Professional Documents

Culture Documents

Class Notes #5 Review of Valuation Exercises and How To Present An Idea

Uploaded by

John Aldridge ChewOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Notes #5 Review of Valuation Exercises and How To Present An Idea

Uploaded by

John Aldridge ChewCopyright:

Available Formats

Special Situation Class # 5 Review of Valuation Exercises

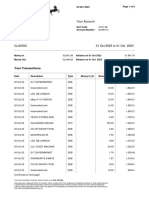

November 08, 2005 Project for Oct. 16th-choose one of these companies. These companies have not been chosen randomly. All are interesting. Symbols RCII LXK IPG PFE MAT UST AEOS FL FOSL GPS

TBL KCP CECO KSWS KG MVL NCOG OVTI TPX INSP

COLM DPZ EFD ABES KND LIZ PETC PGI WGO COCO

GI: I want to go over your papers. In general for a first attempt they were very good. I guess big, big picture, I would like a more concise pitch. I read an article about Bill Miller who runs the Legg Mason funds, and he has done tremendously and he has beaten the market for the last 14 or 15 years. He is an interesting value investor but they run billions and billions of dollars. He wants a pitch very concise and fast. It helps you if you can summarize your pitch very quickly. This company is trading it is out of favor now; it is earning less money but if you look at normalized earnings it is trading at 5 times normalized earnings and ROIC is 50%; they are closing their money losing division so that is why people dont see it. People see it this way and that is why it will get better. You should be able to say it. You should be able to spit out the pitch and the valuation portion of why you think it is cheap in a few lines but then I want to see the back up. It is just very good practice for you to understand why you are or are not buying something. Or this is what I thought and this is how it turned out. It is a little harder when you are assigned something because you might not have a strong pitch on it. It looks fairly priced. I went through normalized earnings it comes out within the range of fairness. Or I cant predict what normalized is. I you can pick BBI (Blockbuster) and say I dont know where earnings are going to be so I have to stay away. Here are three scenarios and if it hits this one, I am going to lose a lot of money and I dont have a lot of confidence which one is going to hit yet. In answer to the question which was asked of Brian, by the way, which is: How do you value a company whose earnings are going to drop off a cliff in three years, five years or whatever? It is really nothing more than a discounted cash flow question. You make your assumptions about future cash flows and if you can buy it at half of all the cash you would collect, then you would buy it. It is not a Warren Buffett pick but it is a way to make money if you think you will collect that money. It is not super complicatedyou are trying to figure out the thing you are buyingwhat is it worth and pay a lot less for it. That is what you are trying to do. The way I answer most questions is that if I cant figure it out then I say I dont know. Then I have no business investing in that. Student: How would you think about the terminal value used for BBI? GI: You know what? Me personally, I would not get that complicated. What are they going to earn in year 1, year 2, .Year 8 and then figure out what that is worth to me. If I pay $5 now will I get $10 within 8 years. $ of the dollars could be next year and the following year I would receive $1. If I can make an IRR

John Chew Aldridge56@aol.com

studying/teaching/practicing investing

Page 1

Special Situation Class # 5 Review of Valuation Exercises

(internal rate of return) on the money I have invested that might look pretty good. A. who cares what I make in year 9 because it will be next to nothing based on my assumptions. I am not looking for exact answers. I am looking forhey, I think it is going to be worth $10 and it is trading $5 to $6. I think that is a pretty good bet there. Es (a prior speaker who runs an activist fund and who spoke on arbitrage) presentation on Risk Arbitrage. Does anyone have any questions? I think many have misconceptions over what I wrote in the book. Dont try this at home. Not that it isnt a bad place to be but it isnt for amateurs who dont do a lot of work. What E said is that spreads are so thin. Traders are investing in situations with 8% annualized returns or just above the risk free rate. I never looked at the business that way. And I think that is the flaw. I look at it as a risk reward business. I can make a dollar but I can lose $10 and all this happens in three months. A lot of people set it up as an annualized return business. One annualized return can be a lot better where you make ten and lose a dollar. People look at it the wrong way which was always my complaint. There is too much money chasing returns. I dont think it is particularly relevant right now because plain vanilla arbitrage is not too good. There are always interesting things when something is changing. Brian just went through the takeover battle for Hollywood. There was a $14 bid and it went down to $10.25 that is an interesting one to think about. If you have a strong valuation opinion and you understand how takeovers work, there is a lot of back of forth and game theory involved as the buyer tries to get a cheap price. What are the incentives here? The CEO is not trying too hard for them to cut the price and they still are interested. They didnt walk away because the business is going nowhere. They probably wouldnt show up again. There is a lot of stuff going on there, so it is still fertile ground. And we talked about merger securities to look at sometimes there is overbidding or management is trying to take it private. There is a chance to make money along the way. I am not saying ignore this are completely. I am saying it is its own special area. I originally did not write that book for MBAs. I hadnt taught MBAs yet. I wrote the book for MBA level readers but I had been doing it for 15 years so I didnt realize that. I really meant for lay people. Comments on Students papers This is in no particular order, I just went through the papers and made comments. Dont take it personally. I bunch of people slapped on a bunch of 12 x EBIT numbers. I would not do that lightly; it has to be a pretty good business to trade at 12 x EBIT and people threw out pretty high numbers. Well, it is trading at half that. That might be, but that is a pretty high number. We talked about 10 x EBIT with a 40% take rate is 6% after-tax return that is a pretty good business to trade off for a government guaranteed bond. To take 12 x EBIT you would want to be pretty certain of the business and the growth. I wouldnt throw those numbers around so lightly. There are certain businesses that are worth that or more than that but it aint cheap! Once again if it is tough to know what normalized earnings are, the best thing is move on to something you can analyze. If you cant analyze normalize earnings then you dont have a clue. -How to Make Presentations to Portfolio Managers by Bill Miller, PM of Legg Mason BM: I want to emphasize in your presentations that if you go into capital markets, you will realize that portfolio managers have ultra-short attention spans. And there is basically no successful portfolio manager of my acquaintance who has ever wanted to hear a story longer than ninety (90) seconds. Peter Lynch, when a senior analyst came into a pitch him a stock, would turn on an egg timer for 90 seconds. The analyst had to complete the presentation within 90 seconds and be out of there.

John Chew Aldridge56@aol.com

studying/teaching/practicing investing

Page 2

Special Situation Class # 5 Review of Valuation Exercises

If you cant get the portfolio managers attention within that time with a convincing case then they will assume that you either dont have a convincing case or you are not able to articulate it, and you should go back and figure it out. Stories not Atoms The world is made of stories, not of atoms. Most people think of the world as analyzing atoms and its constituent parts, and then I am going to figure out how to value it and then describe it. The alternative way to think about it is to construct a convincing story. Take all your material together and construct a convincing story. If you speak to a portfolio manager, the best thing to say is, I want to talk to you about Homestore (HOM). It is at $2.25. The 52-week range is $4 to $2 and the all time high was $100 in 2000. I think it is a buy for the following five reasons: 1. 2. 3. 4. 5. Bam Bam Bam Bam Bam

The stock is trading a $2 and change. I think it is worth $6 or $8 or whatever. Here is why I think it is worth that. Here are the risks. Then you are done. In the presentations: no more than five positive points and three negative points. What is it worth and then you are done.

END

John Chew Aldridge56@aol.com

studying/teaching/practicing investing

Page 3

You might also like

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementFrom EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementNo ratings yet

- Lecture 9 A Great Investor Discusses Investing in Retailers and ANNDocument18 pagesLecture 9 A Great Investor Discusses Investing in Retailers and ANNJohn Aldridge Chew100% (3)

- Li Lu's 2010 Lecture at Columbia: My Previous Transcript View A More Recent LectureDocument21 pagesLi Lu's 2010 Lecture at Columbia: My Previous Transcript View A More Recent Lecturearunabharathi100% (4)

- Greenwald 2005 IP Gabelli in LondonDocument40 pagesGreenwald 2005 IP Gabelli in LondonJohn Aldridge Chew100% (1)

- A Study of Market History Through Graham Babson Buffett and OthersDocument88 pagesA Study of Market History Through Graham Babson Buffett and OthersJohn Aldridge Chew100% (2)

- Great Investor Lecture On Mar - 27 - 2007Document28 pagesGreat Investor Lecture On Mar - 27 - 2007John Aldridge Chew100% (4)

- Sealed Air Case Study - HandoutDocument17 pagesSealed Air Case Study - HandoutJohn Aldridge ChewNo ratings yet

- Cornell Students Research Story On Enron 1998Document4 pagesCornell Students Research Story On Enron 1998John Aldridge Chew100% (1)

- Glenn Greenberg at ColumbiaDocument2 pagesGlenn Greenberg at ColumbiaJUDS1234567No ratings yet

- SNPK FinancialsDocument123 pagesSNPK FinancialsJohn Aldridge Chew100% (1)

- Sees Candy SchroederDocument15 pagesSees Candy SchroederJohn Aldridge ChewNo ratings yet

- Quinsa Example of A Clear Investment Thesis - Case Study 3Document18 pagesQuinsa Example of A Clear Investment Thesis - Case Study 3John Aldridge ChewNo ratings yet

- Lecture 10 Moody's Corporation ExampleDocument13 pagesLecture 10 Moody's Corporation ExampleJohn Aldridge ChewNo ratings yet

- Greenwald 2005 Inv Process Pres GabelliDocument40 pagesGreenwald 2005 Inv Process Pres GabelliJohn Aldridge ChewNo ratings yet

- Ted Weschler 2002 InterviewDocument3 pagesTed Weschler 2002 InterviewekidenNo ratings yet

- Case Study - So What Is It WorthDocument7 pagesCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Assessing Performance Records - A Case Study 02-15-12Document8 pagesAssessing Performance Records - A Case Study 02-15-12John Aldridge Chew0% (1)

- Valuing Growth Managing RiskDocument35 pagesValuing Growth Managing RiskJohn Aldridge Chew67% (3)

- Lecture 11 - Balance Sheet Analysis Duff & Phelps ROE Vs ROCDocument11 pagesLecture 11 - Balance Sheet Analysis Duff & Phelps ROE Vs ROCJohn Aldridge Chew100% (2)

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocument69 pagesCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- Complete Notes On Special Sit Class Joel GreenblattDocument307 pagesComplete Notes On Special Sit Class Joel Greenblattrc753450% (2)

- Lecture #8 On LEAPSDocument16 pagesLecture #8 On LEAPSJohn Aldridge Chew100% (1)

- Ek VLDocument1 pageEk VLJohn Aldridge ChewNo ratings yet

- Great Investor 2006 Lecture On Investment Philosophy and ProcessDocument25 pagesGreat Investor 2006 Lecture On Investment Philosophy and ProcessJohn Aldridge Chew100% (1)

- Class Notes #4 Investor Buying Distressed Tech CompanyDocument30 pagesClass Notes #4 Investor Buying Distressed Tech CompanyJohn Aldridge Chew100% (2)

- Greenwald Class Notes 5 - Liz Claiborne & Valuing GrowthDocument17 pagesGreenwald Class Notes 5 - Liz Claiborne & Valuing GrowthJohn Aldridge Chew100% (2)

- Focus InvestorDocument5 pagesFocus Investora65b66inc7288No ratings yet

- Students Grilled On Their Presentations and Review of CourseDocument43 pagesStudents Grilled On Their Presentations and Review of CourseJohn Aldridge ChewNo ratings yet

- Lecture 1 for Deep Value investing and behavioral biasesDocument53 pagesLecture 1 for Deep Value investing and behavioral biasesJohn Aldridge Chew100% (1)

- Office Hours With Warren Buffett May 2013Document11 pagesOffice Hours With Warren Buffett May 2013jkusnan3341No ratings yet

- ROIC Patterns and Shareholder Returns: Sorting Fundamentals and ExpectationsDocument10 pagesROIC Patterns and Shareholder Returns: Sorting Fundamentals and ExpectationsLee FritzNo ratings yet

- 2009 Annual LetterDocument5 pages2009 Annual Letterppate100% (1)

- Seth Klarman's Baupost Fund Semi-Annual Report 19991Document24 pagesSeth Klarman's Baupost Fund Semi-Annual Report 19991nabsNo ratings yet

- A Thorough Discussion of MCX - Case Study and Capital TheoryDocument38 pagesA Thorough Discussion of MCX - Case Study and Capital TheoryJohn Aldridge Chew100% (2)

- Greenwald Class Notes 6 - Sealed Air Case StudyDocument10 pagesGreenwald Class Notes 6 - Sealed Air Case StudyJohn Aldridge Chew100% (1)

- Arlington Value's 2013 LetterDocument7 pagesArlington Value's 2013 LetterValueWalk100% (7)

- Anf VLDocument1 pageAnf VLJohn Aldridge ChewNo ratings yet

- Max Heine Forbes March 29 1982Document2 pagesMax Heine Forbes March 29 1982jkusnan3341100% (2)

- Seth Klarman - December 2008 - Alumni Bulletin - Harvard Business SchoolDocument1 pageSeth Klarman - December 2008 - Alumni Bulletin - Harvard Business SchoolmattpaulsNo ratings yet

- Greenwald - Case StudyDocument11 pagesGreenwald - Case StudyAkshay Bhatnagar100% (2)

- Connor Leonard IMC 2016 LetterDocument8 pagesConnor Leonard IMC 2016 Lettermarketfolly.com75% (4)

- Interviews Value InvestingDocument87 pagesInterviews Value Investinghkm_gmat4849100% (1)

- Dividend Policy, Strategy and Analysis - Value VaultDocument67 pagesDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewNo ratings yet

- Michael Price Lecture Notes - 1292015Document4 pagesMichael Price Lecture Notes - 1292015brett_gardner_3No ratings yet

- 0313 ChuckAkre TranscriptDocument9 pages0313 ChuckAkre TranscriptKrishnan SubrahmanyamNo ratings yet

- Josh-Tarasoff Markel InsuranceDocument25 pagesJosh-Tarasoff Markel InsuranceCanadianValue50% (2)

- Joe Koster's 2007 and 2009 Interviews With Peter BevelinDocument12 pagesJoe Koster's 2007 and 2009 Interviews With Peter Bevelinjberkshire01No ratings yet

- 2 Value Investing Lecture by Joel Greenblatt With Strategies of Warren Buffett and Benjamin GrahamDocument5 pages2 Value Investing Lecture by Joel Greenblatt With Strategies of Warren Buffett and Benjamin GrahamFrozenTundraNo ratings yet

- Buffett On ValuationDocument7 pagesBuffett On ValuationAyush AggarwalNo ratings yet

- Baupost 2005 Letter Excerpts on Value Investing ChallengesDocument4 pagesBaupost 2005 Letter Excerpts on Value Investing ChallengessexyalexeeNo ratings yet

- Investing in Junk Bonds: Inside the High Yield Debt MarketFrom EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketRating: 3 out of 5 stars3/5 (1)

- Capital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueFrom EverandCapital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueNo ratings yet

- The Big Secret for the Small Investor (Review and Analysis of Greenblatt's Book)From EverandThe Big Secret for the Small Investor (Review and Analysis of Greenblatt's Book)No ratings yet

- Brandes on Value: The Independent InvestorFrom EverandBrandes on Value: The Independent InvestorRating: 5 out of 5 stars5/5 (2)

- Deep Value Investing: Finding bargain shares with BIG potentialFrom EverandDeep Value Investing: Finding bargain shares with BIG potentialRating: 4 out of 5 stars4/5 (9)

- The Best Investment Writing Volume 2: Selected writing from leading investors and authorsFrom EverandThe Best Investment Writing Volume 2: Selected writing from leading investors and authorsRating: 5 out of 5 stars5/5 (1)

- Lecture 1 for Deep Value investing and behavioral biasesDocument53 pagesLecture 1 for Deep Value investing and behavioral biasesJohn Aldridge Chew100% (1)

- A Thorough Discussion of MCX - Case Study and Capital TheoryDocument38 pagesA Thorough Discussion of MCX - Case Study and Capital TheoryJohn Aldridge Chew100% (2)

- Niederhoffer Discusses Being WrongDocument7 pagesNiederhoffer Discusses Being WrongJohn Aldridge Chew100% (1)

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge ChewNo ratings yet

- Tow Times Miller IndustriesDocument32 pagesTow Times Miller IndustriesJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- MLR VLDocument1 pageMLR VLJohn Aldridge ChewNo ratings yet

- SNPK FinancialsDocument123 pagesSNPK FinancialsJohn Aldridge Chew100% (1)

- Assessing Performance Records - A Case Study 02-15-12Document8 pagesAssessing Performance Records - A Case Study 02-15-12John Aldridge Chew0% (1)

- Coors Case StudyDocument3 pagesCoors Case StudyJohn Aldridge Chew0% (1)

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge Chew100% (4)

- Sees Candy SchroederDocument15 pagesSees Candy SchroederJohn Aldridge ChewNo ratings yet

- WMT Case Study #1 AnalysisDocument8 pagesWMT Case Study #1 AnalysisJohn Aldridge Chew100% (1)

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- Ford 35 Year ChartDocument1 pageFord 35 Year ChartJohn Aldridge ChewNo ratings yet

- AMD 35 Year ChartDocument1 pageAMD 35 Year ChartJohn Aldridge ChewNo ratings yet

- JNJ 35 Year ChartDocument1 pageJNJ 35 Year ChartJohn Aldridge ChewNo ratings yet

- WMT 50 Year ChartDocument1 pageWMT 50 Year ChartJohn Aldridge ChewNo ratings yet

- Ko 35 Year ChartDocument1 pageKo 35 Year ChartJohn Aldridge ChewNo ratings yet

- LVLT ChartDocument1 pageLVLT ChartJohn Aldridge ChewNo ratings yet

- Global Crossing CS by Univ of EdinburghDocument35 pagesGlobal Crossing CS by Univ of EdinburghJohn Aldridge ChewNo ratings yet

- Global Crossing 1999 10-KDocument199 pagesGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- Tobacco Stocks Buffett and BeyondDocument5 pagesTobacco Stocks Buffett and BeyondJohn Aldridge ChewNo ratings yet

- GLBC 20000317 10K 19991231Document333 pagesGLBC 20000317 10K 19991231John Aldridge ChewNo ratings yet

- Prof. Greenwald On StrategyDocument6 pagesProf. Greenwald On StrategyMarc F. DemshockNo ratings yet

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocument69 pagesCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- Bubbles and Gullibility 2008Document48 pagesBubbles and Gullibility 2008John Aldridge ChewNo ratings yet

- CA Network Economics MauboussinDocument16 pagesCA Network Economics MauboussinJohn Aldridge ChewNo ratings yet

- Five Forces Industry AnalysisDocument23 pagesFive Forces Industry AnalysisJohn Aldridge ChewNo ratings yet

- Munger's Analysis To Build A Trillion Dollar Business From ScratchDocument11 pagesMunger's Analysis To Build A Trillion Dollar Business From ScratchJohn Aldridge Chew100% (4)

- Narrative Report in PracticumDocument8 pagesNarrative Report in PracticumMichelleCanlasDavidNo ratings yet

- TSADocument8 pagesTSAKevin JesúsNo ratings yet

- Methods of Note IssueDocument8 pagesMethods of Note IssueNeelabh KumarNo ratings yet

- Macroeconomics: International FinanceDocument7 pagesMacroeconomics: International FinanceLuis Fernando Delgado RendonNo ratings yet

- c4613 Sample OutputDocument3 pagesc4613 Sample OutputSaravanan DhandapaniNo ratings yet

- Trial Memorandum Plaintiff SAMPLEDocument10 pagesTrial Memorandum Plaintiff SAMPLEHannah Escudero100% (3)

- Non-Monetary Incentives as Motivational Tools for Non-Teaching StaffDocument3 pagesNon-Monetary Incentives as Motivational Tools for Non-Teaching StaffMichaelAngeloBattung100% (1)

- ACCTG 8D (Week 4-7)Document36 pagesACCTG 8D (Week 4-7)Tepan CarloNo ratings yet

- MOCK BOARD EXAM FOR ADVANCED FINANCIAL ACCOUNTING AND REPORTING (AFARDocument16 pagesMOCK BOARD EXAM FOR ADVANCED FINANCIAL ACCOUNTING AND REPORTING (AFARKial PachecoNo ratings yet

- Lloyds Bank 1Document8 pagesLloyds Bank 1KabanNo ratings yet

- How The Federal Reserve & Banks Create Money - Detailed FlowchartsDocument17 pagesHow The Federal Reserve & Banks Create Money - Detailed FlowchartsJohn DoeNo ratings yet

- Toefl PBT TestDocument34 pagesToefl PBT TestMonica Jazmin Olivera AguirreNo ratings yet

- Real Property Gain TaxDocument17 pagesReal Property Gain TaxTracy LytNo ratings yet

- Better Tax Regime in 10sDocument3 pagesBetter Tax Regime in 10sSaurabh PantNo ratings yet

- Ac108 May2017Document5 pagesAc108 May2017Sahid Afrid AnwahNo ratings yet

- Credit Repair Made Easy Through Expert AdviceDocument3 pagesCredit Repair Made Easy Through Expert AdviceCredit Repair Made Easy Through Expert AdviceNo ratings yet

- ACCA F9 Study GuideDocument4 pagesACCA F9 Study GuidedeepakNo ratings yet

- ECO 102 SIF Course Outline Fall18Document4 pagesECO 102 SIF Course Outline Fall18MOHAMMAD ANASNo ratings yet

- Vanguard: Vanguard All-Equity ETF PortfolioDocument4 pagesVanguard: Vanguard All-Equity ETF PortfolioJanko JerinićNo ratings yet

- Module 5 - Cost of Capital - QuestionsDocument7 pagesModule 5 - Cost of Capital - QuestionsLAKSHYA AGARWALNo ratings yet

- River of Dreams English 9Document3 pagesRiver of Dreams English 9Cresilda BiloyNo ratings yet

- Branch and Unit BankingDocument1 pageBranch and Unit BankingSheetal Thomas100% (1)

- Managing Non Deposit LiabilitiesDocument37 pagesManaging Non Deposit LiabilitiesPrashamsa RijalNo ratings yet

- PG-QP-44: Question Booklet No.Document12 pagesPG-QP-44: Question Booklet No.nayan pareekNo ratings yet

- Types of Major AccountsDocument27 pagesTypes of Major AccountsLala dela Cruz - FetizananNo ratings yet

- 7.advanced WR 7.5+ Strategy 7.softening & Hedging StatementsDocument5 pages7.advanced WR 7.5+ Strategy 7.softening & Hedging StatementsKhanh LinhNo ratings yet

- Deutsche Bank-POF VerbiageDocument2 pagesDeutsche Bank-POF VerbiageChille Nchimunya Bwalya100% (2)

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- OS at Hedge EquitiesDocument46 pagesOS at Hedge EquitiesEby JoseNo ratings yet

- Personal FinanceDocument32 pagesPersonal FinancePrincess MogulNo ratings yet