Professional Documents

Culture Documents

F 1040

Uploaded by

arnodiazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F 1040

Uploaded by

arnodiazCopyright:

Available Formats

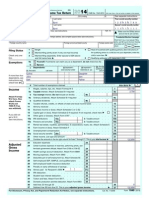

Form

1040

2014

(99)

Department of the TreasuryInternal Revenue Service

U.S. Individual Income Tax Return

OMB No. 1545-0074

, 2014, ending

IRS Use OnlyDo not write or staple in this space.

See separate instructions.

For the year Jan. 1Dec. 31, 2014, or other tax year beginning

Your first name and initial

Last name

, 20

Your social security number

If a joint return, spouses first name and initial

Last name

Spouses social security number

Apt. no.

Home address (number and street). If you have a P.O. box, see instructions.

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Foreign country name

Filing Status

Check only one

box.

Exemptions

Presidential Election Campaign

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking

Foreign postal code

a box below will not change your tax or

refund.

You

Spouse

Foreign province/state/county

Single

Married filing jointly (even if only one had income)

2

3

Head of household (with qualifying person). (See instructions.) If

the qualifying person is a child but not your dependent, enter this

childs name here.

Married filing separately. Enter spouses SSN above

and full name here.

6a

b

Qualifying widow(er) with dependent child

Yourself. If someone can claim you as a dependent, do not check box 6a .

Spouse

.

Dependents:

(1) First name

(2) Dependents

social security number

Last name

(4) if child under age 17

qualifying for child tax credit

(see instructions)

(3) Dependents

relationship to you

Dependents on 6c

not entered above

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

If you did not

get a W-2,

see instructions.

Adjusted

Gross

Income

Boxes checked

on 6a and 6b

No. of children

on 6c who:

lived with you

did not live with

you due to divorce

or separation

(see instructions)

If more than four

dependents, see

instructions and

check here

Income

Make sure the SSN(s) above

and on line 6c are correct.

Total number of exemptions claimed

.

8b

. .

8a

9a

10

11

Qualified dividends . . . . . . . . . . .

9b

Taxable refunds, credits, or offsets of state and local income taxes

Alimony received . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

10

11

12

13

14

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . .

Capital gain or (loss). Attach Schedule D if required. If not required, check here

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . .

12

13

14

15a

16a

17

IRA distributions .

15a

b Taxable amount

. . .

Pensions and annuities 16a

b Taxable amount

. . .

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

15b

16b

17

18

19

20a

Farm income or (loss). Attach Schedule F .

Unemployment compensation . . . .

Social security benefits 20a

18

19

20b

21

22

Other income. List type and amount

Combine the amounts in the far right column for lines 7 through 21. This is your total income

23

Educator expenses

24

Certain business expenses of reservists, performing artists, and

fee-basis government officials. Attach Form 2106 or 2106-EZ

25

Health savings account deduction. Attach Form 8889

24

25

26

27

28

Moving expenses. Attach Form 3903 . . . . . .

Deductible part of self-employment tax. Attach Schedule SE .

Self-employed SEP, SIMPLE, and qualified plans

. .

26

27

28

29

30

31a

Self-employed health insurance deduction

Penalty on early withdrawal of savings . .

.

.

.

.

.

.

.

.

32

33

34

Alimony paid b Recipients SSN

IRA deduction . . . . . . .

Student loan interest deduction . .

Tuition and fees. Attach Form 8917 .

29

30

31a

.

.

.

.

.

.

.

.

.

.

.

.

32

33

34

35

36

37

Domestic production activities deduction. Attach Form 8903

35

Add lines 23 through 35 . . . . . . . . . . . . .

Subtract line 36 from line 22. This is your adjusted gross income

Wages, salaries, tips, etc. Attach Form(s) W-2

8a

b

9a

Taxable interest. Attach Schedule B if required .

Tax-exempt interest. Do not include on line 8a .

Ordinary dividends. Attach Schedule B if required

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. . . . . .

. . . . . .

b Taxable amount

.

.

.

.

.

.

.

.

.

Add numbers on

lines above

21

22

23

.

.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

.

.

.

.

.

.

.

.

36

37

Cat. No. 11320B

Form

1040

(2014)

Page 2

Form 1040 (2014)

38

Amount from line 37 (adjusted gross income)

Tax and

Credits

39a

Check

if:

Standard

Deduction

for

People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

All others:

Single or

Married filing

separately,

$6,200

Married filing

jointly or

Qualifying

widow(er),

$12,400

Head of

household,

$9,100

Other

Taxes

58

59

60a

Unreported social security and Medicare tax from Form:

b

61

First-time homebuyer credit repayment. Attach Form 5405 if required

62

63

Form 8960 c

Taxes from: a

Form 8959 b

Add lines 56 through 62. This is your total tax . .

Payments

If you have a

qualifying

child, attach

Schedule EIC.

Sign

Here

Paid

Preparer

Use Only

You were born before January 2, 1950,

Spouse was born before January 2, 1950,

Blind.

Blind.

38

Total boxes

checked 39a

39b

.

.

42

43

Exemptions. If line 38 is $152,525 or less, multiply $3,950 by the number on line 6d. Otherwise, see instructions

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . .

Form 4972 c

Tax (see instructions). Check if any from: a

Form(s) 8814 b

44

45

46

47

48

49

50

51

52

53

54

55

56

57

64

65

66a

b

67

68

69

70

71

72

75

76a

Alternative minimum tax (see instructions). Attach Form 6251 .

Excess advance premium tax credit repayment. Attach Form 8962

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

48

52

Residential energy credits. Attach Form 5695 . . . .

53

3800 b

8801 c

Other credits from Form: a

54

Add lines 48 through 54. These are your total credits . . . . .

Subtract line 55 from line 47. If line 55 is more than line 47, enter -0-

.

.

.

.

.

.

.

.

.

.

.

.

Self-employment tax. Attach Schedule SE

Add lines 44, 45, and 46

. . . . . . .

Foreign tax credit. Attach Form 1116 if required .

.

.

.

.

.

.

.

.

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

.

.

.

.

.

.

. . .

Instructions; enter code(s)

. . . . . . . . . .

64

Federal income tax withheld from Forms W-2 and 1099 . .

2014 estimated tax payments and amount applied from 2013 return

65

Earned income credit (EIC) . . . . . . . . . . 66a

4137

.

.

.

.

.

.

.

.

.

67

American opportunity credit from Form 8863, line 8 .

Net premium tax credit. Attach Form 8962 . . . .

Amount paid with request for extension to file . . .

.

.

.

.

.

.

68

69

70

71

72

Credits from Form: a

2439 b

Reserved c

Reserved d

73

Add lines 64, 65, 66a, and 67 through 73. These are your total payments .

Excess social security and tier 1 RRTA tax withheld

Credit for federal tax on fuels. Attach Form 4136

.

.

Full-year coverage

Health care: individual responsibility (see instructions)

Nontaxable combat pay election

66b

Additional child tax credit. Attach Schedule 8812 .

8919

Household employment taxes from Schedule H

.

.

.

.

.

.

.

.

40

41

42

43

44

45

46

47

49

50

51

Credit for child and dependent care expenses. Attach Form 2441

Education credits from Form 8863, line 19 . . . . .

Retirement savings contributions credit. Attach Form 8880

Child tax credit. Attach Schedule 8812, if required . . .

55

56

57

58

59

60a

60b

61

62

63

74

.

.

If line 74 is more than line 63, subtract line 63 from line 74. This is the amount you overpaid

75

Amount of line 75 you want refunded to you. If Form 8888 is attached, check here

76a

b

d

c Type:

Routing number

Checking

Savings

Account number

Amount of line 75 you want applied to your 2015 estimated tax 77

77

78

Amount you owe. Subtract line 74 from line 63. For details on how to pay, see instructions 78

79

Estimated tax penalty (see instructions) . . . . . . .

79

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes. Complete below.

No

Personal identification

number (PIN)

Phone

no.

Designees

name

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

Spouses signature. If a joint return, both must sign.

Date

Spouses occupation

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Check

if

self-employed

Joint return? See

instructions.

Keep a copy for

your records.

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

Subtract line 40 from line 38

. . . . . . . . . . . . . . . . .

Third Party

Designee

40

41

Direct deposit?

See

instructions.

Amount

You Owe

If your spouse itemizes on a separate return or you were a dual-status alien, check here

73

74

Refund

Print/Type preparers name

Firms name

Preparers signature

Date

Firm's EIN

Firms address

Phone no.

www.irs.gov/form1040

Form 1040 (2014)

You might also like

- Form 1040Document2 pagesForm 1040Jessi100% (6)

- Form 1040Document2 pagesForm 1040karthu48No ratings yet

- Alice Tax FormDocument6 pagesAlice Tax FormShrey MangalNo ratings yet

- Chapter 10 MERGEDDocument10 pagesChapter 10 MERGEDola69% (13)

- Form 1040 Tax ReturnDocument2 pagesForm 1040 Tax ReturnHamzah B ShakeelNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-173610472No ratings yet

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- F 1040Document2 pagesF 1040Sue BosleyNo ratings yet

- 1040 Tax Return SummaryDocument2 pages1040 Tax Return SummaryLinda100% (2)

- 1040 Tax Form SummaryDocument2 pages1040 Tax Form SummaryKevin RowanNo ratings yet

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnadrianaNo ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- 1040 Form Filing Status and DependentsDocument2 pages1040 Form Filing Status and DependentsAU Sharma0% (1)

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocument5 pagesU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNo ratings yet

- FTF1302745105156Document5 pagesFTF13027451051562sly4youNo ratings yet

- FTF1327867575806Document3 pagesFTF1327867575806erzahler0% (1)

- 2014 Federal 1040 (Esther)Document2 pages2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- f1040 PDFDocument3 pagesf1040 PDFjc75aNo ratings yet

- 2014 Form 1040 Individual Income Tax ReturnDocument9 pages2014 Form 1040 Individual Income Tax ReturnKuan ChenNo ratings yet

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument3 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnSarah Kuldip50% (4)

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- U.S. Individual Income Tax ReturnDocument3 pagesU.S. Individual Income Tax Returnyupper2014No ratings yet

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- Zuckerman2015 Tax ReturnDocument3 pagesZuckerman2015 Tax ReturnAnonymous 2zbzrvNo ratings yet

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- f1040 Draft 2015Document3 pagesf1040 Draft 2015Anonymous IpryXQAKZNo ratings yet

- Itemized Deductions Schedule ADocument2 pagesItemized Deductions Schedule Aljens09No ratings yet

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDocument3 pagesForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandNo ratings yet

- Form 1040A Tax Credit DetailsDocument3 pagesForm 1040A Tax Credit DetailsYosbanyNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- File Your 2014 Tax ReturnDocument4 pagesFile Your 2014 Tax ReturnShakilaMissz-KyutieJenkins100% (1)

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Form 1040NR-EZ Tax Return for Nonresident AliensDocument2 pagesForm 1040NR-EZ Tax Return for Nonresident AliensElena Alexandra CărăvanNo ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- 2015 TaxReturn GregAbbottDocument14 pages2015 TaxReturn GregAbbottDana ThompsonNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620No ratings yet

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisNo ratings yet

- Taxes Are FunDocument2 pagesTaxes Are Funlfoirirjrkjbghghg999No ratings yet

- Form 709 United States Gift Tax ReturnDocument5 pagesForm 709 United States Gift Tax ReturnBogdan PraščevićNo ratings yet

- F 706Document31 pagesF 706Bogdan PraščevićNo ratings yet

- Vice-President Biden's 2010 Tax ReturnDocument28 pagesVice-President Biden's 2010 Tax ReturnBarack ObamaNo ratings yet

- F 1040 NRDocument5 pagesF 1040 NRsrao_919525No ratings yet

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Document2 pagesU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- F 1040 SaDocument1 pageF 1040 Sahgfed4321No ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- F1040sa 2013Document2 pagesF1040sa 2013Sarah KuldipNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Svensson Case V Luxembourg - Case LawDocument2 pagesSvensson Case V Luxembourg - Case LawEzgi BaşNo ratings yet

- 2023 Jul 20 - PersonalDocument2 pages2023 Jul 20 - PersonalCammNo ratings yet

- Retailing: by Shraddha KocharDocument45 pagesRetailing: by Shraddha KocharShraddha KocharNo ratings yet

- Viet Nam - The Emergence of A Rapidly Growing IndustryDocument14 pagesViet Nam - The Emergence of A Rapidly Growing IndustryTuyen Le HaiNo ratings yet

- Cangque A Bapf 106 Ba Module 2 For Checking (Recovered)Document24 pagesCangque A Bapf 106 Ba Module 2 For Checking (Recovered)Armalyn CangqueNo ratings yet

- 4.7 Ethical Issues Sales ManagementDocument12 pages4.7 Ethical Issues Sales ManagementRishab Jain 2027203No ratings yet

- European Innovation Scoreboard 2021Document95 pagesEuropean Innovation Scoreboard 2021Samuel Morales RodríguezNo ratings yet

- Tilkamanjhi Bhagalpur University, Bhagapur: Writ ERDocument14 pagesTilkamanjhi Bhagalpur University, Bhagapur: Writ ERAnkitaNo ratings yet

- 689140894Document7 pages689140894HATEMNo ratings yet

- Guidewire Practice OverviewDocument3 pagesGuidewire Practice OverviewSai VenkatNo ratings yet

- Operations Management - Ebook - MZM PDFDocument341 pagesOperations Management - Ebook - MZM PDFMuntasir Alam Emson100% (2)

- Strategic Management Process PDFDocument8 pagesStrategic Management Process PDFstarvindsouza22100% (1)

- Latest Cda IssuancesDocument49 pagesLatest Cda Issuancesceejhay avilaNo ratings yet

- AIRs LM Business Finance Q1 MOD 2Document19 pagesAIRs LM Business Finance Q1 MOD 2Oliver N AnchetaNo ratings yet

- Refreshers Activity in Labor Law (Activity 2)Document4 pagesRefreshers Activity in Labor Law (Activity 2)Dodong LamelaNo ratings yet

- Cheetah Digital Econsultancy 2022 Digital Consumer Trends Index Infographic 2Document1 pageCheetah Digital Econsultancy 2022 Digital Consumer Trends Index Infographic 2Mark MendozaNo ratings yet

- HRM Distribution of Reports Per StudentDocument3 pagesHRM Distribution of Reports Per Studentclara dupitasNo ratings yet

- The Board of Directors of The Cortez Beach Yacht ClubDocument2 pagesThe Board of Directors of The Cortez Beach Yacht ClubAmit PandeyNo ratings yet

- Monetary Policy and Central Bank SyllabusDocument5 pagesMonetary Policy and Central Bank Syllabusjose aureo camacamNo ratings yet

- Intellectual Capital and Economic Value Added of Quoted Service Firms in NigeriaDocument10 pagesIntellectual Capital and Economic Value Added of Quoted Service Firms in NigeriaEditor IJTSRDNo ratings yet

- FNC PPT FinalDocument32 pagesFNC PPT FinalaDITYA GUJARENo ratings yet

- Pag-IBIG Data FormDocument2 pagesPag-IBIG Data Formnelia_villarete3070No ratings yet

- Llamasoft Gartner Issue1 PDFDocument22 pagesLlamasoft Gartner Issue1 PDFDarshan HDNo ratings yet

- Print - Udyam Registration Certificate MM SteelDocument4 pagesPrint - Udyam Registration Certificate MM SteelravinakhanhifiNo ratings yet

- 5 - Guide Questions - Crops (Bauang)Document4 pages5 - Guide Questions - Crops (Bauang)warren mateoNo ratings yet

- CFAS Chapter 5-8 PDFDocument25 pagesCFAS Chapter 5-8 PDFKenneth PimentelNo ratings yet

- The Role of Cooperatives in Economic Growth in Makassar City During The Covid-19 PandemicDocument4 pagesThe Role of Cooperatives in Economic Growth in Makassar City During The Covid-19 PandemicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Global Grade Profiling StructureDocument6 pagesGlobal Grade Profiling StructuremohammadNo ratings yet

- Pamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2Document4 pagesPamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2suruth242No ratings yet

- Manual-Estimating The Cost of Environmental DegradationDocument265 pagesManual-Estimating The Cost of Environmental DegradationJay Dee100% (2)