Professional Documents

Culture Documents

US Internal Revenue Service: gl196

Uploaded by

IRS0 ratings0% found this document useful (0 votes)

34 views3 pagesProposed regulations provide that authority to modify or rescind taxpayer assistance orders is limited to the commissioner, the Deputy commissioner, or the Ombudsman. The proposed regulations affect all taxpayers with respect to whom a taxpayer assistance order is issued. Written comments and requests for a public hearing must be received by July 18, 1996.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProposed regulations provide that authority to modify or rescind taxpayer assistance orders is limited to the commissioner, the Deputy commissioner, or the Ombudsman. The proposed regulations affect all taxpayers with respect to whom a taxpayer assistance order is issued. Written comments and requests for a public hearing must be received by July 18, 1996.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views3 pagesUS Internal Revenue Service: gl196

Uploaded by

IRSProposed regulations provide that authority to modify or rescind taxpayer assistance orders is limited to the commissioner, the Deputy commissioner, or the Ombudsman. The proposed regulations affect all taxpayers with respect to whom a taxpayer assistance order is issued. Written comments and requests for a public hearing must be received by July 18, 1996.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 3

[4830-01-u]

DEPARTMENT OF THE TREASURY

Internal Revenue Service

26 CFR Part 301

[GL-001-96]

RIN 1545-AU01

Authority to Modify or Rescind Taxpayer Assistance Orders

AGENCY: Internal Revenue Service (IRS), Treasury.

ACTION: Notice of proposed rulemaking.

SUMMARY: This document contains proposed regulations regarding taxpayer

assistance orders. The proposed regulations provide that the authority to

modify or rescind taxpayer assistance orders is limited to the Commissioner,

the Deputy Commissioner, or the Ombudsman. The proposed regulations affect

all taxpayers with respect to whom a taxpayer assistance order is issued.

DATES: Written comments and requests for a public hearing must be received by

July 18, 1996.

ADDRESSES: Send submissions to: CC:DOM:CORP:R (GL-001-96), room 5228,

Internal Revenue Service, POB 7604, Ben Franklin Station, Washington, DC

20044. In the alternative, submissions may be hand delivered between the

hours of 8 a.m. and 5 p.m. to: CC:DOM:CORP:R (GL-001-96), Courier's Desk,

Internal Revenue Service, 1111 Constitution Avenue NW., Washington, DC.

FOR FURTHER INFORMATION CONTACT: Robert A. Miller, (202) 622-3640 (not a

toll-free number).

SUPPLEMENTARY INFORMATION:

Explanation of Provisions

This document contains a proposed amendment to the Procedure and

Administration Regulations (26 CFR part 301) under section 7811 of the

Internal Revenue Code. In Announcement 96-5 (1996-4 I.R.B. 99),

Administrative Initiatives to Enhance Taxpayer Rights, IRS indicated it was

increasing the power of the Ombudsman to assist taxpayers by affording greater

protection for taxpayer assistance orders. Effective on the date of the

Announcement 96-5, January 4, 1996, the power to modify or rescind a taxpayer

assistance order issued under section 7811 is limited to the Commissioner,

Deputy Commissioner, or the Ombudsman.

The current regulations provide that taxpayer assistance orders may be

modified or rescinded by the Commissioner, Deputy Commissioner, or Ombudsman

and, additionally, the following IRS officials: a district director, a

service center director, a compliance center director, a regional director of

appeals, or the superiors of those officials. Announcement 96-5 indicates

that proposed regulations would be published in early 1996 to reflect the

policy restriction in authority to modify or rescind taxpayer assistance

orders. Under the proposed regulations, officials other than the

Commissioner, Deputy Commissioner, or the Ombudsman may modify or rescind a

taxpayer assistance order only with the specific written authorization of the

Commissioner, Deputy Commissioner, or Ombudsman.

Special Analyses

It has been determined that this notice of proposed rulemaking is not a

significant regulatory action as defined in EO 12866. Therefore, a regulatory

assessment is not required. It also has been determined that section 553(b)

of the Administrative Procedure Act (5 U.S.C. chapter 5) and the Regulatory

Flexibility Act (5 U.S.C. chapter 6) do not apply to these regulations, and,

therefore, a Regulatory Flexibility Analysis is not required. Pursuant to

section 7805(f) of the Internal Revenue Code, this notice of proposed

rulemaking will be submitted to the Chief Counsel for Advocacy of the Small

Business Administration for comment on its impact on small business.

Comments and Requests for a Public Hearing

Before these proposed regulations are adopted as final regulations,

consideration will be given to any written comments that are submitted timely

(a signed original and eight copies) to the IRS. All comments will be

available for public inspection and copying. A public hearing may be

scheduled if requested in writing by a person that timely submits written

comments. If a public hearing is scheduled, notice of the date, time, and

place for the hearing will be published in the Federal Register.

Drafting Information

The principal author of these regulations is Robert A. Miller, Office of

Assistant Chief Counsel (General Litigation), CC:EL:GL. However, other

personnel from the IRS and Treasury Department participated in their

development.

List of Subjects in 26 CFR Part 301

Employment taxes, Estate taxes, Excise taxes, Gift taxes, Income taxes,

Penalties, Reporting and recordkeeping requirements.

Proposed Amendments to the Regulations

Accordingly, 26 CFR part 301 is proposed to be amended as follows:

PART 301--PROCEDURE AND ADMINISTRATION

Paragraph 1. The authority citation for part 301 continues to read in

part as follows:

Authority: 26 U.S.C. 7805 * * *

Par. 2. Section 301.7811-1 is amended by revising paragraphs (d) and (h)

to read as follows:

#301.7811-1 Taxpayer Assistance Orders.

* * * * *

(d) Authority to modify or rescind limited to Commissioner, Deputy

Commissioner, or Taxpayer Ombudsman. The Commissioner, the Deputy

Commissioner, and the Ombudsman may modify or rescind a taxpayer assistance

order. A district director, a service center director, a compliance center

director, a regional director of appeals, or the superiors of those officials,

may modify or rescind a taxpayer assistance order only with the specific

written authorization of the Commissioner, Deputy Commissioner, or the

Ombudsman.

* * * * *

(h) Effective dates. This section is effective on March 20, 1992,

except paragraph (d) of this section which is effective on the date 90 days

after the date of publication of these regulations as final regulations in the

Federal Register.

Margaret Milner Richardson

Commissioner of Internal Revenue

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1st Quarter Mps 2k16Document12 pages1st Quarter Mps 2k16Raniel Alemania LacuarinNo ratings yet

- Administrative Order No. 55, SDocument4 pagesAdministrative Order No. 55, SJaica Mangurali TumulakNo ratings yet

- A Presidential Plan To Suspend The ConstitutionDocument2 pagesA Presidential Plan To Suspend The ConstitutionAmman2012No ratings yet

- In Accordance With The Amended CDBG-R Activity Data SpreadsheetDocument2 pagesIn Accordance With The Amended CDBG-R Activity Data SpreadsheetBridgeportCTNo ratings yet

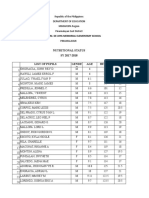

- Nutritional Status SY 2017-2018 List of Pupils AGE Height Gende R Weigh TDocument3 pagesNutritional Status SY 2017-2018 List of Pupils AGE Height Gende R Weigh TRM FerrancolNo ratings yet

- Political Development of The Philippine GovernmentDocument3 pagesPolitical Development of The Philippine Governmentfor pokeNo ratings yet

- Checks & Balances Ensure No Branch DominatesDocument13 pagesChecks & Balances Ensure No Branch DominatesAnantHimanshuEkkaNo ratings yet

- Elem 10 17 18Document669 pagesElem 10 17 18Deped Tayo Bienvenido FojasmesNo ratings yet

- Batas Pambansa Bilang 344 (Accessibility Law) and Its Implementing Rules and Regulations - Department of Public Works and Highways PDFDocument62 pagesBatas Pambansa Bilang 344 (Accessibility Law) and Its Implementing Rules and Regulations - Department of Public Works and Highways PDFNoel CasimeroNo ratings yet

- Marilyn L. Dela CruzDocument3 pagesMarilyn L. Dela Cruzruss8dikoNo ratings yet

- Flores V Drilon DigestDocument2 pagesFlores V Drilon DigestTrxc MagsinoNo ratings yet

- DOTR Memorandum Circular 2016 020-2016Document12 pagesDOTR Memorandum Circular 2016 020-2016Anonymous dtceNuyIFINo ratings yet

- DepEd Launches One Health Week to Promote School Health ProgramsDocument3 pagesDepEd Launches One Health Week to Promote School Health ProgramsVy LirazanNo ratings yet

- Part 1 of 8. Lucas Daniel Smith 4th of July Letter To CongressDocument500 pagesPart 1 of 8. Lucas Daniel Smith 4th of July Letter To CongressLucas Daniel SmithNo ratings yet

- Notice: File No. N-N. 11018/9/2023-Exam2 Dated: 12 April, 2023Document10 pagesNotice: File No. N-N. 11018/9/2023-Exam2 Dated: 12 April, 2023Malik xiyaNo ratings yet

- Philippine Drug Enforcement Agency - WikipediaDocument27 pagesPhilippine Drug Enforcement Agency - WikipediaEarvin PalparaNo ratings yet

- Division of City Schools PlantillaDocument6 pagesDivision of City Schools PlantillaJhasper FLoresNo ratings yet

- Grade 5 Science Exodus RealDocument17 pagesGrade 5 Science Exodus Realann delacruzNo ratings yet

- 2016 Complete Allied Political Law NotesDocument49 pages2016 Complete Allied Political Law Notesalyza burdeosNo ratings yet

- Jeff Arabic Bezozs WorkDocument1 pageJeff Arabic Bezozs WorkjosephNo ratings yet

- Offia of 1E Pss Secem: Republic of Tee Philippines Department of Justice Office of The Government Corporate CounselDocument2 pagesOffia of 1E Pss Secem: Republic of Tee Philippines Department of Justice Office of The Government Corporate CounselAngela Cristy AguilarNo ratings yet

- Rule: Flood Elevation Determinations: South DakotaDocument3 pagesRule: Flood Elevation Determinations: South DakotaJustia.comNo ratings yet

- AttendanceDocument8 pagesAttendanceNylremle AsesorNo ratings yet

- Municipal Peace Order Council Order Jagna BoholDocument2 pagesMunicipal Peace Order Council Order Jagna BoholEdmond DantesNo ratings yet

- SSG President Receives Certificate of ParticipationDocument9 pagesSSG President Receives Certificate of ParticipationAira Joy AnyayahanNo ratings yet

- Angelique G. Jacinto: Certificate of RecognitionDocument45 pagesAngelique G. Jacinto: Certificate of RecognitionAiza Rhea SantosNo ratings yet

- Senior High School Class Record: Region Division School Nam E School Id School YearDocument6 pagesSenior High School Class Record: Region Division School Nam E School Id School YearLorienelNo ratings yet

- Study Guide: Presidential TriviaDocument8 pagesStudy Guide: Presidential Triviadocwatkins_eddNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument2 pagesNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Batangas City East Elementary CertificatesDocument5 pagesBatangas City East Elementary CertificatesMarlen Villarde Zuñiga100% (1)