Professional Documents

Culture Documents

Fundamentals OF Accounting: Common Proficiency Test

Uploaded by

Arvind RamanujanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals OF Accounting: Common Proficiency Test

Uploaded by

Arvind RamanujanCopyright:

Available Formats

COMMON PROFICIENCY TEST

FUNDAMENTALS

OF

ACCOUNTING

The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

The objective of the study material is to provide teaching material to the students to enable them to obtain

knowledge and skills in the subject. In case students need any clarifications or have any suggestions to

make for further improvement of the material contained herein they may write to the Director of Studies.

All care has been taken to provide interpretations and discussions in a manner useful for the students.

However, the study material has not been specifically discussed by the Council of the Institute or any of

its Committees and the views expressed herein may not be taken to necessarily represent the views of the

Council or any of its Committees.

Permission of the Institute is essential for reproduction of any portion of this material.

© The Institute of Chartered Accountants of India

All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted,

in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise, without

prior permission, in writing, from the publisher.

Price : ` 300.00

Revised Edition – November, 2014

Updated Edition – April, 2017

Website : www.icai.org E-mail : bosnoida@icai.in

ISBN : 978-81-8441-033-4

Published by The Publication Department on behalf of The Institute of Chartered Accountants of

India, ICAI Bhawan, Post Box No. 7100, Indraprastha Marg, New Delhi - 110 002, India.

Printed by: Repro India Ltd., Mumbai

April/ 2017 / P2095 (Updated)

© The Institute of Chartered Accountants of India

PREFACE

The paper on Fundamentals of Accounting at CPT Level develops conceptual understanding of fundamentals

of accounting. This Study Material endeavouring towards accounting education, is committed to provide a

framework for understanding accounting discipline and describing the fundamental accounting concepts

and conventions of the basic accounting system. An attempt has been made to provide a solid foundation

on which students can successfully build and enhance their studies.

The book is divided into nine chapters, each addressing to a special aspect of accounting. Chapters 1 to 5

lay emphasis on bookkeeping aspect of accounting whereas chapter 6 deals with preparation of financial

statements of sole proprietors. Chapter 7 covers accounting for special transactions like consignment,

joint ventures, bills of exchange and sale of goods on approval basis which can be entered into by different

forms of business entities viz., sole proprietary concerns, partnership firms or companies. Chapter 8

discusses accounting of partnership firms and chapter 9 explains basic concepts of company accounts.

Learning objectives have been incorporated at the beginning of each chapter/unit to guide students as to

the knowledge they should acquire after studying the chapters. Small illustrations have been incorporated

in each chapter/unit to explain the concepts/principles dealt with in the chapter/unit. Lot of multiple

choice questions have been provided at the end of each chapter/unit which will help students in appearing

Common Proficiency Test Examination. These features would add value to the Study Material and aid the

students in the learning process.

In this revised study material, sincere efforts and care has been taken to incorporate the relevant

Section of the Companies Act 2013, to the extent relevant for the students at CPT level. Care has

also been taken in revising and improving the other chapters. Certain explanations have been added

wherever felt required. In case you need any further clarification/guidance, please send your queries at

seema@icai.in, shilpa@icai.in or asha.verma@icai.in.

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

SYLLABUS

Fundamentals of Accounting (60 Marks)

Objective :

To develop conceptual understanding of the fundamentals of financial accounting system.

Contents

1. Theoretical Framework

(i) Meaning and Scope of Accounting

(ii) Accounting Concepts, Principles and Conventions

(iii) Accounting Standards – concepts, objectives, benefits

(iv) Accounting Policies

(v) Accounting as a measurement discipline – valuation principles, accounting estimates

2. Accounting Process

Books of Accounts leading to the preparation of Trial Balance, Capital and revenue expenditures,

Capital and revenue receipts, Contingent assets and contingent liabilities, Fundamental errors

including rectifications thereof.

3. Bank Reconciliation Statement

4. Inventories

Basis of inventory valuation and record keeping.

5. Depreciation accounting

Methods, computation and accounting treatment of depreciation, Change in depreciation

methods.

6. Preparation of Final Accounts for Sole Proprietors

7. Accounting for Special Transactions

(a) Consignments

(b) Joint Ventures

(c) Bills of exchange and promissory notes

(d) Sale of goods on approval or return basis.

8. Partnership Accounts

Final accounts of partnership firms – Basic concepts of admission, retirement and death of a

partner including treatment of goodwill.

9. Introduction to Company Accounts

Issue of shares and debentures, forfeiture of shares, re-issue of forfeited shares, redemption of

preference shares.

© The Institute of Chartered Accountants of India

CONTENTS

Chapter 1 - Accounting : An Introduction

Unit 1 : Meaning and Scope of Accounting

1. Introduction 1.2

2. Meaning of Accounting 1.4

2.1 Procedural Aspects of Accounting 1.5

3. Evolution of Accounting as a Social Science 1.8

4. Objectives of Accounting 1.9

5. Functions of Accounting 1.10

6. Book-keeping 1.10

6.1 Objectives of Book-keeping 1.11

7. Distinction between Book-keeping and Accounting 1.11

8. Sub-fields of Accounting 1.13

9. Users of Accounting Information 1.13

10. Relationship of Accounting with Other Disciplines 1.14

11. Limitations of Accounting 1.18

12. Role of Accountant in the Society 1.19

12.1 Areas of Service 1.19

12.2 Chartered Accountant in Industry 1.22

12.3 Chartered Accountant in Public Sector Enterprises 1.22

12.4 Chartered Accountant in Framing Fiscal Policies 1.22

12.5 Chartered Accountant and Economic Growth 1.22

Unit 2 : Accounting Concepts, Principles and Conventions

1. Introduction 1.26

2. Accounting Concepts 1.27

3. Accounting Principles 1.27

4. Accounting Conventions 1.27

5. Concepts, Principles and Conventions - an Overview 1.27

6. Fundamental Accounting Assumptions 1.39

7. Financial Statements 1.39

7.1 Qualitative Characteristics of Financial Statements 1.39

Unit 3 : Accounting Standards – Concepts, Objectives, Benefits

1. Introduction 1.48

2. Concepts 1.48

3. Objectives 1.49

4. Benefits and Limitations 1.49

5. Overview of Accounting Standards in India 1.49

Unit 4 : Accounting Policies

1. Meaning 1.61

2. Selection of Accounting Policies 1.61

3. Change in Accounting Policies 1.62

© The Institute of Chartered Accountants of India

CONTENTS

Unit 5 : Accounting as a Measurement Discipline - Valuation Principles, Accounting Estimates

1. Meaning of Measurement 1.66

2. Objects or Events to be Measured 1.67

3. Standard or Scale of Measurement 1.67

4. Dimension of Measurement Scale 1.68

5. Accounting as a Measurement Discipline 1.68

6. Valuation Principles 1.69

7. Measurement and Valuation 1.72

8. Accounting Estimates 1.73

Chapter 2 - Accounting Process

Unit 1 : Basic Accounting Procedures - Journal Entries

1. Double Entry System 2.4

2. Advantages of Double Entry System 2.4

3. Account 2.4

4. Debit and Credit 2.5

5. Transactions 2.8

6. Accounting Equation Approach 2.9

7. Traditional Approach 2.13

7.1 Classification of Accounts 2.13

7.2 Golden Rules of Accounting 2.14

8. Journal 2.14

8.1 Journalising Process 2.14

8.2 Points to be taken into care while recording a transaction in the Journal 2.15

9. Advantages of Journal 2.27

Unit 2 : Ledgers

1. Introduction 2.30

2. Specimen of Ledger Accounts 2.30

3. Posting 2.30

3.1 Rules regarding posting of entries in the Ledger 2.30

4. Balancing an Account 2.31

Unit 3 : Trial Balance

1. Introduction 2.38

2. Objectives of preparing the Trial Balance 2.38

3. Limitations of Trial Balance 2.39

4. Methods of preparation of Trial Balance 2.39

5. Adjusted Trial Balance (Through Suspense Account) 2.44

6. Rules of preparing the Trial Balance 2.44

Unit 4 : Subsidiary Books

1. Subsidiary Books and their advantages 2.50

2. Distinction between Subsidiary Books and Primary Books 2.51

3. Purchases Book 2.52

3.1 Posting the Purchases Book 2.55

© The Institute of Chartered Accountants of India

CONTENTS

4. Sales Book 2.55

4.1 Posting the Sales Book 2.56

4.2 Sales Book with Sales Tax column 2.57

5. Sales Returns Book or Returns Inward Book 2.60

6. Purchase Returns or Returns Outward Book 2.61

6.1 Posting of the Return Books 2.61

6.2 Bills Receivable Books and Bills Payable Books 2.62

7. Importance of Journal 2.62

Unit 5 : Cash Book

1. Cash Book - A Subsidiary Book and A Principal Book 2.68

2. Kinds of Cash Book 2.68

2.1 Simple Cash Book 2.68

2.2 Double-column Cash Book 2.70

2.3 Three-column Cash Book 2.71

3. Posting the Cash Book entries 2.75

4. Petty Cash Book 2.75

4.1 Imprest System of Petty Cash 2.76

4.2 Advantages of Petty Cash Book 2.80

4.3 Posting the Petty Cash Book 2.80

5. Entries for Sale through Credit/Debit Cards 2.81

5.1 Accounting for Credit/Debit Card Sale 2.82

Unit 6 : Capital and Revenue Expenditures and Receipts

1. Introduction 2.87

2. Considerations in determining Capital and Revenue Expenditures 2.88

3. Capital Expenditures and Revenue Expenditures 2.88

4. Deferred Revenue Expenditures 2.89

5. Capital Receipts and Revenue Receipts 2.91

Unit 7 : Contingent Assets and Contingent Liabilities

1. Contingent Assets 2.98

2. Contingent Liabilities 2.98

3. Distinction between Contingent Liabilities and Liabilities 2.99

4. Distinction between Contingent Liabilities and Provisions 2.99

Unit 8 : Rectification of Errors

1. Introduction 2.103

2. Stages of Errors 2.106

2.1 At the stage of Recording the Transactions in Journal 2.106

2.2 At the stage of Posting the Entries in Ledger 2.106

2.3 At the stage of Balancing the Ledger Accounts 2.106

2.4 At the stage of Preparing the Trial Balance 2.106

3. Types of Errors 2.107

4. Steps to locate Errors 2.109

© The Institute of Chartered Accountants of India

CONTENTS

5. Rectification of Errors 2.109

5.1 Before preparation of Trial Balance 2.110

5.2 After Trial Balance but before Final Accounts 2.115

5.3 Correction in the next Accounting period 2.133

Chapter 3 - Bank Reconciliation Statement

1. Introduction 3.2

2. Bank Pass Book 3.3

3. Bank Reconciliation Statement 3.3

4. Importance of Bank Reconciliation Statement 3.4

5. Ascertaining the causes of difference of Bank Balance in bank

column of the Cash-Book and in Pass-Book 3.4

5.1 Timing differences 3.4

5.2 Differences arising due to Errors in Recording the Entries 3.7

6. Procedure for reconciling the Cash-Book balance with the Pass-Book balance 3.9

7. Methods of Bank Reconciliation 3.10

7.1 Bank Reconciliation Statement without Preparation of Adjusted

Cash-book 3.10

7.2 Bank Reconciliation Statement after the Preparation of Adjusted

Cash-book 3.14

Chapter 4 - Inventories

1. Meaning 4.2

2. Inventory Valuation 4.3

3. Basis of Inventory Valuation 4.4

4. Techniques of Inventory Valuation 4.5

4.1 Historical Cost Methods 4.6

4.2 Non-Historical Cost Methods 4.10

5. Inventory Record Systems 4.12

5.1 Periodic Inventory System 4.12

5.2 Perpetual Inventory System 4.12

5.3 Distinction between Periodic Inventory System and

Perpetual Inventory System 4.13

6. Inventories Taking 4.13

Chapter 5 - Depreciation Accounting

1. Introduction 5.2

1.1 Concept of Depreciation 5.2

1.2 Components Method of Depreciation 5.3

1.3 Objectives for Providing Depreciation 5.3

2. Factors in the Measurement of Depreciation 5.4

3. Methods for Providing Depreciation 5.6

© The Institute of Chartered Accountants of India

CONTENTS

3.1 Straight Line Method 5.6

3.2 Reducing Balance Method 5.6

3.3 Sum of Years of Digits Method 5.9

3.4 Annuity Method 5.10

3 5 Sinking Fund Method 5.12

3.6 Machine Hour Method 5.17

3.7 Production Units Method 5.18

3.8 Depletion Method 5.19

4. Profit or Loss on the Sale/Disposal of Property, Plant and Equipment 5.21

5. Change in the Method of Depreciation 5.22

6. Revision of the estimated useful life of Property, Plant and Equipment 5.24

7. Revaluation of Property, Plant and Equipment 5.25

8. Provision for Repairs and Renewals 5.26

Chapter 6 - Preparation of Final Accounts of Sole Proprietors

Unit 1 : Final Accounts of Non-Manufacturing Entities

1. Introduction 6.4

2. Preparation of Final Accounts 6.5

2.1 Inter-relationship of the two statements 6.6

2.2 Matching Principle 6.7

2.3 An exception 6.8

3. Trading Account 6.8

3.1 Trading Account Items 6.9

3.2 Closing entries in respect of Trading Account 6.11

4. Profit and Loss Account 6.14

4.1 Closing entries 6.16

4.2 Adjustments 6.19

5. Certain adjustments and their treatments 6.21

6. Balance Sheet 6.26

6.1 Characteristics 6.27

6.2 Arrangements of Assets and Liabilities 6.27

6.3 Classification of Assets and Liabilities 6.28

7. Sequence of Accounting procedure or the Accounting cycle 6.32

8 Opening Entry 6.32

8.1 Posting the Opening Entry 6.33

9. Provisions and Reserves 6.40

10. Limitations of Financial Statements 6.42

Unit 2 : Final Accounts of Manufacturing Entities

1. Introduction 6.45

2. Purpose 6.45

© The Institute of Chartered Accountants of India

CONTENTS

3. Manufacturing Costs 6.45

3.1 Direct Manufacturing Expenses 6.46

3.2 Indirect Manufacturing Expenses 6.46

3.3 By-Products 6.46

4. Design of a Manufacturing Account 6.47

Chapter 7 - Accounting for Special Transactions

Unit 1 : Consignment

1. Meaning of Consignment Account 7.2

2. Distinction between Consignment and Sale 7.3

3. Accounting for Consignment Transactions and Events in

the books of the Consignor 7.3

4. Valuation of Inventories 7.7

5. Goods Invoiced above Cost 7.7

6. Abnormal Loss 7.10

7. Normal Loss 7.11

8. Commission 7.11

8.1 Ordinary Commission 7.11

8.2 Del-credere Commission 7.11

8.3 Over-riding Commission 7.11

9. Return of Goods from the Consignee 7.11

10. Account Sales 7.12

11. Accounting Books of the Consignee 7.12

12. Advance by the Consignee vs security against the Consignment 7.13

Unit 2 : Joint Ventures

1. Meaning of Joint Venture 7.34

2. Features of Joint Venture 7.35

3. Distinction of Joint Venture with Partnership 7.35

4. Methods of maintaining Joint Venture Accounts 7.36

4.1 When separate set of books are maintained 7.37

4.2 When no separate set of books are maintained 7.40

Unit 3 : Bills of Exchange and Promissory Notes

1. Bills of Exchange 7.65

2. Promissory Notes 7.67

3. Record of Bills of Exchange and Promissory Notes 7.68

4. Term of a Bill 7.70

5. Expiry/Due date of a Bill 7.70

6. Days of Grace 7.70

7. Date of Maturity of Bill 7.70

8. Bill at Sight 7.70

9. Bill after Date 7.70

© The Institute of Chartered Accountants of India

CONTENTS

10. How to calculate due date of a bill 7.71

11. How to calculate date of maturity in case of time bills 7.71

12. Noting Charges 7.72

13. Renewal of Bill 7.72

14. Accommodation Bills 7.78

15. Insolvency 7.78

16. Bills of Collection 7.85

17. Retirement of Bills of Exchange 7.86

18. Bills Receivable and Bills Payable Books 7.87

Unit 4 : Sale of Goods on Approval or Return Basis

1. Introduction 7.97

2. Accounting Records 7.97

2.1 When the business sends goods casually on sales or return 7.98

2.2 When the business sends goods frequently on sale or return basis 7.104

2.3 When the business sends goods numerously on sale or return 7.106

Chapter 8 - Partnership Accounts

Unit 1 : Introduction to Partnership Accounts

1. Introduction 8.2

2. Definition and Features of Partnership 8.2

3. Limited Liability Partnership 8.3

4. Main Clauses in a Partnership Deed 8.3

5. Powers of Partners 8.4

6. Accounts 8.5

6.1 Profit and Loss Appropriation 8.5

6.2 Fixed and Fluctuating Capital 8.9

Unit 2 : Treatment of Goodwill in Partnership Accounts

1. Goodwill 8.24

2. Methods for Goodwill valuation 8.24

3. Need for Valuation of Goodwill 8.29

4. Valuation of Goodwill in case of admission of a Partner 8.29

5. Accounting treatment of Goodwill in case of admission of a new Partner 8.31

6. Accounting treatment of Goodwill in case of change in profit sharing ratio 8.36

7. Accounting treatment of Goodwill in case of retirement or death of a Partner 8.38

Unit 3 : Admission of a New Partner

1. Introduction 8.45

2. Revaluation Account or Profit and Loss Adjustment Account 8.45

3. Reserves in the Balance Sheet 8.53

4. Computation of new profit sharing ratio 8.56

5. Hidden Goodwill 8.61

© The Institute of Chartered Accountants of India

CONTENTS

Unit 4 : Retirement of a Partner

1. Introduction 8.68

2. Calculation of Gaining Ratio 8.68

3. Revaluation of Assets and Liabilities on retirement of a Partner 8.69

4. Reserve 8.70

5. Final payment to a Retiring Partner 8.71

6. Paying a Partner’s loan in instalment 8.86

7. Joint Life Policy 8.89

8. Separate Life Policy 8.94

Unit 5 : Death of Partner

1. Introduction 8.100

2. Special transactions in case of death : Joint Life Policy 8.100

3. Special transactions in case of death : Separate Life Policy 8.101

4. Special transactions in case of death : Payment of deceased Partner’s share 8.102

Chapter 9 - Company Accounts

Unit 1 : Introduction to Company Accounts

1. Introduction 9.2

2. Meaning of Company 9.2

3. Salient Features of a Company 9.3

4. Types of Companies 9.4

5. Maintenance of Books of Account 9.6

6. Preparation of Financial Statements 9.6

Unit 2 : Issue, Forfeiture and Reissue of Shares

1. Introduction 9.12

2. Share Capital 9.12

3. Types of Shares 9.14

4. Issue of Shares for Cash 9.16

4.1 Journal Entries for issue of shares for cash 9.17

5. Subscription of Shares 9.18

5.1 Full Subscription 9.18

5.2 Undersubscription 9.19

5.3 Oversubscription 9.21

6. Shares issued at Discount 9.25

7. Shares issued at Premium 9.25

7.1 Accounting Treatment 9.25

8. Oversubscription and Pro-rata Allotment 9.29

9. Calls-in-arrears and Calls-in-advance 9.32

10. Interest on Calls-in-arrears and Calls-in-advance 9.34

© The Institute of Chartered Accountants of India

CONTENTS

11. Forfeiture of Shares 9.36

11.1 Forfeiture of Shares which were issued at par 9.37

11.2 Forfeiture of Shares which were issued at a premium 9.38

11.3 Forfeiture of fully paid-up shares 9.39

12. Re-issue of Forfeited Shares 9.39

12.1 Points for Consideration 9.40

12.2 Calculation of profit on re-issue of forfeited shares 9.40

13. Issue of Shares for Consideration other than Cash 9.46

Unit 3 : Redemption of Preference Shares

1. Introduction 9.59

2. Purpose of issuing Redeemable Preference Shares 9.59

3. Provisions of the Companies Act (Section 55) 9.60

4. Methods of Redemption of fully paid-up shares 9.60

4.1 Redemption of Preference Shares by Fresh Issue of Shares 9.61

4.2 Redemption of Preference Shares by Capitalisation of

Undistributed Profits 9.70

4.3 Redemption of Preference Shares by combination of fresh issue

and Capitalisation of Undistributed Profits 9.72

4.4 Sale of Investments to provide sufficient funds for Redemption 9.78

5. Redemption of Partly Called-Up Preference Shares 9.78

6. Redemption of Fully Called but Partly Paid-Up Preference Shares 9.81

6.1 When Calls in Arrears is received by the Company 9.81

6.2 In case of Forfeited Shares 9.81

Unit 4 : Issue of Debentures

1. Introduction 9.86

2. Meaning 9.86

3. Features of Debentures 9.87

4. Distinction between Debentures and Shares 9.87

5. Types of Debentures 9.88

6. Issue of Debentures 9.90

6.1 Accounting entries for issue of Redeemable Debentures 9.90

6.2 Accounting for issue of Debentures payable in instalments 9.98

7. Issue of Debentures as collateral security 9.104

8. Issue of Debentures in consideration other than for cash 9.105

9. Treatment of discount/loss on issue of Debentures 9.107

10. Interest on Debentures 9.108

© The Institute of Chartered Accountants of India

You might also like

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- ICAI - Fundamentals of Account TextDocument737 pagesICAI - Fundamentals of Account TextSalmanAnjans100% (1)

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- 28899cpt Fa SM CP InipageDocument14 pages28899cpt Fa SM CP InipageDinesh Kumar0% (1)

- Chapter 1Document90 pagesChapter 1Ankit Deshmukh100% (1)

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- CA CPT Account Book IndexDocument14 pagesCA CPT Account Book IndexNishaPatel100% (2)

- Fundamentals of Accounting-I New Course OutlineDocument3 pagesFundamentals of Accounting-I New Course OutlineGedion100% (2)

- FAC1502 - Study Unit 1 - 2021Document26 pagesFAC1502 - Study Unit 1 - 2021Ndila mangalisoNo ratings yet

- Detailed SyllabusDocument4 pagesDetailed Syllabussundaram MishraNo ratings yet

- DMGT403 Accounting For Managers PDFDocument305 pagesDMGT403 Accounting For Managers PDFpooja100% (1)

- Financial Accounting: II SemesterDocument135 pagesFinancial Accounting: II SemesterASIFNo ratings yet

- Contemporary AccountingDocument176 pagesContemporary AccountingVishnu Prasanna100% (1)

- Session 1-OrientationDocument44 pagesSession 1-OrientationAnshita BansalNo ratings yet

- Accounting For Managers Dmgt403 - e - BookDocument304 pagesAccounting For Managers Dmgt403 - e - BookParul Khanna100% (1)

- Chapter 1 IntroductionDocument30 pagesChapter 1 IntroductionVivek GargNo ratings yet

- Financial AccountingDocument252 pagesFinancial AccountingSonia Dhar100% (1)

- Nptel: Managerial Accounting - Video CourseDocument3 pagesNptel: Managerial Accounting - Video CourseNajlaNo ratings yet

- Ic 46 Book General Insurance Accounts Preparation and Regulation of InvestmentDocument823 pagesIc 46 Book General Insurance Accounts Preparation and Regulation of InvestmentDr. S100% (1)

- Accounting StandardsDocument12 pagesAccounting StandardsShalini TiwariNo ratings yet

- NPTEL Managerial Accounting SyllabusDocument3 pagesNPTEL Managerial Accounting SyllabusNajlaNo ratings yet

- MA Slides Stu.Document169 pagesMA Slides Stu.Phương DungNo ratings yet

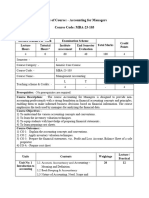

- MBA-23-103 Management AccountingDocument4 pagesMBA-23-103 Management Accountinggadekarganesh977No ratings yet

- Tlaw188l Financial-Accounting TH 1.0 0 Tlaw188lDocument2 pagesTlaw188l Financial-Accounting TH 1.0 0 Tlaw188lShreyaah TSNo ratings yet

- Financial AccountingDocument945 pagesFinancial Accountingtoton33100% (6)

- Unit 2 Accounting Concepts, Principles, Bases, and Policies: StructureDocument24 pagesUnit 2 Accounting Concepts, Principles, Bases, and Policies: StructureShekhar MandalNo ratings yet

- Fundamentals of Accounting and AuditingDocument458 pagesFundamentals of Accounting and Auditingrajeev sharma100% (1)

- Corporate Accounting (B.Com) P-1 PDFDocument131 pagesCorporate Accounting (B.Com) P-1 PDFRitish GargNo ratings yet

- Course Syllabus-Fundamentals of Accounting IDocument4 pagesCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- FMA - Non-Specific - MBA ZC415 COURSE HANDOUTDocument13 pagesFMA - Non-Specific - MBA ZC415 COURSE HANDOUTRavi KaviNo ratings yet

- A Report On THE STRUCTURE OF ACCOUNTING THEORYDocument19 pagesA Report On THE STRUCTURE OF ACCOUNTING THEORYMickeyMathewD'Costa100% (1)

- Financial Accounting Paper-5 InterDocument944 pagesFinancial Accounting Paper-5 InterShaikh Aftab100% (1)

- Financial Accts - PG1Document47 pagesFinancial Accts - PG1Abhishek SinghNo ratings yet

- Col For ModuleDocument26 pagesCol For ModuleIfaNo ratings yet

- Financial Accounting and Reporting 2021Document662 pagesFinancial Accounting and Reporting 2021pronab sarker100% (3)

- Accounting for Managers SyllabusDocument2 pagesAccounting for Managers SyllabusBibek BasnetNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee TubeNo ratings yet

- Accounting and Finance For ManagersDocument322 pagesAccounting and Finance For ManagersPrasanna Aravindan100% (5)

- Accounting Concepts and ConventionsDocument16 pagesAccounting Concepts and ConventionsGinni Mehta100% (2)

- Accounting II BBA 3rdDocument9 pagesAccounting II BBA 3rdTalha GillNo ratings yet

- Learning Outcomes No L01 L02 L03 L04 L05Document11 pagesLearning Outcomes No L01 L02 L03 L04 L05AbiNo ratings yet

- Financial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - IDocument126 pagesFinancial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - Isambhav jindal100% (1)

- MC-4 4Document186 pagesMC-4 4Mustafa Bohra100% (1)

- Foa 1Document402 pagesFoa 1mohammed33nNo ratings yet

- A Minor Project Report On Tally - ERP.9Document14 pagesA Minor Project Report On Tally - ERP.9Prabhat Kumar SinghNo ratings yet

- Fa Class Notes UplodedDocument252 pagesFa Class Notes UplodedDurvas Karmarkar100% (1)

- Ccounting Concepts and PrinciplesDocument33 pagesCcounting Concepts and PrinciplesAllen CarlNo ratings yet

- Accounting For Managers PPT 3Document206 pagesAccounting For Managers PPT 3AbdiNo ratings yet

- BITS Pilani Financial Management Accounting CourseDocument11 pagesBITS Pilani Financial Management Accounting CoursevigneshNo ratings yet

- UNIZIM ACCN Business Accounting Course OutlineDocument7 pagesUNIZIM ACCN Business Accounting Course OutlineEverjoice Chatora100% (1)

- Mba Course HandoutDocument11 pagesMba Course HandoutSajid RehmanNo ratings yet

- Financial Accounting For ICWADocument944 pagesFinancial Accounting For ICWAAmit Kumar100% (2)

- Fundamentals of Accounting IDocument5 pagesFundamentals of Accounting Itarekegn gezahegn0% (1)

- Basic Accounting Concepts ChapterDocument21 pagesBasic Accounting Concepts ChapterBikas AdhikariNo ratings yet

- Accounting in Action: Accounting Principles, Ninth EditionDocument43 pagesAccounting in Action: Accounting Principles, Ninth EditionMuhammad TausiqueNo ratings yet

- Accounting For ManagersDocument82 pagesAccounting For Managersrahul jambagiNo ratings yet

- 7903 Eacc105 Financial AccountingDocument216 pages7903 Eacc105 Financial Accountingshivamarora03082005No ratings yet

- Accounting StandardsDocument7 pagesAccounting StandardsPoojaNo ratings yet

- Answers: Test Series: March, 2018 Foundation Course Mock Test Paper Paper - 4 Part Ii: Business and Commercial KnowledgeDocument1 pageAnswers: Test Series: March, 2018 Foundation Course Mock Test Paper Paper - 4 Part Ii: Business and Commercial KnowledgeArvind RamanujanNo ratings yet

- Soga PDFDocument50 pagesSoga PDFPooja MeenaNo ratings yet

- Conference Research Methodology 17april2020 BrouDocument4 pagesConference Research Methodology 17april2020 BrouArvind RamanujanNo ratings yet

- Pa 4 Economics AnswersDocument1 pagePa 4 Economics AnswersArvind RamanujanNo ratings yet

- Economic Reforms in IndiaDocument35 pagesEconomic Reforms in Indiaashish692No ratings yet

- Mambalam Times PDF Full FreeDocument8 pagesMambalam Times PDF Full FreeArvind RamanujanNo ratings yet

- CA Foundation-Registration PDFDocument2 pagesCA Foundation-Registration PDFArvind RamanujanNo ratings yet

- 45570bos35676 FoundationDocument16 pages45570bos35676 FoundationSIVA KUMARNo ratings yet

- Mylapore Times Real Estate ClassifiedsDocument4 pagesMylapore Times Real Estate ClassifiedsArvind RamanujanNo ratings yet

- Fundamentals OF Accounting: Common Proficiency TestDocument14 pagesFundamentals OF Accounting: Common Proficiency TestArvind RamanujanNo ratings yet

- Chapter - 6: © The Institute of Chartered Accountants of IndiaDocument56 pagesChapter - 6: © The Institute of Chartered Accountants of IndiaArvind RamanujanNo ratings yet

- Chapter - 2: © The Institute of Chartered Accountants of IndiaDocument144 pagesChapter - 2: © The Institute of Chartered Accountants of Indiadipak sahNo ratings yet

- Basic Concept of Economics and Introduction To Micro Economics PDFDocument35 pagesBasic Concept of Economics and Introduction To Micro Economics PDFashish69250% (2)

- Chapter - 6: Select Aspects of Indian EconomyDocument77 pagesChapter - 6: Select Aspects of Indian EconomyArvind RamanujanNo ratings yet

- Chapter - 4: Unit 1 Meaning and Types of MarketsDocument58 pagesChapter - 4: Unit 1 Meaning and Types of Marketsharsha143saiNo ratings yet

- Theory of Production and Cost: Chapter - 3Document50 pagesTheory of Production and Cost: Chapter - 3Arvind RamanujanNo ratings yet

- 28890cpt Fa SM Cp1 Part1Document76 pages28890cpt Fa SM Cp1 Part1Lenin KumarNo ratings yet

- 28895cpt Fa SM cp3Document28 pages28895cpt Fa SM cp3Lenin KumarNo ratings yet

- Revised SnakeCube PDFDocument15 pagesRevised SnakeCube PDFArvind RamanujanNo ratings yet

- Ybn Fee 2019 2020Document5 pagesYbn Fee 2019 2020SDPMIT SHUBH DIAGNOSTICSNo ratings yet

- Cleansheet Target CostingDocument4 pagesCleansheet Target CostingrindergalNo ratings yet

- Emerson Electric Financial Statement AnalysisDocument6 pagesEmerson Electric Financial Statement Analysismwillar08No ratings yet

- Understanding Hotel Valuation TechniquesDocument0 pagesUnderstanding Hotel Valuation TechniquesJamil FakhriNo ratings yet

- Case 1 Is Coca-Cola A Perfect Business PDFDocument2 pagesCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- Case StudyDocument7 pagesCase StudynarenderNo ratings yet

- A Literature Review OF Diversity Management Research &theoriesDocument16 pagesA Literature Review OF Diversity Management Research &theoriessammi112233No ratings yet

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- BBA Syllabus - 1Document39 pagesBBA Syllabus - 1Gaurav SaurabhNo ratings yet

- Transfer Pricing of Tivo and Airbag Division: RequiredDocument7 pagesTransfer Pricing of Tivo and Airbag Division: RequiredajithsubramanianNo ratings yet

- Purpose of Research (Purpose)Document8 pagesPurpose of Research (Purpose)Ayushi ChoumalNo ratings yet

- Flavia CymbalistaDocument3 pagesFlavia Cymbalistadodona7772494No ratings yet

- Lgu Naguilian HousingDocument13 pagesLgu Naguilian HousingLhyenmar HipolNo ratings yet

- LA Chief Procurement OfficerDocument3 pagesLA Chief Procurement OfficerJason ShuehNo ratings yet

- HAZOP ReportDocument27 pagesHAZOP ReportMuhammad.Saim100% (3)

- 25 Phrases That Pay - Sales Strategy and CommunicationDocument9 pages25 Phrases That Pay - Sales Strategy and CommunicationRJNo ratings yet

- Sunco QuestionDocument10 pagesSunco QuestionVarun HknzNo ratings yet

- Simple Service InvoiceDocument2 pagesSimple Service InvoiceFaisalNo ratings yet

- Fundamental RulesDocument18 pagesFundamental RulesrakeshNo ratings yet

- 35kv To 550kv Switchgear - (Tong Guan)Document10 pages35kv To 550kv Switchgear - (Tong Guan)benwkg0% (1)

- Engleza in AfaceriDocument293 pagesEngleza in Afacerililiana lilianaNo ratings yet

- Operations and Supply Chain Management B PDFDocument15 pagesOperations and Supply Chain Management B PDFAnonymous sMqylHNo ratings yet

- Part 5Document2 pagesPart 5PRETTYKO0% (1)

- CV of Faysal AhamedDocument2 pagesCV of Faysal AhamedSyed ComputerNo ratings yet

- Tensor Catalogue USA PDFDocument72 pagesTensor Catalogue USA PDFdavev2005No ratings yet

- COHR321 Module Guide S2 2019Document14 pagesCOHR321 Module Guide S2 2019Tsakane SibuyiNo ratings yet

- Sime Darby R&D Advances Oil Palm GenomeDocument4 pagesSime Darby R&D Advances Oil Palm GenomeAhmad Zubair Hj YahayaNo ratings yet

- FM11 CH 10 Capital BudgetingDocument56 pagesFM11 CH 10 Capital Budgetingm.idrisNo ratings yet

- Stanford Antigua ComplaintDocument74 pagesStanford Antigua ComplaintFOXBusiness.com100% (2)

- MC DonaldDocument3 pagesMC DonaldRahulanandsharmaNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingFrom EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingRating: 5 out of 5 stars5/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNo ratings yet

- Accounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesFrom EverandAccounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesRating: 5 out of 5 stars5/5 (4)

- Accounting Policies and Procedures Manual: A Blueprint for Running an Effective and Efficient DepartmentFrom EverandAccounting Policies and Procedures Manual: A Blueprint for Running an Effective and Efficient DepartmentNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)