Professional Documents

Culture Documents

Almeda v. CA

Uploaded by

Emir MendozaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Almeda v. CA

Uploaded by

Emir MendozaCopyright:

Available Formats

Almeda v.

CA (1996)

Petitioners: SPOUSES PONCIANO ALMEDA AND EUFEMIA P. ALMEDA

Respondents: CA AND PNB

Ponente: KAPUNAN

Topic: Remedies for Breach

SUMMARY: (1-2 sentence summary of facts, issue, ratio and ruling)

FACTS:

-

Ponciano and Eufemia Almeda acquired several loan/credit accommodations totalling

P18 million from PNB, at an interest rate of 21% per annum. To secure the loan,

spouses executed a Real Estate Mortgage Contract covering a parcel of their land at

Pasong Tamo, Makati and the building erected thereon (Marvin Plaza).

A credit agreement was also executed by the parties, which provides: the Bank

reserves the right to increase the interest rate within the limits allowed by law at

any timeprovided, that the interest rate on this/these accommodations shall be

correspondingly decreased in the event that the applicable maximum interest rate is

reduced by law or by the Monetary Board. In either case, the adjustment in the

interest rate agreed upon shall take effect on the effectivity date of the increase or

decrease of the maximum interest rate.

the Almedas made several partial payments on the loan totaling P7,735,004.66, a

substantial portion of which was applied to accrued interest.

Then, over the Almedas protests, PNB raised the interest rate to 28% pursuant to their

credit agreement, and thereafter increased it to a high of 68% before the loan matured.

Thus, the Almedas filed a petition for declaratory relief with prayer for a writ of

preliminary injunction and TRO to enjoin PNB from unilaterally raising the interest rates

on the loan, pursuant to the credit agreements escalation clause.

The RTC Makati issued the TRO, but by this time the Almedas were already in default of

their loan obligations.

Invoking the law on Mandatory Foreclosure (Act 3135 and PD 385), PNB countered by

ordering the extrajudicial foreclosure of the Almedas mortgaged properties and

scheduling an action sale.

The RTC granted a supplemental writ of preliminary injunction, staying the public

auction. The RTC later dissolved the writ. PNB then set a new date for the sale.

Before the sale, the Almedas tendered to PNB P40,142,518, which covered the

remaining principal amount of the loan plus interest at 21%.

PNB refused to accept the tender of payment, thus the Almedas consigned the P40M

with the RTC. The RTC granted the Almedas prayer for a writ of preliminary injunction

against the sale anew.

PNB appealed to the CA, which set aside the trial courts order granting the writs and

upheld PNBs right to foreclosure pursuant to Act 3135 and PD 385.

Thus, this petition.

PNB vigorously denied that the increases in the interest rates were illegal, unilateral,

excessive and arbitrary, it argued that the escalated rates of interest it imposed was

based on the agreement of the parties.

ISSUES:

WoN PNB was authorized to raise its interest rates from 21% to as high as 68% under

the credit agreement

o NO. Any contract which appears to be heavily weighed in favor of one of the

parties so as to lead to an unconscionable result is void. Likewise, any stipulation

regarding the validity or compliance of the contract which is left solely to the will

of one of the parties is invalid.

o The binding effect of any agreement between parties to a contract is premised on

two settled principles: that any obligation arising from contract has the force of

law between the parties and that there must be mutuality between the parties

based on their essential equality.

o PNB unilaterally altered the terms of its contract with the Almedas by

increasing the interest rates on the loan without prior assent of the latter, in

violation of the mutuality principle of contracts expressed in A1308, NCC.

o While interest escalation clauses in credit agreements are perfectly valid and do

not contravene public policy, they are still subject to laws and provisions.

o The stipulation in the credit agreement, which requires that the increase be

within the limits allowed by law refers to legislative enactments, not

administration circulars, otherwise the credit agreement would not have made

the distinction between law and the Monetary Board in the phrase that the

interest rate on this/these accommodations shall be correspondingly decreased

in the event that the applicable maximum interest rate is reduced by law or by the

Monetary Board.

o The increased interest rates, to which the Almedas never assented, thereby

resulting to PNBs contravention of their credit agreement by implementing the

same, are patently unconscionable and excessive, unjustly disabling the

Almedas from fulfilling their obligation due to the new amount of the loan that is

way above the original amount of the old interest rate.

NOTES:

You might also like

- CD Almeda V CADocument3 pagesCD Almeda V CACistron ExonNo ratings yet

- Philippine National Bank VS RocamoraDocument2 pagesPhilippine National Bank VS RocamoraFeliz Xhanea CanoyNo ratings yet

- Cristina Garments v. CADocument2 pagesCristina Garments v. CAEmir MendozaNo ratings yet

- Ligutan Vs CA DigestDocument1 pageLigutan Vs CA DigestClaire CulminasNo ratings yet

- Citibank v. Sabeniano: Compensation of Loan and Deposit Accounts UpheldDocument1 pageCitibank v. Sabeniano: Compensation of Loan and Deposit Accounts UpheldShiela Pilar100% (1)

- Eastern Shipping Lines v. CADocument3 pagesEastern Shipping Lines v. CAEmir MendozaNo ratings yet

- Crismina Garments Inc. v. Court of AppealsDocument1 pageCrismina Garments Inc. v. Court of AppealsAianna Bianca Birao (fluffyeol)No ratings yet

- Parole Evidence Rule bars evidence of terms not in written agreementDocument1 pageParole Evidence Rule bars evidence of terms not in written agreementeNo ratings yet

- Almeda Vs. Court of Appeals interest rate hike prohibitionDocument3 pagesAlmeda Vs. Court of Appeals interest rate hike prohibitionMikhailFAbz100% (1)

- Case Digest Tan V Mendez G.R. No. 138669 June 6, 2002Document3 pagesCase Digest Tan V Mendez G.R. No. 138669 June 6, 2002Bon Magdalera100% (2)

- CBP Vs CaDocument2 pagesCBP Vs CaGale Charm SeñerezNo ratings yet

- 52-59.06 - Banco Atlantico V Auditor GeneralDocument2 pages52-59.06 - Banco Atlantico V Auditor GeneralElaine Atienza-IllescasNo ratings yet

- Sps. Juico v. China BankDocument2 pagesSps. Juico v. China BankRad IsnaniNo ratings yet

- American Express Co. the Proper Party in Credit Card Collection CaseDocument3 pagesAmerican Express Co. the Proper Party in Credit Card Collection CaseElla ThoNo ratings yet

- Inciong vs. Court of Appeals 257 SCRA 578 (1996)Document1 pageInciong vs. Court of Appeals 257 SCRA 578 (1996)Vikki Amorio100% (2)

- Security Bank v. RTC MakatiDocument1 pageSecurity Bank v. RTC MakatiEmir MendozaNo ratings yet

- Marimperio v. CADocument3 pagesMarimperio v. CAMigs GayaresNo ratings yet

- Bonifacio Olegario Vs CADocument1 pageBonifacio Olegario Vs CAClase Na Pud100% (1)

- Cui V CuiDocument3 pagesCui V CuiLawdemhar CabatosNo ratings yet

- Supreme Court Affirms Ruling Holding Guarantor Liable Despite Release of CollateralDocument3 pagesSupreme Court Affirms Ruling Holding Guarantor Liable Despite Release of CollateralEmil BautistaNo ratings yet

- Panganiban v. Cuevas-OBLICONDocument1 pagePanganiban v. Cuevas-OBLICONCzarina Lea D. MoradoNo ratings yet

- Osmena Vs Citibank (2004)Document6 pagesOsmena Vs Citibank (2004)Jaelein Nicey A. MonteclaroNo ratings yet

- Philippine National Bank vs. Sayo, Jr. 292 SCRA 202 (1998)Document2 pagesPhilippine National Bank vs. Sayo, Jr. 292 SCRA 202 (1998)angelicaNo ratings yet

- Prudential Bank vs. Alviar, G. R. No. 150197, July 28, 2005, 464 SCRA 353Document3 pagesPrudential Bank vs. Alviar, G. R. No. 150197, July 28, 2005, 464 SCRA 353WrenNo ratings yet

- Investors Finance Corporation vs. Autoworld Sales CorporationDocument3 pagesInvestors Finance Corporation vs. Autoworld Sales CorporationMike E DmNo ratings yet

- Jimmy Co v CA ruling on negligence of repair shop for carnapped vehicleDocument2 pagesJimmy Co v CA ruling on negligence of repair shop for carnapped vehicleBryan Kylle LoNo ratings yet

- Payment Validity in Loan CaseDocument3 pagesPayment Validity in Loan CaseTippy Dos SantosNo ratings yet

- AGBAY VsDocument2 pagesAGBAY VsCharlie ThesecondNo ratings yet

- Vda de Lopez Vs LopezDocument5 pagesVda de Lopez Vs LopezRap BaguioNo ratings yet

- Case Digest - Asset Builders Vs StrongholdDocument3 pagesCase Digest - Asset Builders Vs StrongholdDianaVillafuerteNo ratings yet

- Central Bank Vs CA 139 SCRA 46 (1985)Document1 pageCentral Bank Vs CA 139 SCRA 46 (1985)Benitez GheroldNo ratings yet

- Case Digest - Rehabilitation Finance Corporation V CA, Estelito Madrid, Jesus AnduizaDocument2 pagesCase Digest - Rehabilitation Finance Corporation V CA, Estelito Madrid, Jesus AnduizaEllie Yson80% (5)

- Letter of Credit Payment Quasi-ContractDocument2 pagesLetter of Credit Payment Quasi-ContractjrvyeeNo ratings yet

- First Metro Investment vs. Estate of Del SolDocument3 pagesFirst Metro Investment vs. Estate of Del SolEmir MendozaNo ratings yet

- Bpi Vs ArmovitDocument2 pagesBpi Vs ArmovitJay Mark Albis SantosNo ratings yet

- CAMPUA UY TINA vs. HON. DAVID P. AVILADocument1 pageCAMPUA UY TINA vs. HON. DAVID P. AVILAMargie Marj GalbanNo ratings yet

- 5 - US vs. PAnaligan, 14 Phil 46Document1 page5 - US vs. PAnaligan, 14 Phil 46gerlie22No ratings yet

- Borromeo vs. CADocument3 pagesBorromeo vs. CAcmv mendozaNo ratings yet

- #8 Central Bank V Court of AppealsDocument2 pages#8 Central Bank V Court of AppealsCrystal Kate A AgotNo ratings yet

- G.R. No. 141938 - DigestDocument4 pagesG.R. No. 141938 - DigestEdmund Pulvera Valenzuela IINo ratings yet

- BPI v. SanchezDocument3 pagesBPI v. SanchezMatanglawin RunnersNo ratings yet

- Silahis Marketing v. IACDocument2 pagesSilahis Marketing v. IACJennifer Oceña100% (2)

- Philippine Lawyer's Association Vs Agrava 1959Document6 pagesPhilippine Lawyer's Association Vs Agrava 1959MelvzNo ratings yet

- Sesbreno Vs CA DigestDocument2 pagesSesbreno Vs CA DigestriajuloNo ratings yet

- First Metro Investment Corporation Vs Este Del Sol 369 SCRA 99Document2 pagesFirst Metro Investment Corporation Vs Este Del Sol 369 SCRA 99Roseve Batomalaque100% (1)

- Equitable PCI Bank v. NG Sheung NgorDocument2 pagesEquitable PCI Bank v. NG Sheung Ngorcarmelafojas100% (3)

- 1 - Antonio Tan V CaDocument9 pages1 - Antonio Tan V CaBelle MaturanNo ratings yet

- Tolentino Vs CADocument2 pagesTolentino Vs CAcheryl talisikNo ratings yet

- 23 - Gonzales v. PCIBDocument1 page23 - Gonzales v. PCIBeieipayadNo ratings yet

- Ramos Vs EscobalDocument2 pagesRamos Vs EscobalCecille Garces-SongcuanNo ratings yet

- Peoples Bank Vs OdomDocument1 pagePeoples Bank Vs Odomcmv mendozaNo ratings yet

- Case 15 Frias Vs San Diego-SisonDocument3 pagesCase 15 Frias Vs San Diego-SisonAdrian AlamarezNo ratings yet

- Facts:: Eastern Shipping Lines, Inc. vs. Hon. Court of Appeals and Mercantile Insurance Company, INCDocument2 pagesFacts:: Eastern Shipping Lines, Inc. vs. Hon. Court of Appeals and Mercantile Insurance Company, INCEmilio Pahina100% (1)

- Jaucian v. QuerolDocument4 pagesJaucian v. QuerolamberspanktowerNo ratings yet

- Valmonte V CA DigestDocument3 pagesValmonte V CA DigestJien Lou100% (1)

- Eastern Shipping Lines Vs CADocument2 pagesEastern Shipping Lines Vs CAmaximum jicaNo ratings yet

- Cleofas Vs ST Peter Memorial ParkDocument9 pagesCleofas Vs ST Peter Memorial ParkEKANGNo ratings yet

- Spouses Ponciano Almeda and Eufemia P. Almeda The Court of Appeals and Philippine National Bank G.R. No. 113412 April 17, 1996 FactsDocument2 pagesSpouses Ponciano Almeda and Eufemia P. Almeda The Court of Appeals and Philippine National Bank G.R. No. 113412 April 17, 1996 FactsJovz BumohyaNo ratings yet

- Almeda V CaDocument2 pagesAlmeda V CaLiv PerezNo ratings yet

- Almeda v. Ca - Julian, Raymund M.Document2 pagesAlmeda v. Ca - Julian, Raymund M.Deanne ViNo ratings yet

- Comelec 2025 Aes TorDocument70 pagesComelec 2025 Aes TorEmir MendozaNo ratings yet

- Labay vs. Sandiganbayan DigestDocument4 pagesLabay vs. Sandiganbayan DigestEmir Mendoza100% (2)

- Office of The Court Administrator vs. Alaras DigestDocument3 pagesOffice of The Court Administrator vs. Alaras DigestEmir MendozaNo ratings yet

- Juego-Sakai vs. Republic DigestDocument2 pagesJuego-Sakai vs. Republic DigestEmir Mendoza100% (3)

- People vs. Ubungen DigestDocument3 pagesPeople vs. Ubungen DigestEmir MendozaNo ratings yet

- Montejo vs. Commission On Audit DigestDocument2 pagesMontejo vs. Commission On Audit DigestEmir MendozaNo ratings yet

- People vs. San Jose DigestDocument7 pagesPeople vs. San Jose DigestEmir Mendoza100% (1)

- People vs. Rojas DigestDocument3 pagesPeople vs. Rojas DigestEmir MendozaNo ratings yet

- Pacho vs. Judge Lu DigestDocument3 pagesPacho vs. Judge Lu DigestEmir MendozaNo ratings yet

- People vs. Olarbe DigestDocument4 pagesPeople vs. Olarbe DigestEmir Mendoza100% (5)

- People vs. Salga DigestDocument5 pagesPeople vs. Salga DigestEmir Mendoza100% (2)

- People vs. Gajila DigestDocument3 pagesPeople vs. Gajila DigestEmir MendozaNo ratings yet

- Philippine Health Insurance Corporation vs. Commission On Audit (July 2018) DigestDocument3 pagesPhilippine Health Insurance Corporation vs. Commission On Audit (July 2018) DigestEmir MendozaNo ratings yet

- Department of Transportation vs. Philippine Petroleum Sea Transport Association DigestDocument8 pagesDepartment of Transportation vs. Philippine Petroleum Sea Transport Association DigestEmir Mendoza100% (1)

- Heirs of Arce vs. Department of Agrarian Reform DigestDocument3 pagesHeirs of Arce vs. Department of Agrarian Reform DigestEmir MendozaNo ratings yet

- Anonymous vs. Judge Buyucan DigestDocument4 pagesAnonymous vs. Judge Buyucan DigestEmir MendozaNo ratings yet

- Department of Education vs. Dela Torre DigestDocument2 pagesDepartment of Education vs. Dela Torre DigestEmir Mendoza100% (2)

- Revilla vs. Sandiganbayan DigestDocument7 pagesRevilla vs. Sandiganbayan DigestEmir Mendoza50% (2)

- Ramos vs. People DigestDocument2 pagesRamos vs. People DigestEmir Mendoza100% (1)

- Land Bank vs. Prado Verde Corporation DigestDocument3 pagesLand Bank vs. Prado Verde Corporation DigestEmir MendozaNo ratings yet

- Radiowealth Finance Company, Inc. vs. Pineda, JR PDFDocument7 pagesRadiowealth Finance Company, Inc. vs. Pineda, JR PDFEmir MendozaNo ratings yet

- Republic vs. Decena DigestDocument3 pagesRepublic vs. Decena DigestEmir MendozaNo ratings yet

- Bangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestDocument3 pagesBangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestEmir Mendoza100% (3)

- People vs. de Vera DigestDocument4 pagesPeople vs. de Vera DigestEmir MendozaNo ratings yet

- People vs. Balubal DigestDocument3 pagesPeople vs. Balubal DigestEmir MendozaNo ratings yet

- Philippine Assisted Reproductive Technologies Act (Proposed Version by Emir Mendoza)Document5 pagesPhilippine Assisted Reproductive Technologies Act (Proposed Version by Emir Mendoza)Emir MendozaNo ratings yet

- Radiowealth Finance Company, Inc. vs. Pineda, Jr. DigestDocument2 pagesRadiowealth Finance Company, Inc. vs. Pineda, Jr. DigestEmir Mendoza100% (2)

- Moreno vs. Kahn DigestDocument2 pagesMoreno vs. Kahn DigestEmir Mendoza100% (3)

- Masbate vs. Relucio DigestDocument3 pagesMasbate vs. Relucio DigestEmir Mendoza100% (5)

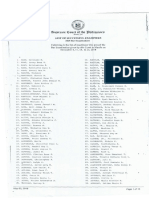

- Bar 2018 ResultsDocument15 pagesBar 2018 ResultsEmir MendozaNo ratings yet

- Phys101 CS Mid Sem 16 - 17Document1 pagePhys101 CS Mid Sem 16 - 17Nicole EchezonaNo ratings yet

- Fernandez ArmestoDocument10 pagesFernandez Armestosrodriguezlorenzo3288No ratings yet

- Top Malls in Chennai CityDocument8 pagesTop Malls in Chennai CityNavin ChandarNo ratings yet

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDocument4 pagesMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldeNo ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- GATE ECE 2006 Actual PaperDocument33 pagesGATE ECE 2006 Actual Paperkibrom atsbhaNo ratings yet

- Chennai Metro Rail BoQ for Tunnel WorksDocument6 pagesChennai Metro Rail BoQ for Tunnel WorksDEBASIS BARMANNo ratings yet

- Android software download guideDocument60 pagesAndroid software download guideRizky PradaniNo ratings yet

- IoT BASED HEALTH MONITORING SYSTEMDocument18 pagesIoT BASED HEALTH MONITORING SYSTEMArunkumar Kuti100% (2)

- Rubber Chemical Resistance Chart V001MAR17Document27 pagesRubber Chemical Resistance Chart V001MAR17Deepak patilNo ratings yet

- TWP10Document100 pagesTWP10ed9481No ratings yet

- Contact and Profile of Anam ShahidDocument1 pageContact and Profile of Anam ShahidSchengen Travel & TourismNo ratings yet

- SD8B 3 Part3Document159 pagesSD8B 3 Part3dan1_sbNo ratings yet

- Guidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016Document76 pagesGuidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016kofafa100% (1)

- Unit 1 TQM NotesDocument26 pagesUnit 1 TQM NotesHarishNo ratings yet

- Pub - Essentials of Nuclear Medicine Imaging 5th Edition PDFDocument584 pagesPub - Essentials of Nuclear Medicine Imaging 5th Edition PDFNick Lariccia100% (1)

- Kami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Document3 pagesKami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Anna HattenNo ratings yet

- DELcraFT Works CleanEra ProjectDocument31 pagesDELcraFT Works CleanEra Projectenrico_britaiNo ratings yet

- International Certificate in WealthDocument388 pagesInternational Certificate in Wealthabhishek210585100% (2)

- ITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFDocument280 pagesITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFMohamed AliNo ratings yet

- Log File Records Startup Sequence and Rendering CallsDocument334 pagesLog File Records Startup Sequence and Rendering CallsKossay BelkhammarNo ratings yet

- Obstetrical Hemorrhage: Reynold John D. ValenciaDocument82 pagesObstetrical Hemorrhage: Reynold John D. ValenciaReynold John ValenciaNo ratings yet

- Sarvali On DigbalaDocument14 pagesSarvali On DigbalapiyushNo ratings yet

- Sharp Ar5731 BrochureDocument4 pagesSharp Ar5731 Brochureanakraja11No ratings yet

- Difference Between Text and Discourse: The Agent FactorDocument4 pagesDifference Between Text and Discourse: The Agent FactorBenjamin Paner100% (1)

- QueriesDocument50 pagesQueriesBajji RajinishNo ratings yet

- Family Service and Progress Record: Daughter SeptemberDocument29 pagesFamily Service and Progress Record: Daughter SeptemberKathleen Kae Carmona TanNo ratings yet

- Passenger E-Ticket: Booking DetailsDocument1 pagePassenger E-Ticket: Booking Detailsvarun.agarwalNo ratings yet

- ABP - IO Implementing - Domain - Driven - DesignDocument109 pagesABP - IO Implementing - Domain - Driven - DesignddoruNo ratings yet

- Analytical Approach To Estimate Feeder AccommodatiDocument16 pagesAnalytical Approach To Estimate Feeder AccommodatiCleberton ReizNo ratings yet