Professional Documents

Culture Documents

Welcome To Bollinger Bands Squeeze PDF

Uploaded by

RenatoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Welcome To Bollinger Bands Squeeze PDF

Uploaded by

RenatoCopyright:

Available Formats

Welcome to the Bollinger Bands® Squeeze Package for TradeStation.

Without a doubt the Squeeze is the most talked about of all the Bollinger Band strategies and this

TradeStation Package is your key to the Bollinger Band Squeeze.

First, some background: a Squeeze is a periodic low in BandWidth and a Bulge is a periodic peak in

BandWidth. A Squeeze is potentially an indication of the start of a trend and a Bulge is an indication that a

trend may be ending. A Squeeze or a Bulge is not by itself a signal; there are times when they can persist

for a long time. Price action and the action of indicators like %b and Intraday Intensity are the ultimate

arbiters of what to do.

A Squeeze is a tightening of the Bollinger Bands. Squeezes are the birthplace of new trends and can help

forecast periods of increased volatility. However, without the right combination of tools, locating and

trading the Squeeze can be difficult. This Bollinger Band Squeeze indicator package is the key to getting

the most out of this powerful trading set up.

The Charting tools in this Bollinger Band Squeeze package are:

Bollinger Bands: which define high and low on a relative basis

%B: which tells us where we are in relation to the bands

BandWidth: which tells us how wide the bands are

Squeeze/Bulge: which is used to identify the beginnings and ends of trends

Squeeze Breakout: which is used to find opportunities in the wake of a Squeeze

BackIn: which is used to identify Head Fakes and other potential reversals

Intraday Intensity %: which is used to gauge supply and demand

Finally there is a scan for on-demand searching of lists of tickers for trading opportunities, and a

RadarScreen for monitoring watch lists in real time.

The RadarScreen tool in this Bollinger Band Squeeze package is:

Bollinger Bands Squeeze: finds trading opportunities on a watch list of symbols

These tools can be applied in most markets; stocks, futures and forex are popular target markets. They can

also be applied in many time frames, from intraday to long term. The qualifier is that there be enough data

in each bar to get a good picture of the price-formation mechanism at work. For big, liquid ETFs like

SPY, or highly liquid futures like the e-mini, minute bars are no problem, but for an illiquid stock daily

bars might be the downward limit.

A lot of time, work and experience have gone into developing this package. I think that you will find it to

be very useful in your day to day trading operations. If you have questions about what these tools are,

how to use them or the ideas behind them please see the documentation for the individual tools or feel

free to drop us a line at BBands@BollingerBands.com. If you need help with the TradeStation platform,

their excellent customer support is available at: 800.822.0512

Good trading,

John Bollinger

www.BollingerBands.com

© Copyright 2017 Bollinger Capital, All Rights Reserved

Bollinger Band Squeeze Package Disclosure Statement

This product is not a recommendation to buy or sell, but rather a guideline to interpreting the specified

analysis methods. The information provided should only be used by investors who are aware of the risks

inherent in securities trading. TradeStation, John Bollinger or Bollinger Capital Management accept no

liability whatsoever for any loss arising from any use of this product or its contents.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future

performance or success. There is a possibility that you may sustain a loss equal to or greater than your

entire investment regardless of which asset class you trade (equities, options futures or forex); therefore,

you should not invest or risk money that you cannot afford to lose.

If you plan to use margin, please read about the risks of margin:

http://www.finra.org/Investors/SmartInvesting/AdvancedInvesting/MarginInformation/P005927

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ Bollinger Bands® (Charting Indicator)

‘Bollinger Bands’ are volatility-driven trading bands that define whether price is high or low on a relative

basis. There are three Bollinger Bands, upper, middle and lower, with the middle band serving as the base

for the upper and lower bands. The middle band is colored to reflect the direction of the trend, green when

the trend is up and red when it is down. The upper band is traditionally colored red and the lower green.

By definition price is high at the upper band and low at the lower band. The information derived from the

bands can be used in developing trading approaches, pattern recognition, identifying over bought and over

sold levels, tracking trades, anticipating moves and more...

To identify a ‘Squeeze’ we look for period in which the Bollinger Bands are very close together, which is

often a precursor of important moves in security prices.

By analyzing price action in relation to the Bollinger Bands and employing the other indicators in this

package, you will be able to identify and manage opportunities as they arise. The indicator

‘SqueezeBulge’ will highlight the Squeeze and Bulge conditions.

The default parameters for Bollinger Bands are a calculation period of 20 bars and a width of plus/minus

2 standard deviations. These parameters work in most applications, but can be adjusted to suit your

trading style.

Parameters:

BB_Data: Close

BB_Length: 20

BB_Width: 2.0

BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ %b® (Charting Indicator)

‘%b’ tells us where we are in relation to the Bollinger Bands. While %b has many uses, for the Squeeze

there are two important ones. Its primary use is to help identify the potential breakout direction and then

to alert us to breakouts or breakdowns when they actually occur.

The %b formula is derived from the formula for Stochastics, with the values of the upper and lower

Bollinger Bands being substituted for Stochastics' periodic highs and lows.

%b equals 1.0 when the close of the bar is at the upper Bollinger Band and 0.0 when it is at the lower

band. Hence a breakout is indicated by a value for %b of greater than 1.0 or a breakdown with a value for

%b of less than 0.0.

%b is usually combined with BandWidth to identify opportunities in the wake of a Squeeze.

Parameters:

BB_Data: Close

BB_Length: 20

BB_Width: 2.0

BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ BandWidth® (Charting Indicator)

‘BandWidth’ tells us how wide the range of the Bollinger Bands are. BandWidth's most important use is

to identify the beginning and end of trends. BandWidth is the distance from the upper band to the lower

band divided by the middle band. For most securities BandWidth runs in the low single digits, but it can

get as high as fifty, with occasional readings outside of that range.

BandWidth and %B were the first two Bollinger Band indicators. Like the bands, their formulation has

not changed over the years.

Troughs in BandWidth are known as Squeezes and mark beginnings of trends; peaks in BandWidth are

known as Bulges and mark the end of trends. The problem with BandWidth is that it can be hard to

discern what is a peak and what is a trough. Is BandWidth high enough? Or low enough? Absolute levels

won't do as they vary from security to security and time to time. That means that we must adopt a relative

measure. Our solution is to define a Squeeze as a 125-period low in BandWidth and a Bulge as a 125-

period peak. Armed with those relative definitions we can successfully diagnose market conditions that

lead to the beginnings and ends of trends.

BandWidth is usually combined with %B to identify breakouts and breakdowns after Squeezes.

Parameters:

BB_Data: Close

BB_Length: 20

BB_Width: 2.0

BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

LookBack: 125

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ SqueezeBulge® (Charting Indicator)

The “SqueezeBulge’ indicator automates the identification of Squeezes and Bulges. When plotted as an

indicator SqueezeBulge is +1 for a Squeeze (Yellow Arrow) and -1 for a Bulge (Cyan Arrow). When

plotted with price, arrows above and below the Bollinger Bands highlight Squeezes and Bulges. We have

tested the SqueezeBulge look-back period and found it to be very robust, periods of 100 through 150 all

seem to produce similar results over time. The default lookback is 125 bars.

SqueezeBulge can be combined with BackIn to identify Head Fakes. SqueezeBulge is often paired with

Intraday Intensity to give a sense of potential directionality as the trade sets up.

Parameters:

BB_Data: Close

BB_Length: 20

BB_Width: 2.0

BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

Squeeze_Lookback: 125

RangePct: 95 {show Squeeze and Bulge when thet are close.}

ShowSqueeze: TRUE

Squeeze_Color: DarkGreen {for Charting SQUEEZE}

Squeeze_ArrowSize: 18 {for Charting SQUEEZE}

Squeeze_String: "SQUEEZE" {for SQUEEZE - RadarScreen and Scanner}

ShowBuldge: TRUE

Bulge_Color: DarkRed {for Charting BULGE }

Bulge_ArrowSize: 18 {for Charting BULGE }

Bulge_String: "BULGE" {for BULGE - RadarScreen and Scanner}

ArrowShiftATRs: 0.5 {for chart display }

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ SqueezeBreakout® (Charting Indicator)

‘SqueezeBreakout’ looks first for a Squeeze and then searches for a breakout or a breakdown within the

next five periods. SqueezeBreakout presents trading signals much in the same way that the old volatility

breakout systems tried to do, but rather than a simplistic stand-alone approach, Squeeze Breakout is part

of the BBTK Squeeze ecosystem and, as such, integrates with the other tools in the package to produce a

comprehensive trading approach. A SqueezeBreakout signal is generated when price closes above the

upper or below the lower Bollinger Band within five periods of a Squeeze.

SqueezeBreakout is often paired with Intraday Intensity to quantify accumulation / distribution as the

trade sets up and then develops. Many traders like to look for a downturn in BandWidth after a squeeze

expansion to signal the end of a trend. Often, that is coincident with a Bulge. Others like to use a trailing

stop like our Chandelier stops.

Parameters:

BB_Data: Close

BB_Length: 20

BB_Width: 2.0

BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

Squeeze_Lookback: 125

RangePct(95),

Signal_Window: 5

Up_Color: Green {For BUY signal}

Up_ArrowSize: 18 {For BUY signal, chart}

Up_String: "BUY" {For BUY signal, RadarScreen and Scanner}

Down_Color: Red {For SELLSHORT signal}

Down_ArrowSize: 18 {For SELLSHORT signal, chart}

© Copyright 2017 Bollinger Capital, All Rights Reserved

Down_String: "SELLSHORT" {For SELLSHORT signal, RadarScreen and Scanner}

PlotShiftATRs: 1.0 {for chart display}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ SqueezeBreakout® (RadarScreen Indicator)

Inputs Parameters: Same as the Charting Indicators

Note: Make sure the inputs for each indicator line up with the others so that the values match across all

windows.

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ BackIn® (Indicator)

‘BackIn’ is one of the simplest of the tools in this package, but it is the key to one of the most powerful

Squeeze trading setups, The Head Fake. BackIn indicates when a close outside the Bollinger Bands is

followed by a close inside the Bollinger Bands, +1 for in from below, -1 for in from above. It is most

significant immediately after a SqueezeBreakout. Smaller arrows are used to denote the Head Fake, with

red arrows showing selling opportunities and green arrow showing buying opportunities.

For many years traders have noticed that when Squeeze Breakouts fail they often lead to spectacular

moves in the opposite direction. This combination of a failed breakout and an emerging trend in the

opposite direction is known as a Head Fake. The term comes from sports where an attacker will tilt their

head in one direction to fake out the defender before making the real move in the opposite direction.

For Bollinger Band traders a Head Fake is signaled by a Squeeze Breakout and then an immediate

BackIn. High volume and large ranges are strong confirmation indicators.

Parameters:

BB_Data: Close

BB_Length:20

BB_Width: 2.0

BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

Up_Color: Green {for Back-In from below}

Up_ArrowSize: 12 {for Back-In from below, Chart}

Up_String: "UP" {for Back-In from below, RadarScreen and Scanner}

Down_Color: Red {for Back-In from above}

Down_ArrowSize: 12 {for Back-In from above, Chart}

Down_String: "DOWN" {for Back-In from above, RadarScreen and Scanner}

© Copyright 2017 Bollinger Capital, All Rights Reserved

PlotShiftATRs: 0.5 {for chart display}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ Intraday Intensity % (Indicator)

‘Intraday Intensity %’ is a volume indicator that was developed by David Bostian. It is the best technical

gauge of accumulation distribution that I know of. Intraday Intensity is designed to track the action of

large institutional investors, going negative as they sell and positive as they buy.

Intraday Intensity was originally designed for daily bars, but we have found it useful in shorter time

frames as well. The key is that there must be enough activity in each bar to transmit a clear picture of the

price formation mechanism in action.

The formula parses the location of the close in the period's range to partition volume into positive and

negative components. We give you two versions of Intraday Intensity, an unbounded line and an

oscillator. The choice is mostly a matter of taste and is entirely up to you. The information is the same, but

the presentation is different. The line is generally plotted in the same clip as price, while the oscillator is

usually plotted in its own clip. I'd suggest plotting the line in the same clip with price as an initial choice

for Squeeze trading. For buy/sell decisions using Bollinger Bands the oscillator is generally favored.

Parameters:

Length: 21

Up_Color: Green

Down_Color: Red

© Copyright 2017 Bollinger Capital, All Rights Reserved

You might also like

- Using Bollinger Band® - Bands - To Gauge TrendsDocument3 pagesUsing Bollinger Band® - Bands - To Gauge TrendsfredsvNo ratings yet

- 22 Bollinger Band RulesDocument4 pages22 Bollinger Band Rulesravee100% (2)

- Financial SwitchwordsDocument97 pagesFinancial SwitchwordspreshantNo ratings yet

- Bollinger Bands RulesDocument2 pagesBollinger Bands RulesBalajii RangarajuNo ratings yet

- Using Bollinger Bands To Gauge Trends - InvestopediaDocument9 pagesUsing Bollinger Bands To Gauge Trends - InvestopediarajritesNo ratings yet

- Best Indicators To Use in Conjunction With Bollinger BandsDocument4 pagesBest Indicators To Use in Conjunction With Bollinger BandsMubashirNo ratings yet

- Bollinger BandsDocument10 pagesBollinger Bandsarvindk.online6095No ratings yet

- Bollinger BandsDocument34 pagesBollinger BandsKiran Kudtarkar50% (2)

- Bollinger Bands RulesDocument2 pagesBollinger Bands RulesHandisaputra LinNo ratings yet

- Microsoft Word - Bollinger Bands TutorialDocument13 pagesMicrosoft Word - Bollinger Bands Tutorialadoniscal100% (1)

- Bollinger BandsDocument9 pagesBollinger BandsRavinderNo ratings yet

- CollectionDocument4 pagesCollectionAhuja AbhishekNo ratings yet

- Bollinger Band® Definition: Standard Deviations Simple Moving AverageDocument3 pagesBollinger Band® Definition: Standard Deviations Simple Moving AverageSandeep MishraNo ratings yet

- Bollinger Bands Trading Strategies That Work PDFDocument39 pagesBollinger Bands Trading Strategies That Work PDFTonino81% (26)

- Bollinger Bands Explained - Best Settings & Strategy TestedDocument25 pagesBollinger Bands Explained - Best Settings & Strategy TestedOPTIONS TRADING20No ratings yet

- Insilico BBPCT Rough DraftDocument3 pagesInsilico BBPCT Rough DraftIllia LinovNo ratings yet

- MACD Explained: What is the Moving Average Convergence Divergence IndicatorDocument11 pagesMACD Explained: What is the Moving Average Convergence Divergence IndicatorJose JohnNo ratings yet

- Moving Linear Regression: Greatest Annual Percent Fall in The Dow JonesDocument3 pagesMoving Linear Regression: Greatest Annual Percent Fall in The Dow JonesAnonymous sDnT9yuNo ratings yet

- Bollinger Bandit Trading StrategyDocument4 pagesBollinger Bandit Trading Strategyvaldez944360No ratings yet

- % BOLLINGER B and BOLLINGER BAND WIDTH 25 5Document8 pages% BOLLINGER B and BOLLINGER BAND WIDTH 25 5alistair7682No ratings yet

- TradingDocument63 pagesTradingfireNo ratings yet

- Bollinger Bands: Bollinger Bands and The Related Indicators %B and Bandwidth AreDocument4 pagesBollinger Bands: Bollinger Bands and The Related Indicators %B and Bandwidth AresrikanthpoonaNo ratings yet

- Technical IndicatorsDocument13 pagesTechnical IndicatorsTraders Advisory100% (1)

- Bollinger Bands Understanding VolatilityDocument4 pagesBollinger Bands Understanding Volatilitypravin1806874No ratings yet

- Bollinger Bands Scalping Strategy PDFDocument24 pagesBollinger Bands Scalping Strategy PDFrais270472No ratings yet

- Scalping with Bollinger Bands (BB) on M1 TimeframesDocument3 pagesScalping with Bollinger Bands (BB) on M1 TimeframesMohd AslimNo ratings yet

- END-OF-DAY SWING STRATEGY - The Prop TraderDocument8 pagesEND-OF-DAY SWING STRATEGY - The Prop Traderyoussner327No ratings yet

- Bollinger Band Magic by Mark DeatonDocument13 pagesBollinger Band Magic by Mark DeatonRangaprasad Nallapaneni67% (3)

- How to Use Bollinger Bands in TradingDocument9 pagesHow to Use Bollinger Bands in TradingThe ShitNo ratings yet

- Bradley and TechEdge Summation Users GuideDocument13 pagesBradley and TechEdge Summation Users GuideKrishnamurthy HegdeNo ratings yet

- The Basics of Trading CryptocurrencyDocument6 pagesThe Basics of Trading Cryptocurrencyfor SaleNo ratings yet

- Technical IndicatorsDocument37 pagesTechnical Indicatorskrishna4340No ratings yet

- 3 Warrior Winning Stock StrategiesDocument16 pages3 Warrior Winning Stock Strategiesmoneymaker1905100% (1)

- Trade Smart OscillatorsDocument23 pagesTrade Smart OscillatorsBimal MaheshNo ratings yet

- Top 6 Bollinger BandsDocument28 pagesTop 6 Bollinger BandsSteve67% (3)

- Bollinger Bands Guide: Learn How to Use This Popular IndicatorDocument5 pagesBollinger Bands Guide: Learn How to Use This Popular Indicatorsaied jaberNo ratings yet

- Tradingwithrayner ComDocument13 pagesTradingwithrayner ComMohanNo ratings yet

- High Probability Scalping Strategies: Day Trading Strategies, #3From EverandHigh Probability Scalping Strategies: Day Trading Strategies, #3Rating: 4.5 out of 5 stars4.5/5 (4)

- The Basics of Bollinger Bands® PDFDocument8 pagesThe Basics of Bollinger Bands® PDFangkiongbohNo ratings yet

- Trading Options With Bollinger Bands and The Dual CCIDocument9 pagesTrading Options With Bollinger Bands and The Dual CCIsttbalan100% (15)

- Bollinger Bands Indicator - Trading Signals and StrategiesDocument8 pagesBollinger Bands Indicator - Trading Signals and StrategiesOPTIONS TRADING20No ratings yet

- Opening Bell: L B R O S T T SDocument8 pagesOpening Bell: L B R O S T T SErezwaNo ratings yet

- Bollinger Band TradingDocument24 pagesBollinger Band TradingHalit Baris SertbakanNo ratings yet

- Bearish Stop LossDocument3 pagesBearish Stop LossSyam Sundar ReddyNo ratings yet

- Bollinger Bands Explained: A Complete Trading GuideDocument12 pagesBollinger Bands Explained: A Complete Trading GuideKouzino KouzinteNo ratings yet

- Kings ViewDocument10 pagesKings ViewGennady NeymanNo ratings yet

- Bollinger Band (Part 2)Document5 pagesBollinger Band (Part 2)Miguel Luz RosaNo ratings yet

- Bollinger Band - 10Document1 pageBollinger Band - 10skodeNo ratings yet

- StokDocument8 pagesStoksadeq100% (1)

- BNP Paribas) Corridor Variance Swaps - A Cheaper Way To Buy VolatilityDocument6 pagesBNP Paribas) Corridor Variance Swaps - A Cheaper Way To Buy VolatilityHeidi ReedNo ratings yet

- How To Use IG Client SentimentDocument7 pagesHow To Use IG Client SentimentRJ Zeshan AwanNo ratings yet

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyFrom EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyRating: 3 out of 5 stars3/5 (1)

- Winning Binary Options Trading Strategy: Simple Secret of Making Money From Binary Options TradingFrom EverandWinning Binary Options Trading Strategy: Simple Secret of Making Money From Binary Options TradingRating: 4.5 out of 5 stars4.5/5 (22)

- The Green Line: How to Swing Trade the Bottom of Any Stock Market Correction: Swing Trading BooksFrom EverandThe Green Line: How to Swing Trade the Bottom of Any Stock Market Correction: Swing Trading BooksRating: 1 out of 5 stars1/5 (1)

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4From EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Rating: 4 out of 5 stars4/5 (1)

- Bitcoin Day Trading Strategies For Beginners: Day Trading StrategiesFrom EverandBitcoin Day Trading Strategies For Beginners: Day Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Crypto Scalping Strategies: Day Trading Made Easy, #3From EverandCrypto Scalping Strategies: Day Trading Made Easy, #3Rating: 3 out of 5 stars3/5 (2)

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Welcome To Bollinger Band SqueezeDocument12 pagesWelcome To Bollinger Band SqueezeRenatoNo ratings yet

- Timothy Leary Start Your Own ReligionDocument15 pagesTimothy Leary Start Your Own Religionpaul75777No ratings yet

- The Secret Billionaires' Club: Why Study Warren BuffettDocument11 pagesThe Secret Billionaires' Club: Why Study Warren BuffettRenatoNo ratings yet

- Lamia Mobila ImmobiliattiDocument20 pagesLamia Mobila ImmobiliattiRenatoNo ratings yet

- WWW Trading System Trade Tables January - June 2003Document7 pagesWWW Trading System Trade Tables January - June 2003maixtorNo ratings yet

- Essence of Advaitas Pointing NirajDocument4 pagesEssence of Advaitas Pointing Nirajkshamh@yahoo.comNo ratings yet

- Essence of Advaitas Pointing NirajDocument4 pagesEssence of Advaitas Pointing Nirajkshamh@yahoo.comNo ratings yet

- Lamia Mobila ImmobiliattiDocument20 pagesLamia Mobila ImmobiliattiRenatoNo ratings yet

- The Lucky DarkDocument8 pagesThe Lucky DarkRenatoNo ratings yet

- Fibonacci Price Clusters Identify Euro Trend ReversalDocument4 pagesFibonacci Price Clusters Identify Euro Trend Reversalxian_386No ratings yet

- Forex Trading - Avoiding MistakesDocument2 pagesForex Trading - Avoiding MistakesmohoraNo ratings yet

- Forex Trading - Avoiding MistakesDocument2 pagesForex Trading - Avoiding MistakesmohoraNo ratings yet

- (SM) Momentum Investing - Screening For PDFDocument5 pages(SM) Momentum Investing - Screening For PDFRenatoNo ratings yet

- DDDDDDocument22 pagesDDDDDRenatoNo ratings yet

- 1 2 3 Trading SignalDocument44 pages1 2 3 Trading SignalTezzerDogga21No ratings yet

- 5 Chart Patterns To Know PDFDocument15 pages5 Chart Patterns To Know PDFRenato100% (1)

- Timothy Leary Start Your Own ReligionDocument15 pagesTimothy Leary Start Your Own Religionpaul75777No ratings yet

- The Lucky DarkDocument8 pagesThe Lucky DarkRenatoNo ratings yet

- GuideToClassicChartPatterns PDFDocument1 pageGuideToClassicChartPatterns PDFRenato100% (1)

- The Truth About Money ManagementDocument4 pagesThe Truth About Money ManagementHai NgoNo ratings yet

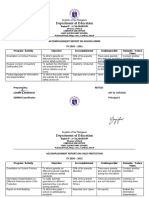

- Annex D Initial Evaluation Results IER 2Document6 pagesAnnex D Initial Evaluation Results IER 2ruffaNo ratings yet

- Regional Director: Command GroupDocument3 pagesRegional Director: Command GroupMae Anthonette B. CachoNo ratings yet

- Islam Today: Syed Abul Ala MawdudiDocument21 pagesIslam Today: Syed Abul Ala MawdudiArap MamboNo ratings yet

- Hannover Messe 2011: New Marke New Con NEWDocument16 pagesHannover Messe 2011: New Marke New Con NEWsetzen724No ratings yet

- Weekly Mass Toolbox Talk - 23rd Feb' 20Document3 pagesWeekly Mass Toolbox Talk - 23rd Feb' 20AnwarulNo ratings yet

- Introduction To Distribution ManagementDocument18 pagesIntroduction To Distribution ManagementGaurav VermaNo ratings yet

- Agrade CAPSIM SECRETS PDFDocument3 pagesAgrade CAPSIM SECRETS PDFAMAN CHAVANNo ratings yet

- Afi11 214Document3 pagesAfi11 214amenendezamNo ratings yet

- Heiter Skelter: L.A. Art in The 9o'sDocument2 pagesHeiter Skelter: L.A. Art in The 9o'sluis_rhNo ratings yet

- New Jersey V Tlo Research PaperDocument8 pagesNew Jersey V Tlo Research Paperfvg7vpte100% (1)

- XTRO Royal FantasyDocument80 pagesXTRO Royal Fantasydsherratt74100% (2)

- Dunn, David Christopher vs. Methodist Hospital (Court 189)Document1 pageDunn, David Christopher vs. Methodist Hospital (Court 189)kassi_marksNo ratings yet

- Software Quality Assurance FundamentalsDocument6 pagesSoftware Quality Assurance FundamentalsTrendkill Trendkill TrendkillNo ratings yet

- Regio v. ComelecDocument3 pagesRegio v. ComelecHudson CeeNo ratings yet

- PHILIP MORRIS Vs FORTUNE TOBACCODocument2 pagesPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRNo ratings yet

- St. Edward The Confessor Catholic Church: San Felipe de Jesús ChapelDocument16 pagesSt. Edward The Confessor Catholic Church: San Felipe de Jesús ChapelSt. Edward the Confessor Catholic ChurchNo ratings yet

- Pedagogy of Teaching HistoryDocument8 pagesPedagogy of Teaching HistoryLalit KumarNo ratings yet

- Mitul IntreprinzatoruluiDocument2 pagesMitul IntreprinzatoruluiOana100% (2)

- Determining Audience NeedsDocument5 pagesDetermining Audience NeedsOrago AjaaNo ratings yet

- Looc Elementary School Accomplishment Report on DRRM and Child ProtectionDocument2 pagesLooc Elementary School Accomplishment Report on DRRM and Child ProtectionKASANDRA LEE ESTRELLA100% (1)

- Literary Structure and Theology in The Book of RuthDocument8 pagesLiterary Structure and Theology in The Book of RuthDavid SalazarNo ratings yet

- Lec 2 IS - LMDocument42 pagesLec 2 IS - LMDương ThùyNo ratings yet

- HSS S6a LatestDocument182 pagesHSS S6a Latestkk lNo ratings yet

- 2017 Cannes Product Design ShortlistDocument6 pages2017 Cannes Product Design Shortlistadobo magazineNo ratings yet

- Pragma c4Document4 pagesPragma c4ElenaNo ratings yet

- Silicon Valley Competitiveness AND Innovation Project - 2017 ReportDocument1 pageSilicon Valley Competitiveness AND Innovation Project - 2017 ReportFJ ERNo ratings yet

- Passwordless The Future of AuthenticationDocument16 pagesPasswordless The Future of AuthenticationTour GuruNo ratings yet

- Leave Travel Concession PDFDocument7 pagesLeave Travel Concession PDFMagesssNo ratings yet

- Purnama RT Sinaga - MB-4D - Developing Skiils Before Graduating From PolmedDocument2 pagesPurnama RT Sinaga - MB-4D - Developing Skiils Before Graduating From PolmedPurnamaNo ratings yet

- Product BrochureDocument18 pagesProduct Brochureopenid_Po9O0o44No ratings yet