Professional Documents

Culture Documents

Dividend Policy at PFL Group

Uploaded by

Wthn2kOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend Policy at PFL Group

Uploaded by

Wthn2kCopyright:

Available Formats

Dividend Policy at PFL Group, Inc. FPL An Overview FPL Group, Inc. is Floridas largest electric utility company.

. In 1925, through the consolidation of numerous electric and gas companies, they formed Florida Power & Light Company (FP&L). FP&L grew steadily over the next 50 years until rising fuel costs, operating issues, and construction costs began to decrease profitability. In the mid-1980s, FPL diversified with four major acquisitions - Colonial Penn Life Insurance Company, Telesat Cablevision, Inc., CBR Information Group Inc., and Turner Foods Corporation- in order to minimize the potential risk within the utilities industry. To address problems in operations, FPL began a rigorous program of Japanese-inspired quality control. Management succeeded in transforming FPL into a lean operational system resulting in a drop in scheduled downtime from 18% to 4%, while customer complaints also fell by 60%. By 1989, FPL was recognized as one of the best-managed U.S. corporations. Despite the progress in quality, FPL was still dealing with problems: Colonial Penn was losing money, there were safety concerns about a particular nuclear plant, and demand was growing faster than capacity. In 1989, James Broadhead succeeded Chairman Marshall McDonald. Broadhead placed an emphasis on commitment to quality and customer service, increasing focus on the utilities industry, expanding capacity, and improving cost positions. He took measures to scale back the intense quality controls while still working to preserve the high level of operational efficiency. Furthermore, Broadhead brought focus back to FPLs core business utilities, by selling off many of its non-utility businesses. FPL also budgeted $6.6 billion, spread over five years, for expansion. They funded the development through internal profits and by issuing $3.7 billion of long-term debt and $1.9 billion of common stock. The Electric Utility Industry FPL is an established leader in the utility industry. They have proven their ability to survive and succeed in the dynamic and evolving competitive market. The electric utility industry has established itself as a vital public service within todays society. Until the 1970s and 1980s, the government played a major role in determining the rates, returns, and capacity planning of the power industry. Congress passed several laws regulating the sale of wholesale energy and even formed committees to monitor utility companies dealings. Deregulation In the 1970s and 1980s deregulation weakened the monopolies that had dominated the trucking, banking, airlines, natural gas, telecommunication, and eventually the electric utilities industry. By 1978 most major segments were faced with mandatory changes. In 1992 the National Energy Policy Act (NEPA) was passed requiring utility companies to make their transmission systems available to third-party users at the same level of cost. A clatter of legal quarrels ensued thereafter and FPL was accused of charging excessive rates and denying fair access to its system. In 1994, the industry was facing deregulation of the last segment - distribution. While states such as California and Michigan had toyed with the retail wheeling concept in the past as a way to increase competition, Florida had not yet adopted this method. Retail wheeling allows customers to buy power from any utility, not just their local monopoly supplier. Data from the California experimentation with retail wheeling indicated an average loss of 8% of market value per utility company once this method was initiated Recent Happenings in the Electric Utility Industry Despite Californias proposal on retail wheeling, as of May 1994, the Florida Public Service Commission was not considering implementing the policy. Although FPL is the largest electric utility in the state, retail wheeling would greatly increase the amount of competitors in the market. The industry faces a challenging future full of change, and shareholders would benefit from understanding the potential risks and rewards of their investment. The Standard & Poors Ratings Group declared a revision to their guidelines for evaluating utilities in October of 1993. This revision included the utilities competitive position as part of its financial rating. FPLs

positions rose based on the new criteria, placing them in the top 10% of publicly owned utilities. Major Issues Confronting FPL in 1994 In spite of a favorable position rating, FPL cannot ignore the deregulation movements threatening their current business landscape. The most important issues facing FPL in May 1994 are potential competition resulting from industry deregulation and their high payout ratio. 1) Retail Wheeling The threat of retail wheeling within FPLs market forces management to consider whether or not they can maintain high payout ratios. Retail wheeling is reshaping the utilities industry and if enacted in Florida, it will bring grave challenges to the future of FPL. 2) Low Capacity Margin FPL must prepare for increased competition from the establishment of retail wheeling and other forms of distribution deregulation. FPL is an old firm which is running at roughly 92% capacity. Their low capacity margin (8.6%) suggests that they have less room for growth compared to their competitors. FPL must work to foster growth in order to survive in an evolving industry. 3) Transmission & Power Costs FPL carries a transmission cost of nearly double the industry average. FPLs cost is $.0019 compared to the $.0010 of their peers. With the potential onslaught of competitors, these high costs will hinder FPLs ability to compete. Furthermore, FPLs power generation costs are high because they purchase 30% of their power used in the generation process from outside sources. Thus, they are subject to any price sensitivity in the power market. 4) High Payout Ratio The payout ratio interprets the amount of earnings paid out in dividends from earnings available to shareholders. Currently, FPL has a payout ratio of 90%. While it is true that firms in the utilities industry typically have a high payout ratio, FPLs ratio is abnormally high. Given the possibility of expansion due to increased competition, FPL cannot afford to carry on such a high payout ratio. By decreasing the payout ratio, FPL can use a higher portion of earnings to encourage growth and safeguard against competition. Dividend Policy Firms pay dividends for several reasons; however the main reason is to reward shareholders for investing in the firm. Dividends send a signal to current and future investors that the company is financially stable. It also tells investors that they are sharing in the firms profits, and encourages them to continue with their investment. There have been several debates regarding the benefits of consistent dividends for the investor. No one theory is conclusive concerning whether or not dividends should be paid, however they all agree that the companys dividend policy should be based upon the shareholders preference. Dividend Policy Theories When discussing whether or not to pay dividends, theorists have come up with three alternatives: MM Indifference, Bird in hand (or dividend preference) and Tax preference (or dividend dislike). 1.) Dividend Indifference The leading proponents of this theory are Merton Miller and Franco Modigliani (MM). MM argue that a stocks price is only determined by its earnings and business risk. MMs claim that dividend policy is irrelevant is based on the idea that any shareholder can create their own dividend policy. If a stock does not pay dividends, and a shareholder wants a dividend, they can simply sell enough of their stock to create the desired dividend. Conversely, if a stock pays a dividend, and the shareholder does not want the dividend, then they simply use the payout to buy additional shares. Imagine two stocks, X and Y. Suppose these two stocks have the same earnings and business risk, but stock X pays more of its earnings out as dividends and has a higher price. According to MM, investors will sell X and buy Y if they dont want this high dividend payout. Due to their low payout ratio, Ys share price should rise faster than Xs because it is plowing back more of its earnings. Ys investors who want more dividends could sell enough of their shares to make up for the dividend shortfall. They then argue that arbitrage would occur until X and Y sold at the

same price. Although this theory has not been proved wrong, MM make a number of assumptions. Two of the major assumptions are the absence of taxes and brokerage costs which in reality may have a large effect on the net profit an investor receives. Based on this theory, FPL investors should have no preference whether they continue to allow their dividend to grow, or withhold it and allow for more capital gains. 2.) Bird-in-Hand The main conclusion from the MM irrelevance theory is that a companys dividend policy has no affect on the required rate of return on equity, rs. This idea has been debated by several individuals; however the main objectors have been Myron Gordon and John Lintner. Based on old proverb that says a bird in the hand is worth two in the bush, Gordon and Lintner argue that a dividend payout causes rs to decrease because investors believe that capital gains which are kept invested in the company are more risky and subject to loss than the dividends they have already earned and have in their hand. Gordon and Lintner are saying that investors value a dollar of expected dividends more than a dollar of expected capital gains. They theorize that this is the case because the dividend yield component, D1/P0 is less risky than the g component in the expected return equation, rs = D1/P0 + g MM disagree with this position. MM argue that rs is independent of dividend policy, implying that investors are indifferent between D1/P0 and g. If this is the case then investors are indifferent between dividends and capital gains. In MMs view, investors tend to reinvest their dividends in stock from the same company, or stock of similar companies. When investors do this, they are exposing themselves to the same risk as they would have if the company had kept the dividend, invested the proceeds, and not given a payout. If an investor believes the bird-in-hand theory to be right, they will want FPL to either keep their current dividend consistent or continue increasing it as they have for the past 47 years. 3.) Tax Preference The tax preference theory gives three reasons why investors may want low dividend payouts due to their tax effects. The first reason is that long-term capital gains have a maximum tax rate of 20%. This differs from dividends which are taxed at incremental effective rates. With this in mind, wealthy investors would prefer companies which retained earnings back into the business and not receive dividends. The second tax effect deals with the time value of money. The value of a dollar paid in taxes in the future has a lower effective cost than a dollar paid today. Finally, beneficiaries, one who receives the stock upon death, pay no taxes on the capital gains at all. Therefore, they escape the tax altogether. FPL investors may want to defer the payment of taxes or attempt to avoid taxes all together on their gains and have FPL cut their dividend. Dividend Policy: Cut or Hold Constant Two additional theories that deal with a company changing their dividend policy are the Clientele Effect and the Signaling Effect. 1.) Clientele Effect There are many groups of investors within the market that prefer different payout ratios. Investors often look for a company in which maintains a payout ratio similar to their preferences. If a company decides to change their dividend policy or their payout ratio due to strategy decisions their shareholders or clientele might decide to sell their shares in that company and invest in another. If enough new shareholders are not in line to replace these old shareholders, the stock price may drop. On the other hand, if there is a newfound demand for this dividend payout more shareholders may want this stock than previously and the stock price may increase. Retired individuals, pension funds, and university endowments prefer high dividends and as a result have been attracted to the energy market and specifically this stock in the past due to its dividend policy. Therefore, their clientele is believed to be those who prefer a high and consistent

dividend. If FPL does end up reducing their payout ratio, individual shareholders will be more likely to sell their shares and move to another company with a high dividend payout. If this is the case, FPLs stock price may fall in price. 2.) Signaling Effect Due to asymmetric information between managers and shareholders, shareholders often look at management decision for indications about the future performance of the company. Therefore, if FPL management decides to decrease the dividend, the market often views this as a negative sign regarding future profits and their stock price will decline. On the other hand, if management increases the dividend this sends a positive signal to the market which will lead to an increase in the price of the stock. For example, if FPL cut their dividend payout ratio by 30%, there would be a larger percentage of earnings dedicated towards growth. Cutting the payout ratio would provide FPL as much as $150 million additional cash per year. This newfound cash can be used to pay off debt or finance growth. Another potential impact of decreasing the payout ratio is FPL would have the ability to repurchase outstanding shares. As the number of shares outstanding decreases, the earnings per share will increase, assuming all else remains unchanged. This speculation can potentially offset the negative signal sent to the market as a result of cutting the dividend amount. Furthermore, when a company repurchases their stock it signals management feels their stock is undervalued. Overall Analysis FPL faces many challenges. The recent drop in stock price, along with the favorable estimation of future earnings would inevitably suggest a buy recommendation. After researching the electrical utilities industry, it is apparent that FPL is on the brink of a major change in their industry. It becomes increasingly difficult to predict how Florida will implement deregulation within the industry. The thought of retail wheeling is not assuring; however, we feel that FPL is a strong company choosing to make a preemptive move to prepare for the future changes in their industry. We anticipate deregulation in distribution to be fully implemented by the Florida government and FPL will be ready to handle the competition. As we have discussed, companies usually decrease their dividend payout ratio for negative reasons; however we feel that FPL should decrease their ratio due to strategic growth. An analysis of dividend payout ratios within the electric utilities industry reveals the range to be from 60% to 106% (See Exhibit 9). By comparing the range of ratios with potential future growth, we have found that the most strategic position for FPL to be is at the lower end of the industry. If FPL cut their payout ratio by 30%, it will give them the opportunity to retain more in equity and increase their payout at a faster rate in the years to come. One obvious concern FPL has with such a dramatic reduction in dividends is their shareholders reaction. The clientele effect suggests that if the current shareholders choose to sell because of the new dividend payout ratio, a new set of investors who are seeking a low dividend, high growth stock will step in to buy the shares. Recommendation Our recommendation depends on the personal needs of the investor. If the investor has the stock because of the high payout ratio, then we recommend selling. These individuals expect high, steady dividends that they have seen in the past; however, this will not be the case anymore. They need to sell as soon as possible because the news of this new dividend structure will most likely drive the price of the stock down and result in a capital loss. If the shareholder is investing for reasons other than the historically large cash dividend, they should hold the stock because we feel that there is a high likelihood of growth in the future. Based on extensive analysis, we believe that the FPL Group will continue to show growth and profitability. 1993 was a record year for the company, in terms of their net income and price per share. According to company statements, 1994 will be an even better year, with increasing sales and decreasing capital expenditures. FPL has repeatedly shown above average sales growth. Given their preemptive strike on the potential competition from deregulation we believe in their continued success. With this in mind, they would not want to sell their shares and potentially lose

the capital gain that is coming to them. Our final recommendation is to those investors who do not currently own shares in FPL. For these individuals we would recommend waiting until after the news of this new dividend structure, then buy. Based on the signaling theory, if FPL repurchases shares, the negative affect of the lower dividend may be somewhat offset; however we believe that the news of the new dividend structure will inevitably drive the price of the stock further down. The best time for these investors to buy is when the stock price is at its absolute lowest. If they wait until then, they will have the highest possible capital gain. Conclusion Dividend policy is a very sensitive subject that involves many theories. Whenever changes are made in a companys dividend policy they need to be aware of what signal it sends, and how the market will react. There is no one right answer when determining optimal dividend structure. Individual companys need to look at their own financial statements, position in the industry, and corporate goals to decide which structure will be best for them.

You might also like

- FPLDocument20 pagesFPLJasmani CervantesNo ratings yet

- Dividend Policy Analysis Florida Power LightDocument5 pagesDividend Policy Analysis Florida Power LightShilpi Kumari100% (1)

- FPL Group Dividend Policy AnalysisDocument3 pagesFPL Group Dividend Policy AnalysisGovert Wessels100% (1)

- Dividend Policy at FPL Case 4Document4 pagesDividend Policy at FPL Case 4Ankur280475% (4)

- FPL Dividend Policy-1Document6 pagesFPL Dividend Policy-1DavidOuahba100% (1)

- FPL SolutionsDocument4 pagesFPL SolutionsMegan Lo75% (4)

- Analyzing FPL's Dividend Policy Amid Industry ChangesDocument16 pagesAnalyzing FPL's Dividend Policy Amid Industry ChangesrohanNo ratings yet

- Dividend Policy at FPL GroupDocument20 pagesDividend Policy at FPL Groupczx88No ratings yet

- Dividend Policy at FPLDocument24 pagesDividend Policy at FPLKinnari PandyaNo ratings yet

- CBRM Calpine Case - Group 4 SubmissionDocument4 pagesCBRM Calpine Case - Group 4 SubmissionPranavNo ratings yet

- FPL Dividend Policy AnalysisDocument7 pagesFPL Dividend Policy AnalysisIsmath KhanNo ratings yet

- Case 5 - FPL Group Questions)Document1 pageCase 5 - FPL Group Questions)Jasper Yip0% (1)

- Dividend Policy at FPL Group: Submitted byDocument13 pagesDividend Policy at FPL Group: Submitted byismathNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Porsche CanadaDocument8 pagesPorsche CanadaMohammed Omer Elgindi100% (1)

- Massey Ferguson: Case ReportDocument5 pagesMassey Ferguson: Case ReportCarlos BNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Ferrari Case StudyDocument2 pagesFerrari Case StudyjamesngNo ratings yet

- FPL Case Submission MS19A001Document10 pagesFPL Case Submission MS19A001karanNo ratings yet

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- Williams CEO evaluates $900M financing offer and long-term strategyDocument1 pageWilliams CEO evaluates $900M financing offer and long-term strategyYun Clare Yang0% (1)

- Pine Street CapitalDocument5 pagesPine Street CapitalAnket Gupta0% (1)

- Porsche Volkswagen Case StudyDocument3 pagesPorsche Volkswagen Case Studydivakar62No ratings yet

- Investme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementDocument8 pagesInvestme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementANKUR PUROHITNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Initial Public Offering of FacebookDocument6 pagesInitial Public Offering of FacebookAkhil Uchil100% (1)

- Bank Merger Synergy Valuation and Accretion Dilution AnalysisDocument2 pagesBank Merger Synergy Valuation and Accretion Dilution Analysisalok_samal_250% (2)

- Sealed Air Corporation-V5 - AmwDocument8 pagesSealed Air Corporation-V5 - AmwChristopher WardNo ratings yet

- Dividend Policy at FPL Group, Inc. (A)Document16 pagesDividend Policy at FPL Group, Inc. (A)Aslan Alp0% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Mergers & AcquisitionsDocument2 pagesMergers & AcquisitionsRashleen AroraNo ratings yet

- Apache Case Study Analysis of Risk Management TechniquesDocument14 pagesApache Case Study Analysis of Risk Management TechniquesSreenandan NambiarNo ratings yet

- Porsche's acquisition of Volkswagen shares leads to short squeezeDocument2 pagesPorsche's acquisition of Volkswagen shares leads to short squeezeMuhammad Imran Bhatti100% (1)

- Case Study Hertz CorporationDocument27 pagesCase Study Hertz CorporationprajeshguptaNo ratings yet

- Dow Chemicals’ $280 Million Bid for PBB in ArgentinaDocument7 pagesDow Chemicals’ $280 Million Bid for PBB in ArgentinaOrante100% (1)

- Yell U.K. Valuation Analysis for $1.8B AcquisitionDocument5 pagesYell U.K. Valuation Analysis for $1.8B AcquisitionAdithi RajuNo ratings yet

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- Focus Questions For Laura MartinDocument10 pagesFocus Questions For Laura MartinAgnik DuttaNo ratings yet

- Ferrari IPO Case v3.0Document9 pagesFerrari IPO Case v3.0Kshitish100% (1)

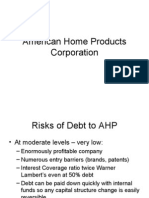

- American Home Products CorporationDocument7 pagesAmerican Home Products Corporationpancaspe100% (2)

- Jet fuel price trends 1990-2011Document123 pagesJet fuel price trends 1990-2011jk kumar100% (1)

- Comparing Bloomin' Brands to Chipotle Using P/E and PEG RatiosDocument3 pagesComparing Bloomin' Brands to Chipotle Using P/E and PEG RatiosDoritosxuNo ratings yet

- Ali NNNNNNDocument18 pagesAli NNNNNNFahad Ali0% (1)

- FNCE 6018 Group Project: Hedging at PorscheDocument2 pagesFNCE 6018 Group Project: Hedging at PorschejorealNo ratings yet

- FIN RealOptionsDocument3 pagesFIN RealOptionsveda20No ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- Focus Questions For Laura MartinDocument10 pagesFocus Questions For Laura MartinEyiram Adanu100% (2)

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Case QuestionsDocument8 pagesCase QuestionsUsman ShakoorNo ratings yet

- Massey Ferguson CaseDocument6 pagesMassey Ferguson CaseMeraSultan100% (1)

- Cost of Capital at AmeritradeDocument3 pagesCost of Capital at AmeritradeAnkur JainNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Mid Term (Assignment)Document6 pagesMid Term (Assignment)Srikant SharmaNo ratings yet

- 8f14ecase Analysis - FPL EnergyDocument13 pages8f14ecase Analysis - FPL EnergyMary FergusonNo ratings yet

- Case 1 - Dividend Policy at FPL GroupDocument3 pagesCase 1 - Dividend Policy at FPL GroupMorten LassenNo ratings yet

- Case4 Group17Document11 pagesCase4 Group17Ankur2804No ratings yet

- Jet Etihad PresentationDocument22 pagesJet Etihad PresentationAjay Sancheti100% (1)

- A Comparative Analysis of Mutual Fund Schemes: College LogoDocument65 pagesA Comparative Analysis of Mutual Fund Schemes: College Logosk9125770027No ratings yet

- 7IFDocument2 pages7IFKumaraswamy HgmNo ratings yet

- Ratios Analysis For Bank of Punjab 2012 Till 2016Document14 pagesRatios Analysis For Bank of Punjab 2012 Till 2016Abbas WarsiNo ratings yet

- LIC Assistant Mains 2019 MCQDocument9 pagesLIC Assistant Mains 2019 MCQWasif FayazNo ratings yet

- Role of MNCs in Indian EconomyDocument2 pagesRole of MNCs in Indian EconomyBhupen SharmaNo ratings yet

- DLF Ltd. Buy: Uilding NdiaDocument4 pagesDLF Ltd. Buy: Uilding NdiaTakreem AliNo ratings yet

- 9959 A Review of Fast Growing Blockchain Hubs in AsiaDocument16 pages9959 A Review of Fast Growing Blockchain Hubs in AsiaImran JavedNo ratings yet

- Management Accounting MCQsDocument4 pagesManagement Accounting MCQshaiqazainab01No ratings yet

- Business RulesDocument2 pagesBusiness RulesCosminaStancalaNo ratings yet

- Family Progression MatrixDocument1 pageFamily Progression MatrixPavan KrishnamurthyNo ratings yet

- Basic Accounting - Q3Document1 pageBasic Accounting - Q3wivadaNo ratings yet

- Mutual Funds: An OverviewDocument18 pagesMutual Funds: An OverviewOjas LeoNo ratings yet

- Chapter 4 - RETURN and RiskDocument23 pagesChapter 4 - RETURN and RiskAlester Joseph ĻĕěNo ratings yet

- Evolution of Ford MotorsDocument23 pagesEvolution of Ford MotorsAdnanAhmadNo ratings yet

- Faysal Bank Boosts Market Share with RBS Pakistan MergerDocument6 pagesFaysal Bank Boosts Market Share with RBS Pakistan MergerUsama Jahangir BabarNo ratings yet

- An Introduction To Cost Terms and PurposesDocument22 pagesAn Introduction To Cost Terms and PurposesMegawati MediyaniNo ratings yet

- Clutch Auto PDFDocument52 pagesClutch Auto PDFHarshvardhan KothariNo ratings yet

- Objectives of FirmDocument20 pagesObjectives of Firmdranita@yahoo.comNo ratings yet

- Ba&a - MCQ4Document11 pagesBa&a - MCQ4Aniket PuriNo ratings yet

- Global Finance Names Best Investment Banks for 2005Document1 pageGlobal Finance Names Best Investment Banks for 2005tami abadiNo ratings yet

- Dual Aspect Concept: Convention of DisclosureDocument3 pagesDual Aspect Concept: Convention of DisclosurePayal MaskaraNo ratings yet

- Final Accounting Exam ReviewDocument10 pagesFinal Accounting Exam ReviewKevin James Sedurifa OledanNo ratings yet

- Indian Investment - Various Aspects To Invest in IndiaDocument40 pagesIndian Investment - Various Aspects To Invest in IndiaDiwakar ChaturvediNo ratings yet

- MGT401 Final Term 7 Solved Past PapersDocument71 pagesMGT401 Final Term 7 Solved Past Paperssweety67% (3)

- Balance ScorecardDocument19 pagesBalance ScorecardJasmen AlijidNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Modern Portfolio Theory and Investment Analysis, 6th SolutionsDocument153 pagesModern Portfolio Theory and Investment Analysis, 6th SolutionsXiaohe Chen86% (7)

- ch08 Solution Manual Managerial Accounting Tools For Business Decision Making PDFDocument54 pagesch08 Solution Manual Managerial Accounting Tools For Business Decision Making PDFMunna Bhattacharjee100% (1)

- NCFM SeminarDocument20 pagesNCFM Seminarkumar_3233No ratings yet