Locos 21% in

2013, and is sitting on a much healthier balance sheet with net cash at 2x

EBITDA vs net debt of 3.4x ADJ EBITDA at El Pollo Loco. Yet Potbelly

doubled from its offering price, traded side ways for a few months, then

slowly trickled back down to the offering price, and later fell off a cliff after

its third quarterly report as a public company on weaker than expected

comps. It currently trades at an EV/ADJ 2013 EBITDA OF 8x and EV/2013

Sales multiple of 0.96x. These multiple should give any El Pollo Loco

investors pause, especially when you factor in that Potbelly has been

steadily growing their brand since 1995, and has not experienced the type

of significant geographic retrenchments El Pollo Loco has faced over the

years. However Potbelly has been weak of late, so lets look at a more

mature restaurant chain with better recent operating momentum.

Jack in the Box, which owns the 600+ unit Mexican themed Qdoba chain,

(as well as 2,200+ Jack in the Boxes) has been on a tear of late with shares

up 60% over the last 12 months. The driver has been significant comp

momentum at the Qdoba chain recently, which as of the most recent

quarter were up 7.5% year over year, and year to date are up 500bps over

2013. Despite this recent run-up, the stock is trading at EV/TTM EBITDA of

roughly 10x. In fact, most of the successful established national restaurant

chains trade in this neighborhood. Panera, Bloomin Brands, Wendys,

McDonalds, Red Robin Gourmet, Buffalo Wild Wings, and Yum Brands all

trade at roughly 11x EV/EBITDA or less.

The next step up comp wise is Popeyes Louisiana Kitchen which has 20%+

mkt share in the domestic chicken QSR segment, and thus makes for a solid

August 18, 2014

www.suhailcapital.com

comparable. Popeyes trades at 14.5x EV/ TTM EBITDA. The chain sports

EBITDA margins that are nearly double El Pollo Loco at 31.7%, and grew

revenue by 35%(only 2% of the chains 2,225 are company owned) over the

past two years. Their Net Debt to EBITDA clocks in at 0.9x, and over the

past three years they have on average returned 36% of EBITDA to

shareholders via buybacks. Furthermore, the Popeyes brand continues to

grow both domestically and internationally despite it large unit base. The

global brand equity is hard to ignore considering the brand was founded

only two years before El Pollo Loco.

After Popeyes, the next chain worth looking at in the comp ladder is the

very relevant Fiesta Restaurant Group. FRGI, which operates two

Mexican/Caribbean themed chains in Taco Cabana and Pollo Tropical, is

about as close as you are going to get to El Pollo Loco. The chains have a

similar regional focus with Pollo Tropicals base concentrated in Florida and

Taco Cabanas in Texas. FRGI trades at an EV/EBITDA multiple of 18x or 40%

lower than El Pollo Loco. We believe the name is also an attractive Chipotle

inflated Mexican chain stock short, but will concede that for now it

provides a more marketable surface level growth story. Pollo Tropicals 7%

average same-store sales growth over the past two years is 66% weighted

to traffic vs El Pollo Locos 37% traffic weighting for a virtually identical

company owned same-store sales two year average. Pollo Tropicals stores

are also averaging 53% more in avg sales per unit, and exhibit 350 bps

higher restaurant level margins. Wed also note at that FRGIs largely

company owned model has resulted in a much more controlled domestic

brand expansion with no significant failed retrenchments in recent years

damaging brand equity, and thus remains more open to future domestic

franchising margin expanding opportunities.

The last non-Chiptole chain in El Pollo Locos valuation neighborhood is the

50x+ EV/ADJ EBITDA multiple sporting and seemingly unique

August 18, 2014

www.suhailcapital.com

Mediterranean concept story of Zoes Kitchen, ticker ZOES. Zoes, which

has gone from 20 units to 100+ in the past five years, is still growing its top

line at close to 50%. But a fresh concept chain and a small store base with

exceptional and consistent unit growth trends over five years is again the

very antithesis of El Polo Loco.

We even fished around for private chicken chain comps during our research

and came across QSR behemoth Churchs Chicken which was sold four

years ago for an estimated 6x EBITDA.

There is another way to think about how to value this business other than

looking at public company comps. If youve had any experience valuing

small regionally focused private service industry businesses or large

franchisees of a healthy restaurant brand, El Pollo Loco should be right up

your alley. When you come across a regionally strong business that has the

characteristics of a finite/limited geographic expansion story, you dont

want pay more than 5x EBITDA. Ideally, you come across such a business

and conclude you can clean it up and significantly improve profitability and

find a seller who is willing to part from it for less than 3.5x. However, youd

be willing to pay up to 5x knowing there is plenty of room to grow your

value and effectively reduce your cost base. The exact opposite is true if the

business is being well run or has in fact made some recent changes which

significantly improved operating profitability.

In such a scenario, you are more likely to discount the recently improved

operating metrics as what you are trying to buy is a cash cow and not a

growth story. Essentially, if the current owner has recently significantly

improved operating profitability, you are going to be much more stubborn

with respect to your valuation ceiling. We like to think of El Pollo Loco in

the same way, but on a somewhat grander scale. This is not a hot growth

story brand or national/global scale play. At best, there might be room

for some selective further southwest regional expansion, but for the most

August 18, 2014

www.suhailcapital.com

part the view here is that this is a more mature regionally specific strong

service brand. This puts the 10x+ EBITDA range out of the question for it.

Our acceptable range is going to be more like 5x-10x. The more confident

we are that they can significantly improve operating profitability, the more

comfortable we are with the higher end of the range. This is where the pre-

IPO metrics come into play. The 340 bps in restaurant contribution margin

improvement, sizeable average check growth, huge comp deviation from

historical averages, new menu changes, near 50% completed store base

remodelings, 2013 debt refinancing, Second Lien Term Loan paydown in

conjunction with the IPO, and recent wave of underperforming store

closures are ironically all the things WE DONT WANT TO SEE as buyers of a

strong cash flowing Southern California restaurant chain. Because what is

there left for us to do but try and turn it into a growth story, which as

buyers looking at this regionally mature brand we already have assumed it

is not. If both parties are sharp, what you end up with here is a stalemate.

The buyer doesnt want to pay top dollar for a cash cow business that has

just gone through a thorough once a decade refurbishing, and the last thing

the seller wants is a prospective buyer who does nothing but remind him

that he has put all this work in and is selling here because he has accepted

that meaningful expansion is not feasible.

This is the key issue with El Pollo Loco, and probably goes a long way to

explaining how the underwriters were able to price the IPO at $15. If you

pro forma the hell out the name, the stock priced at a seemingly

reasonable P/E of 22x 2013 net income. That is a pretty big leap from $16.8

million reported loss, and the close to $200 million in reported losses

incurred by the company since Trimaran bought it. Bankers love these

types of IPOs because they are essentially deleveraging turnaround stories

that are partially contingent on the IPO happening, and the huge

deleveraging impact on reported results quickly becomes the only thing

investors want to talk about. The El Pollo Loco business couldnt have been

more ideally suited for this type of pitch. Between 2011 and 2013 revenues

August 18, 2014

www.suhailcapital.com

are up 15%, operating income is up 56%, restaurant contribution margin

improved by 230 bps, ADJ EBITDA margins improved by 300 bps, and

company operated store average unit volumes went from $1.6 million to

$1.75 million.

These are impressive metrics to say the least, and that is the problem here.

They are literally so good that you are immediately forced to red-flag them.

How are you growing operating income 56% with 2.5% yr/yr growth in

traffic? 230bps in restaurant margin expansion is no joke for a mature chain

with 67% of their stores in one city, are you not testing the upper limits of

pricing on your core Hispanic base in Los Angeles? What happens to

Average Store Sales Volume when stores doing 30-50% less than the core

LA base close down? What kind of restaurant chain goes from 6% D&A avg

expense of total revenue to 3%? When you answer all these questions, you

should have no problem figuring out that El Pollo Locos impressive growth

in metrics are not due to organic growth. Instead, they reflect a cash-cow

business pulling short-term levers in anticipation of a sale. The fixed cost

leverage that has been extracted here doesnt comport with a growing

franchise. El Pollo Loco has the labor, occupancy, depreciation, food cost,

and marketing spend cost structure of a very mature one region focused

chain that is simply milking its base. Start to expand, which btw they have

failed to do when there was much less powerful competition for their

brand, and these savings being squeezed out all go in the other direction.

Start growing and lower average store volumes as you enter markets

further away from your core base or cannibalize your existing mature base

with new stores, more complex and costly distribution, expanding

overhead, much higher marketing spend to build brand awareness are what

you have to look forward to. There are also regulatory issues to worry

about like the July 1, 2014 12.5% California minimum wage increase, and a

further 11% increase coming at the end of 2015. Considering that 88% of

the store base is located in California, a 25% increase in payroll over the

next 18 months is going to be a very meaningful EBITDA headwind (again

August 18, 2014

www.suhailcapital.com

nice IPO timing). Put all this together and you start to appreciate why a

discounted multiple is warranted here. In our case we settled on 7.5x ADJ

2013 EBITDA or a fair value of $6.10 a share for now.

Note there is nothing wrong with running this business the way it has been

run. Management has done what they needed to do over the past three

years, and the economic rebound obviously helped them out as well. Our

concern with El Pollo Loco is that between its LBO ownership history

nightmare and its recent refurbishing a whole lot of time has passed, and

the competitive landscape is not what it used to be. Their core

demographic in Los Angeles has absorbed the pricing shifts thus far, but the

risks have gone up with respect to economic sensitivity of the chain and

vulnerability to competition from more upmarket brands as well as from

the better positioned value players. We have not accounted for these risks

in our fair value, but we are fairly confident that if a whiff of evidence

were to materialize indicating tiring of the brand in Los Angeles, 5x and not

10x ADJ EBITDA will quickly become the ceiling.

Summary

1) El Pollo Loco was a hot franchise chain with amazing growth

prospects 30 years ago. Today its still just an LA staple that is

probably going to have to work very hard just to maintain its grip on

what it already has. Comparing it to Chipotle is like comparing a

highly touted draft pick from 20 years ago whose early career was

marred by injuries and poor coaching, and thus ended up being

relegated to role player status, to Lebron James today.

2) Chipotles success which has buoyed the share price out the gate

actually works against them as far as future growth prospects go.

August 18, 2014

www.suhailcapital.com

3) El Pollo Locos pre-IPO comp numbers and margin expansion are

somewhat misleading. Significant price increases/menu mix shift into

a rebounding economy have been the driver, and thus should be

heavily discounted by investors.

4) Setting aside what repeated failed domestic expansions implies

about the brands future long-term growth prospects; the very

recent nature of franchise expansion failures across multiple states

does not bode well for any future franchising in an already

competitive franchise marketplace.

5) The largest shareholder is a legacy PE fund in runoff mode that filed

to take them public no more than six months after initially acquiring

them. At lock-up expiration their holding period will have been just

shy of ten years! The sheer fact that they avoided bankruptcy and a

complete wipeout of their investment is a miracle in and of itself. As

of a couple years ago, they were marking this investment at $0.30 on

the dollar. We imagine anything greater than $5/share feels like a

victory to them at this point. With all this in mind, we have no doubt

they will be highly motivated sellers anywhere over $10.

6) The income tax receivable agreement with the current shareholders

is like pouring salt on an open wound. Its just another way of

structuring a $40 million IPO contingent distribution kicker for the

pre-existing shareholders at the expense of new investors. The $10

million in cash interest expense savings from retiring the 2

nd

lien

facility ends up getting funneled back to the current PE owners in the

form of cash tax savings over the for the next four years. Further

evidence that this is a financially engineered and abused orphan of a

restaurant business, and not the next potential shining growth star

its being portrayed as in the financial media.

7) Finally, the restaurant stock euphoria of the last 18 months is no

longer a tail wind. Red Robin, Bloomin Brands, Potbelly, and Noodles

and Co have all recently demonstrated just how quickly the market

will punish the slightest dip in operating momentum. Those looking

August 18, 2014

www.suhailcapital.com

for long exposure in this sector are better served nibbling away at a

solid growing brand like Panera that has spent the last year or two

dealing with its own operational hiccups and is trading at an

attractive 8x EBITIDA multiple. We think betting on them ahead of a

potential rebound beats giving your money way in this dressed up

Chipotle piggy-back PE exit.

DISCLAIMER

Suhail Capital Limited is an exempted company registered in the Cayman

Islands (Suhail Capital) is an investment advisor to funds that actively

participate in the buying and selling securities and other financial

instruments.

You should assume that as of the publication date of this report, Suhail

Capital (possibly along with or through our partners, affiliates, employees,

and/or consultants) along with our clients and/or investors and/or their

clients and/or investors has a short position in El Pollo Loco LOCO

(and/or options, swaps, and other derivatives related to the stock), and

therefore stands to realize significant gains in the event that the stock

price of LOCO should decline. You should also assume that as of the

publication date of this report, Suhail Capital (possibly along with or

through our partners, affiliates, employees, and/or consultants) along

with our clients and/or investors and/or their clients and/or investors has

a long or short position in Chipotle Mexican Grill, Potbelly and any other

publicly listed company in this report (and/or options, swaps, and other

derivatives related to these stocks) , and therefore stands to realize

significant gains in the event that the price of Chipotle Mexican Grill,

Potbelly or any other company listed should increase or decrease.

August 18, 2014

www.suhailcapital.com

Suhail Capital strongly recommends that you do your own due diligence

before buying or selling any of the securities mentioned in this report.

We intend to continue transacting in the securities of issuers covered in

this report for an indefinite period after its publication, and we may be

long, short, or neutral at any time hereafter regardless of our initial

recommendation.

This report expresses our opinion, which we have based upon generally

available information, field research, inferences and deductions through

our due diligence and analytical process. To the best of our ability and

belief, all information contained herein is accurate and reliable, and has

been obtained from public sources we believe to be accurate and reliable,

and who are not insiders or connected persons of the stock covered

herein or who may otherwise owe any fiduciary duty or duty of

confidentiality to the issuer. However, such information is presented as-

is, without warranty of any kind, whether express or implied. Suhail

Capital makes no representation, express or implied, as to the accuracy,

timeliness, or completeness of any such information or with regard to the

results to be obtained from its use. All expressions of opinion are subject

to change without notice, and Suhail Capital does not undertake to

update or supplement this report or any of the information, analysis and

opinion contained in it.

Please refer to the below link for our Term of Use applicable to this report

and any other publication issued by Suhail Capital:

http://www.suhailcapital.com/#!terms-of-use/cgpu

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tips - Butler Lumber Company Case SolutionDocument18 pagesTips - Butler Lumber Company Case Solutionsara_AlQuwaifliNo ratings yet

- Interim Report On Devolved GovernmentDocument341 pagesInterim Report On Devolved GovernmentSpartacus OwinoNo ratings yet

- AHAP Insurance Financial SummaryDocument2 pagesAHAP Insurance Financial SummaryluvzaelNo ratings yet

- The Nairobi Stock Exchange (NSE) Sectors ReconfiguredDocument5 pagesThe Nairobi Stock Exchange (NSE) Sectors ReconfiguredPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Chapter 6 - ProblemsDocument6 pagesChapter 6 - ProblemsDeanna GicaleNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

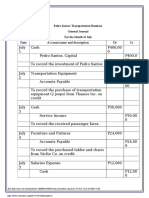

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლNo ratings yet

- Kotak Annual Report Highlights Simplicity and PrudenceDocument196 pagesKotak Annual Report Highlights Simplicity and PrudenceCaCs Piyush SarupriaNo ratings yet

- Asset-Backed Commodity TradingDocument4 pagesAsset-Backed Commodity Tradingluca sacakiNo ratings yet

- Real Estate Presentation - Chapter 12Document27 pagesReal Estate Presentation - Chapter 12Cedric McCorkleNo ratings yet

- W5 ADDRESS SolutionDocument169 pagesW5 ADDRESS SolutionDemontre BeckettNo ratings yet

- Term Plan 65yeras PDFDocument5 pagesTerm Plan 65yeras PDFRohit KhareNo ratings yet

- INV2001082Document1 pageINV2001082Bisi AgomoNo ratings yet

- Ijaz KhanDocument78 pagesIjaz Khanwaqar ahmadNo ratings yet

- IAS 24 - Related Party Disclosures PDFDocument14 pagesIAS 24 - Related Party Disclosures PDFJanelle SentinaNo ratings yet

- Forex Trading, Simplified Members Strategy E-BookDocument77 pagesForex Trading, Simplified Members Strategy E-BookShankar R100% (1)

- Risk Identification and Mitigation StrategiesDocument5 pagesRisk Identification and Mitigation StrategiesnishthaNo ratings yet

- Pradhan Mantri Fasal Bima Yojana (PMFBY) : Challenges and Way ForwardDocument17 pagesPradhan Mantri Fasal Bima Yojana (PMFBY) : Challenges and Way Forwardm_sachuNo ratings yet

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanNo ratings yet

- Heineken 2004Document50 pagesHeineken 2004k0yujinNo ratings yet

- The Correct Answer Is: P105,000Document5 pagesThe Correct Answer Is: P105,000cindy100% (2)

- Default Profile Customer Level Account - FusionDocument1 pageDefault Profile Customer Level Account - FusionhuyhnNo ratings yet

- Measuring National IncomeDocument71 pagesMeasuring National IncomeMayurRawoolNo ratings yet

- MSU-CBA Receivables Financing Pre-Review ProgramDocument2 pagesMSU-CBA Receivables Financing Pre-Review ProgramAyesha RGNo ratings yet

- DepartmentalizationDocument19 pagesDepartmentalizationmbmsabithNo ratings yet

- The Payment of Bonus Act, 1965Document15 pagesThe Payment of Bonus Act, 1965Raman GhaiNo ratings yet

- Part Char 4Document9 pagesPart Char 4Denise Jeon25% (4)

- CIMA F1 Financial Operations KitDocument433 pagesCIMA F1 Financial Operations KitAnonymous 5z7ZOp67% (3)

- SBI Focused Equity Fund (1) 09162022Document4 pagesSBI Focused Equity Fund (1) 09162022chandana kumarNo ratings yet